Both services have increased their fleets because of increased patronage on the back of lower car-use costs than traditional rental companies.

Hertz is stepping up its involvement as a means of protecting its core rental business and Subaru is enthusiastic because of the large numbers of drivers it gets effectively test-driving its cars.

But, while ride-sharing is growing in popularity, research is showing that at this stage any increases are not coming at the expense of traditional car-rental businesses.

The Motor Trades Association of Australia, with research supplied by specialists including IBISworld, found that the annual growth rate for car rental from 2013-2018 was 1.7 per cent and that it predicted growth from 2018 to 2023 would be 1.2 per cent.

In the face of future growth, Flexicar has installed eight vehicle pods – which generally have two vehicles – at Melbourne Airport and two pods at Canberra Airport. Pods are designated car bays and the airport locations are in addition to its inner-city Melbourne sites.

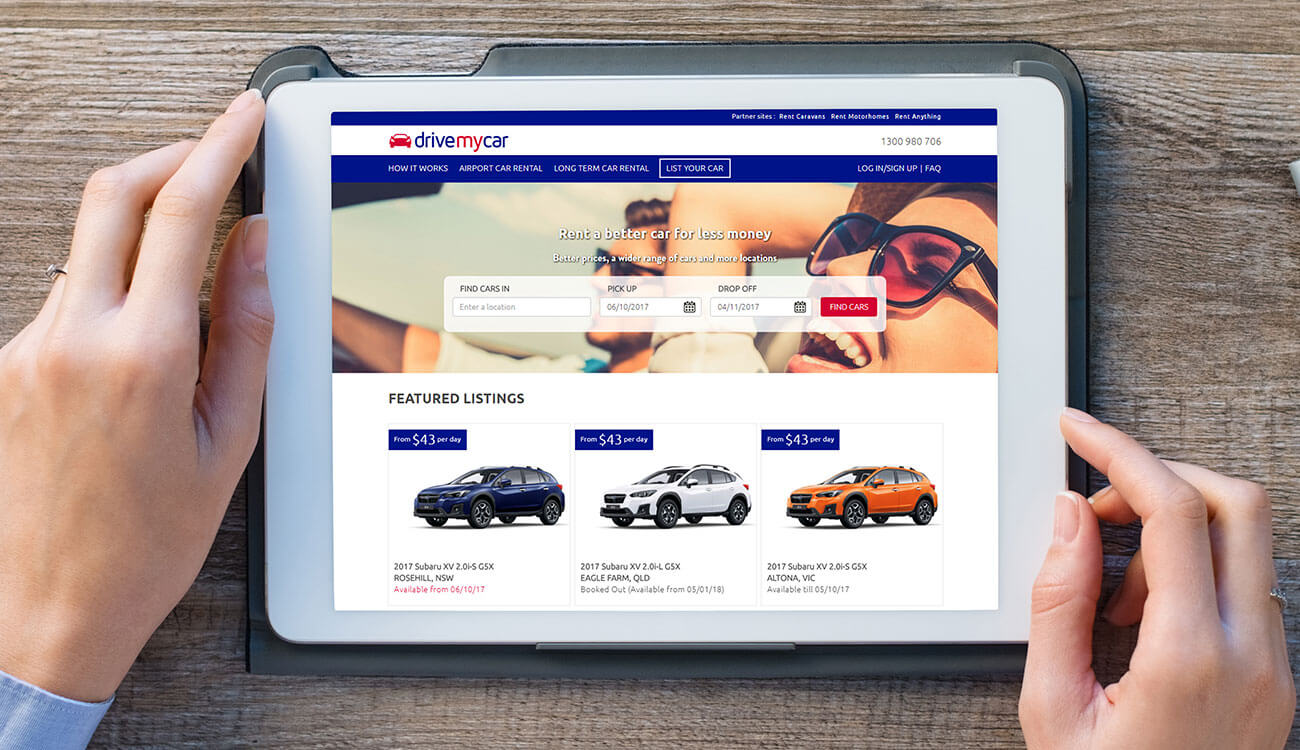

Subaru XV

The new pods are located to offer easy and affordable alternatives to public transport and taxis, requiring users only to become members of the car-share business before booking vehicles from between one hour and up to five days.

The expansion adds more vehicles to Flexicar’s inventory, which includes Nissan SUVs, Suzuki Swifts in its “economy cars” segment, and Audis using A3 for “prestige cars” and Q5 for “prestige SUVs”.

DriveMyCar was founded as a peer-to-peer organisation that shares private cars in downtime periods. But it has recently formed an alliance with Subaru.

Subaru last month added its XV SUV model to vehicles available through the car-share business.

Subaru Australia managing director Colin Christie said the involvement of the brand in car sharing allowed a “try before you buy” opportunity for customers.

It is the second collaboration between the car-share firm and Subaru, following the 101 Subaru Imprezas that were added to the fleet in March 2017. Now, 105 XVs are on the road for DriveMyCar customers.

The Subarus are available for rent by anyone and recently has been opened up to Uber operators.

Mr Christie said that all the Imprezas were rented within two weeks of being added to the rental fleet, describing the campaign as “hugely successful”.

More than 20,000 people were exposed to the new Subaru Impreza, either as drivers or passengers.

The CEO of Collaborate Corporation, the parent company of DriveMyCar, Chris Noone, said adding the XV to the rental fleet “is further evidence of how our online marketplaces can deliver unique benefits to consumers and marketers”.

“We received very positive feedback from renters about the Impreza, including inquiries about purchasing vehicles. We expect the Subaru XV will be just as popular.”

The MTAA reported that it found no drop-off in traditional car rental despite new car-share options. Revenue from the industry was $3.5 billion a year with profits estimated at about $365 million a year.

The biggest player in the Australian market is Avis with a 10.9 per cent market share followed by Hertz at 8.1 per cent. Behind these were a staggering list of smaller players totalling 1641 business operations although many were subsidiaries of bigger companies.

By Neil Dowling

Read More: Related articles

Read More: Related articles