With Volkswagen’s strong sales growth and upper-echelon premium marques – Audi, BMW, Mercedes-Benz and Porsche, for example – entering more affordable segments such as small crossovers and small passenger cars, buyers are beginning to turn away from Australian or Asian-built cars in favour of higher-end brands.

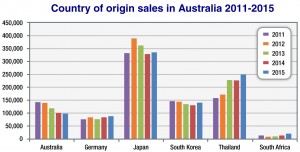

VFACTS figures show that 97,443 Australian-built cars were sold in 2015, representing a decline of 3.0 per cent over 2014, compared with 87,894 German-built vehicles – a figure that marked a 4.9 per cent rise over the previous year.

This difference between the two countries narrows the gap to a strikingly close 9549 vehicles. In 2014, the difference was 16,657 sales, a year earlier it was 42,627, while in 2012 the gap was 53,965. Track a little further back, to 2009, and the distance between the two countries of origin was a cavernous 86,876 units.

We should note that there are non-German brands including Ford and Holden which source vehicles from Germany, such as the Opel-built Insignia sedan and ST versions of the Ford Fiesta and Focus (with the forthcoming Focus RS joining them this year).

However, the volumes here are relatively small and Germany’s rise as a country of origin is largely the result of Audi, BMW and Mercedes increasing in popularity.

Mercedes was again knocking on the door of the top-10 best-sellers in 2015 with 36,374 units (+14 per cent), BMW reached a best-ever 25,022 units (+10.1 per cent) and Audi also hit a record high of 23,088 sales (+20.1 per cent).

While these three brands trade on their German build quality and design, a number of their best-selling models are not built in their home country.

Mercedes’ top-selling C-Class, for example, is built in South Africa and made a major impact on the Australian market last year with 9373 sales – enough to give it a dominant 36.1 per cent share of the mid-size (over $60,000) segment and to place second in the entire medium-car market behind the Australian-built Camry.

Its key rival, the BMW 3 Series, is also built in South Africa, although as with Mercedes’ popular AMG stable, BMW’s high-performance M models are built in Germany.

Unsurprisingly, sales of South African-built cars grew by 50 per cent last year, up from 13,588 in 2014 to 20,401.

Among the variety of countries that build cars for Mercedes, BMW and/or Audi are Slovakia, Belgium, Hungary, Spain, the United States and Mexico.

The slide in sales of Australian-built cars has been well documented and the closure of the manufacturing operations of Ford in October this year, and GM Holden and Toyota a year later, all but guarantees the downward trend will continue.

Some non-German marques also lifted their game last year, with the number of French-built vehicles rising by 13.4 per cent to 7560 units on the back of solid Renault sales – and despite dips from Peugeot, down 9.0 per cent to 4000 sales, and Citroen, down 15.4 per cent to 1106 units.

Sales of vehicles built in neighbouring countries Slovakia and the Czech Republic lifted in 2015, with the giant Hyundai Motor Group sourcing a number of models there for the Australian market, including the Kia Sportage (Slovakia) and some versions of the Hyundai ix35 SUV and the model that replaced it last year, the Tucson. Audi’s Q7 also hails from Slovakia.

Suzuki’s move to import some of its Australia-bound product from the Japanese car-maker’s Hungarian production facility ensured a 4100-unit, or 176 per cent, lift in the sales of vehicles built in the Eastern European country last year.

The S-Cross and Vitara SUVs and Mercedes’ popular CLA four-door coupe all hail from Hungary, as does Audi’s A3 sedan and cabriolet.

More Spanish-built cars arrived on boats in 2015 compared with 2014, thanks to the popularity of models like the Audi Q3 as well as Ford’s Kuga SUV and the new-generation Mondeo.

The sales of Turkish-built cars increased last year by 23.6 per cent to 3812 units, with Renault’s Bursa facility producing non-Renault Sport Meganes and Clios for the Australian market.

Sales of Italian-built cars dropped off in 2015, which can be attributed to a slowing of interest in Fiat and Alfa Romeo products including the MiTo, which only found 156 homes last year, and the Giulietta hatch, sales of which fell 44 per cent.

Volvo’s sales may have lifted slightly in 2015 – up 5.3 per cent to 4943 sales – but the overall number of Swedish-built car sales in Australia dropped by about 330 units last year.

Out of Africa: German car-maker BMW’s 3 Series and its main rival, Mercedes’ C-Class are both produced in South Africa for the Australian market.

Belgian-built car sales also dipped by a little over 2000 units. The switch in production of Ford’s Mondeo to Spain following the closure of the Genk factory may have had an impact. Audi’s A1 is also produced in Belgium.

Japan was again the number-one country of origin, but remained steady compared with 2014, with 6279 more vehicles sold here last year for a total of 335,288. The flat result is unsurprising given the number of models built by Japanese car-makers in Thailand.

Thailand was the country with the second-highest number of sales last year – 249,804 – representing a 10 per cent, or 22,868-unit, increase over 2014, and highlighting the increasing popularity of Thai-built pick-ups.

Almost 175,000 light-commercial utilities were sold in Australia in 2015, with the vast majority hailing from Thailand.

Passenger cars and SUVs also make up a big portion of Thailand’s haul, with Ford’s Focus and Fiesta, the Mazda2, Honda’s Jazz, City, HR-V and petrol-powered CR-V, Nissan’s Altima and Pulsar and Toyota’s Corolla sedan all coming from the South-East Asian Kingdom.

Other Asian countries saw a decline, including Malaysia where Proton models are produced. The 48.3 per cent dip mimics the drop in sales of that brand. Sales of Indian-built cars also dropped by a whopping 7543 units to 13,901.

Far fewer Chinese-built cars were sold in Australia last year – 1834 fewer to be precise – due in part to the virtual collapse of the Great Wall brand Down Under, and the significant drop for Chery cars, but light-commercial vehicle specialists LDV and Foton picked up the pace in 2015. The arrival of SUV brand Haval late last year could turn that figure around in 2016.

Sales of cars built in the United States were steady, dropping just 39 units over 2014, and while Jeep’s American-made models took a dive, Nissan’s resurgent US-built Pathfinder, as well as SUV models from BMW and Mercedes, helped stem the tide.

Jaguar and Land Rover sales increased by 10.7 per cent and 17.6 per cent respectively year-on-year, but other British-built cars – Honda’s Civic for example – lost ground, causing a minor 2.4 per cent decline.

By Tim Nicholson

Read More: Related articles

Read More: Related articles