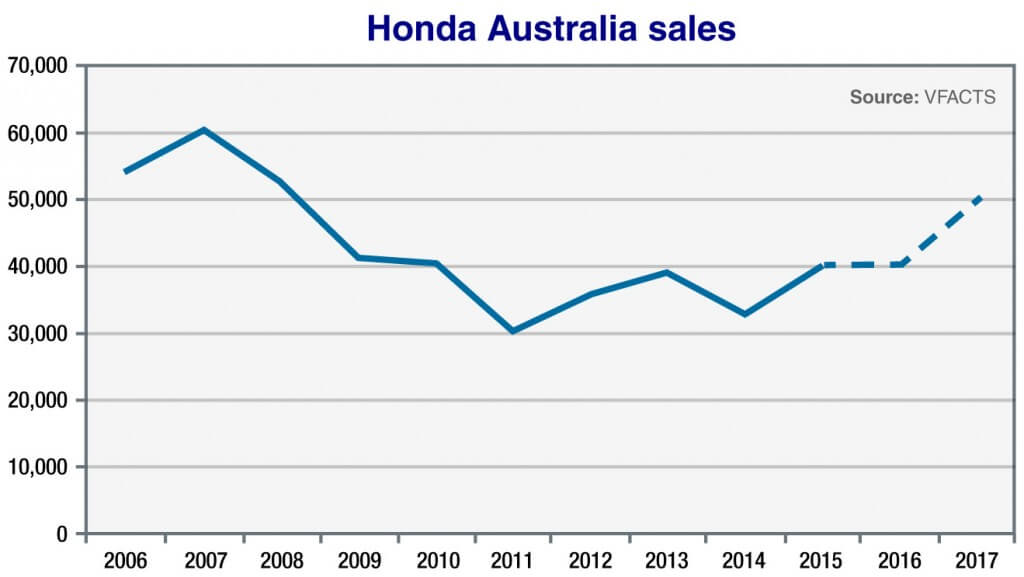

From a low of 32,998 registrations in 2014, Honda managed to claw back sales to 39,884 in 2015 but says it will crack two milestones this year and in 2017 with a target of 40,000 and 50,000 units respectively.

The welcome growth is being partly fuelled by the arrival of the company’s first compact crossover contender last year, with the HR-V spiking annual figures thanks to 10,899 additional registrations, while the arrival of a tenth-generation Civic is expected to continue the upward trend, the company it says.

Speaking at the launch of the new Civic sedan, Honda Australia director Stephen Collins said the car-maker’s strategies were not pegged to the coveted top-10 best-seller list, but if its predictions for growth are realised, its position was not under threat.

“To me, the top 10 is not the be all and end all,” he said. “If you gave me the choice of course we would want to stay in the top 10 but I think what’s important is that we’re building a stronger business and I think by the end of the year we will sell 40,000 units.

“Next year we will go to 50,000 which will keep us well and truly in the top 10.”

Mr Collins explained that while he could see the allure of brand ranking status, the monthly results did not accurately represent the relative performance of those car-makers that do not compete in every vehicle segment – including Honda.

Civic standard: Mercedes is breathing down Honda’s neck in the battle for a top-10 placing, but the Japanese car-maker says it will change up a gear and draw out its lead in 2017 with more fresh models.

With only a small gap in its line-up at the compact end of the scale, European marque Mercedes-Benz has a product offering in every segment from small hatchback through to large sedans and sportscars, to a comprehensive range of SUVs and light-commercial vehicles – an unfair comparison, says Honda.

“When you take the total picture, because we don’t compete in commercial vehicles or big SUVs, I’m not looking at Mercedes and thinking are we going to beat them,” said Mr Collins.

“What I do know is that where we compete, we compete a lot better than a number 10 position.”

With the strong sales of HR-V, that has already chalked up 3899 sales to its name at the end of April this year, Mr Collins said the company performs better when the figures are more closely analysed.

In the people-mover segment Honda performs well with its Odyssey that has captured 866 sales this year – up 2.9 per cent year on year – and second only to Kia’s Carnival that has found 1523 homes and is up 99 per cent over January to April 2015.

Kia is another company that is knocking on the door of the top 10, with 12,574 sales to the end of April, it is trailing Benz which is on 13,366 by 792 units, while Honda is currently hanging on to twelfth spot overall with 11,705.

Honda’s CR-V has a fight on its hands in the mid-sized SUV segment which is flooding with new offerings, but has still managed eighth position in the sub-$60,000 segment and 2543 registrations – down 6.4 per cent compared with the same period last year – and an all-new model is on the way.

But Mr Collins said that while the company would always consider filling some of the gaps in its line-up, it was not desperate to be able to offer at least one model in each segment, including the upper end of the SUV category and commercials in which Mercedes will soon offer a one-tonne ute.

“We are always looking for products to fill those but they are probably the two segments we c

an’t compete in and when you add those two together it would probably be a thousand units or about 35 or 40 per cent.”

Nor would the company try to plump figures at the end of a month or year with limited time offers, according to Mr Collins, who said such measures have only a temporary effect.

“We won’t do any silly offers at the end of the year to get to a number. It’s a short-term thing and of no benefit. What we are most interested in is where we compete – where we are a lot better than number 10.”

While other companies pursue sizable volumes through car hire companies and large organisation fleets, Mr Collins explained that, like discount deals, Honda would not be adopting the tactic to preserve resale value and build a better brand reputation.

“We don’t do rent-a-car, we don’t do big discount for big businesses. If you take private where we compete with all our core cars, we would be in the top five,” he said.

“Mainly because it severely impacts your residuals. The rental company buys 500 hundred cars, which is all good at the front end, but at the back end they have to get rid of them and the used value drops. It’s very bad for retention and poor for consistent owners.

“Generally speaking it’s a massive discount business so we are just not interested. It’s just buying volume. Anyone can give away as much as you want to get the volume.”

Honda’s new Civic sedan is on track to secure 350 pre-orders by the end of the month, ahead of its arrival in June, and it will be joined by a hatchback and vicious Type R next year.

A CR-V replacement will also target a more youthful crowd later with a sportier persona and high-profile promotional campaigns similar to the HR-V marketing strategy, bolstering Honda’s efforts to return to prominence.

By Daniel Gardener

Read More: Related articles

Read More: Related articles