However, the deal that helped the small hatchback rise to the top of the Australian sales charts in the first half of this year may not be sustainable.

Responding to suggestions that the aggressive pricing strategy with the entry i30 Active was a ‘loss leader’ designed to boost sales and push the model ahead of the ever-popular Toyota Corolla and Mazda3, HMCA chief operating officer Scott Grant told GoAuto that was not the case.

“No, and it’s interesting, in the full five years of manufacturing the volume that was expected to be produced and sold we’d exceeded globally, so the amortisation of expenses associated with the car (i30) have been achieved,” Mr Grant said.

“From a manufacturing cost point of view we have the opportunity to have a lower cost base through this final period of sale.

“We’re just in a position where we have a really strong product, it’s a really well-received product in the consumer’s mind and we’ve also got a manufacturing cost position that’s advantageous right now.”

The i30 Active automatic offer, which ended on June 30 and has since been replaced by a $22,990 driveaway deal, wiped around $7000 from the driveaway price.

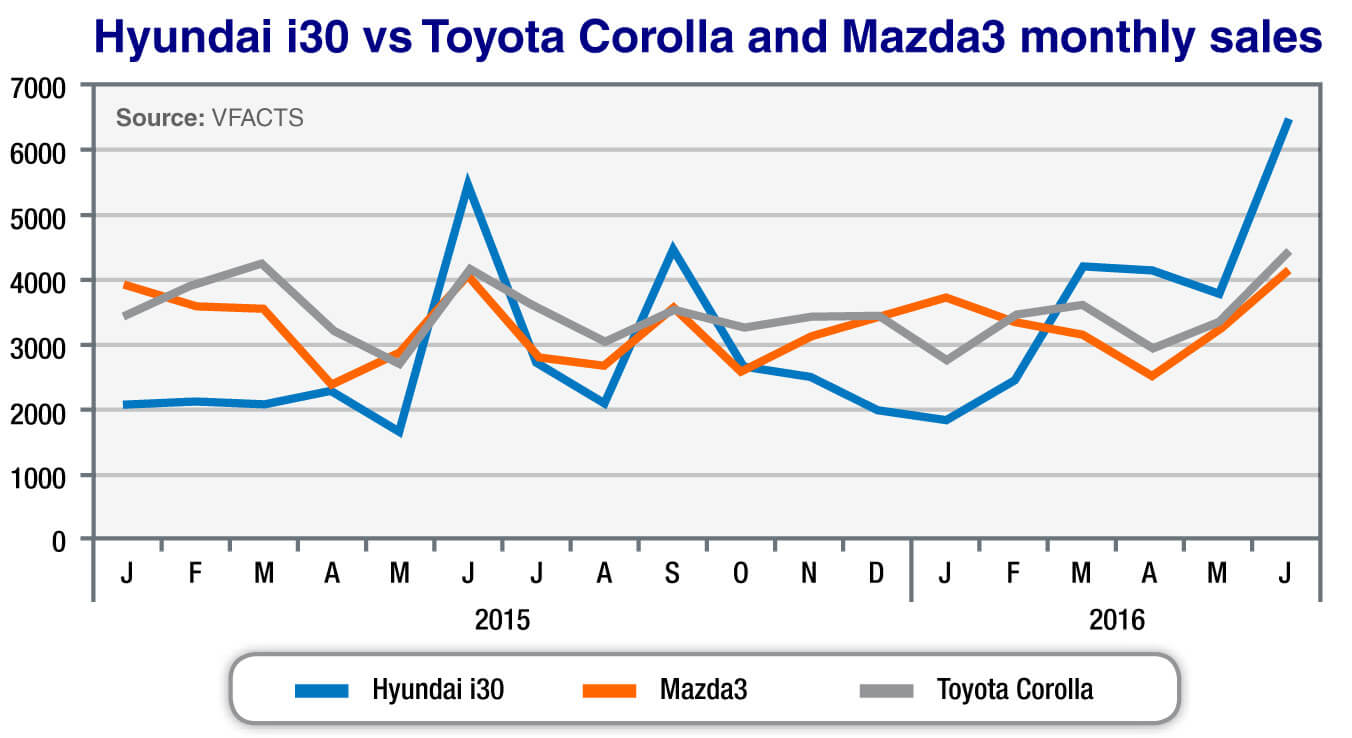

With 62 per cent of buyers opting for the Active automatic, and many thousands of prospective buyers drawn into Hyundai showrooms as a result of the heavily advertised deal, HMCA has racked up 22,857 i30 sales to the end of June – including 6432 last month alone – which puts it 44.7 per cent (or more than 7000 units) ahead of where it was at the same point last year.

The Corolla, by comparison, is at 20,544 (-5.5 per cent) while the Mazda3 is at 20,088 (-1.7 per cent), with Mazda Australia managing director Martin Benders already conceding defeat to either Hyundai or Toyota in terms of ‘Australia’s Top Model’ come December 31.

Hard to top: Hyundai’s i30 Active pricing at $19,990 driveaway with free auto has taken the small car to the top of the sales charts, but the offer is now back out to $22,990 d/a.

Time will tell whether this was a premature call by the Mazda chief as Mr Grant indicated that ongoing production availability would dictate the i30’s sales performance in the second half, with HMCA still to receive word on the final number of vehicles coming this way as the factory prepares for a model changeover later this year.

“It’s just a matter for us of determining the correct balance for our business between supply and demand, and now that the vehicle is in its final stage of run-out, within the next 30 to 60 days we’ll have a ‘to go’ number in terms of production and then it will stop,” he said.

“Depending on how many cars we can secure and order … we can either effectively go hard at the product if we have available stock, or as stock tightens we don’t need to be quite as aggressive. We’ll have to see how that looks.”

Mr Grant acknowledged that Hyundai had created a divide in its range among its older Accent – often advertised for $15,990 driveaway with free automatic – and i30 models, and newer products such as the Elantra, Tucson and Sonata that were not the subject of aggressive deals.

However, he added that future models would help alter the aggressive pricing approach, starting with the next-generation i30 set to be revealed at September’s Paris motor show ahead of its 2017 Australian launch.

“We talk about it quite a lot internally, whether we’re just going to focus on the entry-level product in each segment and focus on the price point, or are we going to talk about the value proposition, the specification level, the competitiveness in that context,” he said.

“Really, the last five or six years have been about developing the brand to the point where research shows us most people think Hyundai, they think value. So do we need to talk price point all the time? Not so much.

“We’re going to start moving in a different direction.”

Asked whether the i30 Active had taken the shine off the company’s newer Elantra sedan, which launched here in January, Mr Grant replied: “Yeah, possibly.

“But again, it (Elantra) is priced differently, in the mid-$20,000s and the Elite model is really well specified, it’s a sedan … so its positioning and product credentials are quite different to what an i30 offers the market,” he added.

“You do run into some other issues when you consider pricing as there is a certain price point and they are almost like bands, a buyer comes into this band and as soon as you click over into the next band volume will drop.”

He claimed that $19,990 driveaway “is a perfect band because you get some people from the light segment who will come up and perhaps people who will want a small SUV will go down and across”.

“But as soon as you start going to the $24,000-$25,000 car, it’s a different type of customer,” he said.

In the first half of 2016, Hyundai Australia sold 2517 Elantras.

By Daniel DeGasperi

Read More: Related articles

Read More: Related articles