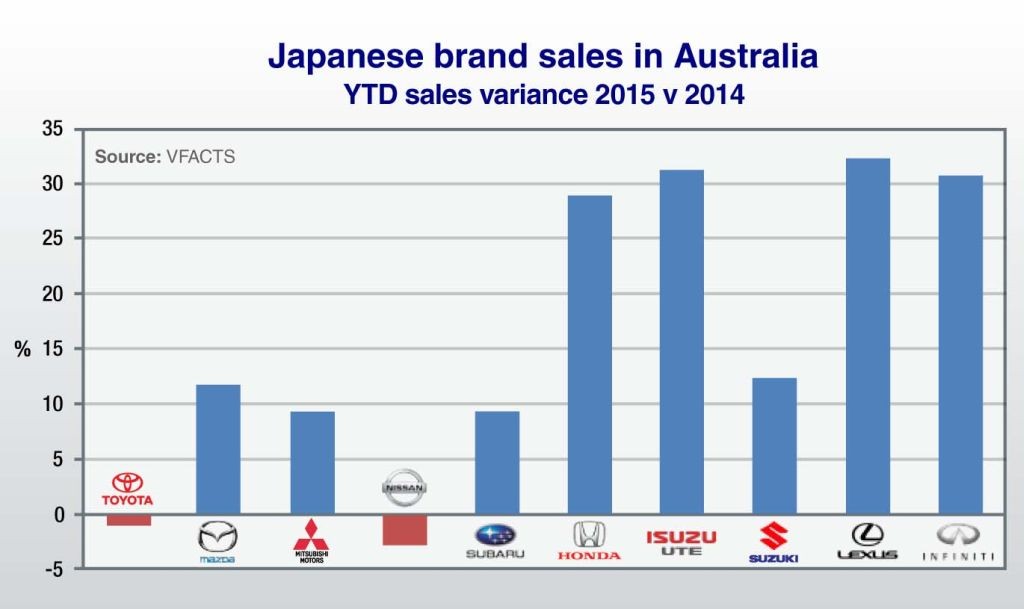

Toyota remains the dominant force in the industry by a huge margin, despite a 1.0 per cent sales decline so far this year, and Mazda is turning in consistently strong results to be the clear number-two brand with sales up 11.7 per cent to the end of September. But elsewhere among the leading brands, Honda’s sales have climbed a remarkable 28.9 per cent this year, and Mitsubishi and Subaru have both experienced 9.3 per cent growth.

Outside the top 10, Suzuki (+12.3%), Isuzu Ute (+31.2%) and premium brands Lexus (+32.3%) and Infiniti (+30.7%) are also outstripping the overall industry’ s 3.6 per cent improvement, leaving Nissan as the only other Japanese brand in negative territory, down 2.8 per cent YTD.

For the improvers in the leading bunch, the turnaround is significant in the face of sustained sales pressure brought on by an increasingly competitive marketplace – particularly with the continued rise of South Korean brands Hyundai (+2.8% YTD) and Kia (+16.5%), and more affordable European alternatives including Volkswagen (+14%), Renault (+26.1%) and Skoda (+26.4%).

As we have reported, the major luxury brands such as Audi, BMW and Mercedes-Benz have also taken a bite out of mainstream Japanese brand sales with their new compact passenger cars and SUVs, while on the flipside the major full-import brands have clearly all taken customers from the local manufacturers, especially Ford (-16.0%) and Holden (-7.4% YTD).

Honda has not had much good fortune in recent years, with a cutback in spending in the wake of the global financial crisis impacting future product planning, leaving the company with a generally uninspiring line-up.

But this has changed in the past year, with the launch of the new-generation Jazz light car – now back to being one of the top picks in its segment (+64.2% YTD) – and the arrival of the reborn HR-V city SUV, which has proven to be an instant hit in a red-hot segment and is now the biggest-selling vehicle in Honda’s line-up, with 8158 sales YTD.

Honda’s 30,454 overall sales YTD is almost past 2014’s full-year result, and puts it on track to get back beyond 40,000 units for the first time since 2010. The next benchmark will be 50,000, then on to the pre-GFC 60,000 mark it had initially targeted for 2015 (back in 2012).

Mitsubishi, meanwhile, is climbing up the charts again after falling off the pace last year and recording lower-than-expected numbers between 2010 and 2013, hovering around the 56,000-62,000 mark during that period.

Outback saviour: The popularity of the new Liberty and Outback twins is keeping Subaru 9.3 per cent ahead of its 2014 year-to-date tally.

Last year, the triple-diamond brand dropped by 4.0 per cent over 2013 with 68,637 sales, which was well off the target of 100,000 Australian sales set in 2013 by former MMC president and COO Osamu Masuko.

Mitsubishi Motors Australia Limited (MMAL) has since pulled back from this target, and earlier this year was working on 72,000 for the current Japanese financial year (April 1, 2015, to March 31, 2016).

For the 2015 calendar year Mitsubishi has already racked up 53,566 sales, with strong interest in the new-generation Triton pick-up – up 24 per cent in 4×4 sales YTD – and solid returns from its SUV line-up including the ASX crossover (+31.7 per cent), the soon-to-be-replaced Challenger (+62.2 per cent) and Outlander (+8.8 per cent).

Another big mover and shaker, albeit with a smaller line-up, is Subaru, which has seen huge interest in its new-generation Liberty and Outback twins – launched in January – after a lacklustre few years prior with the previous models that were simply not as appealing to buyers.

The Liberty is up by a phenomenal 291.3 per cent to 3103 so far this year to become the third-best-selling mainstream mid-sizer behind the Toyota Camry and Mazda6. Outback sales have grown by 326.6 per cent to 8177 units and is now the fourth-best-selling model in the sub-$70,000 SUV category behind Toyota’s Prado and Kluger, and the Jeep Grand Cherokee, which is retracting late in its lifecycle.

This performance is making up for contracting sales of the Impreza (-19.6 per cent) and the XV (-36.4 per cent), the latter now feeling the heat after a raft of new models have muscled their way into the city SUV segment, including Honda’ s HR-V and the Mazda CX-3.

With overall sales of 31,995 units YTD, Subaru is on track to easily exceed 2014’s year-end total of 40,502 and possibly even exceed the 41,000 mark, which is a number it has not been able to crack in the past six years.

As GoAuto has reported, Suzuki also has ambitious plans to reach 30,000 annual sales in Australia by 2017 – a figure it believes will come off the back of a line-up that will consist solely of small cars and crossovers, as per its latest global strategic plan.

Suzuki has also floated around the 20,000 annual sales mark for a number of years, but ended last year on 17,422 – the first time it had fallen below 20,000 units in eight years. Its YTD tally is at 14,652 units, with growth coming from the rugged Jimny (+160.7%), ageing Grand Vitara (+11.8%), utilitarian APV van (+7.4%) and the continually popular Swift (+24.4%).

The just-arrived Vitara is likely to have an impact in the crossover segment, having found 352 homes already after less than three weeks on sale.

Another smaller Japanese brand punching above its weight is Isuzu Ute, a manufacturer that has just two models in its line-up but is outselling established brands with five times as many offerings.

In March this year Isuzu Ute Australia managing director and CEO Yasuhiro Takeuchi announced a lofty target of 20,000 units in 2015 from its D-Max utility and MU-X SUV, and with 15,352 sold to the end of September, the target looks a certainty.

MU-X sales have increased by 39 per cent to 4698 units and it is now outselling established fare such as the Mazda CX-9, Kia Sorento, Mitsubishi Pajero and Challenger, as well as the mechanically related Holden Colorado 7, while combined sales of the D-Max 4×2 (+107.7%) and 4×4 (+15.4%) are at 10,654, edging out the Nissan Navara, Mazda BT-50 and Volkswagen Amarok to be the fifth-best-selling one-tonne ute in Australia.

With 47,860 sales YTD, Nissan Australia continues to claw its way back after a tough few years battling issues such as oversupply and an unsatisfactory model mix.

Nissan sales have fluctuated in recent years from 52,901 in 2009 to a touch fewer than 80,000 in 2012, but this year it looks set to hit about 62,000.

It is currently sitting in seventh place behind Ford, but Volkswagen – currently in crisis-management mode with the global diesel emissions scandal – is breathing down its neck on 46,846 sales YTD.

By Tim Nicholson

Read More: Related articles

Read More: Related articles