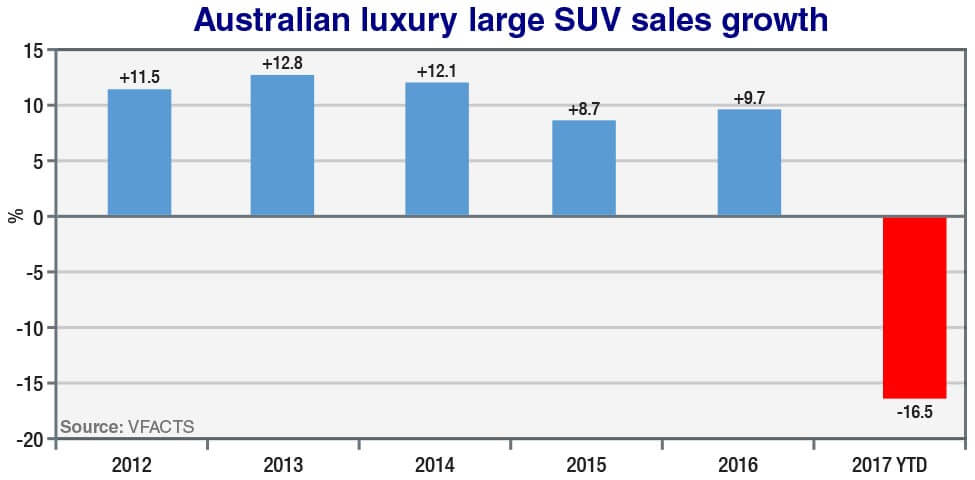

By the end of July last year, combined sales of these vehicles priced above $70,000 had hit 15,294 units, but this year, the tally sits at 12,775 sales, representing a decline of 16.5 per cent so far in 2017.

This compares with growth of 5.6 per cent in the overall SUV market so far this year, led by the family friendly mainstream medium SUV segment that has soared 20.1 per cent.

Among the large luxury SUVs on the market, only Porsche’s Cayenne has eked out a year-on-year sales gain, and that is up just 1.8 per cent, to 913 vehicles.

The question is: why? Has the segment peaked at a natural ceiling? Is this a mere hiccup, perhaps caused by easing of price discounts, or – worse – the harbinger of a broader market hiatus?

Sales of the long-time segment leader, the BMW X5, have slipped 18.6 per cent year to date, from 2737 units in the first seven months of last year to 2228 this year.

It remains on target to top 4000 units for the fourth year in a row, but it might struggle to achieve the 4181 units it achieved in the full 12 months of both 2016 and 2015.

The X5’s sister model, the X6 “coupe”, is down 22.2 per cent, to 298 sales year to date.

Bogged: BMW’s X5 is still the unabashed large luxury SUV sales champion, but sales have slipped this year across the segment.

The biggest fall has been recorded by Land Rover’s Discovery, down 67.2 per cent this year, from 1755 vehicles to 576, but that is almost entirely due to this year’s change-over to an all-new model that only now is coming on stream.

In July, Discovery sales jumped to 341 units, up 32 per cent on the corresponding month last year, as the ships from England docked, delivering vehicles into customers’ hands.

This helped to steady the luxury SUV sales ship a little, but overall July sales were still down 7.2 per cent month on month.

Stock shortages at various times this year might explain some of the shortfall, with Mercedes-Benz telling GoAuto that supply of its GLE has been constrained in some months.

The GLE wagon has declined 13.9 per cent year to date, to 1463 sales, while the related GLE Coupe is down 2.9 per cent, to 468 units.

Rival Audi’s Q7 has slipped 11.4 per cent, to 1735 units. The Q7 is relatively new, introduced just two years ago, and should be at the peak of its powers.

At launch in 2015, Audi Australia said it hoped to double Q7 sales to more than 200 units a month – a goal it has achieved and then some, averaging about 240 units in 2016-17.

In July last year, Q7 sales peaked at 389 sales, but plunged to 91 units the following month, presumably because dealer stock had been cleaned out. The fluctuations have continued since, indicating a feast and famine scenario with stock supply.

Volvo’s new XC90 is struggling to maintain its early promise, with sales slipping 12.3 per cent, to 697 units this year compared with 2016 – its first full year of sales.

The Range Rover Sport and Lexus RX have both been relatively steady this year, down 1.8 per cent and 3.8 per cent respectively.

With 1833 sales, the Range Rover Sport is now the second-best-selling SUV in the class, having moved ahead of the Audi Q7.

In July, combined sales of the Discovery and Range Rover Sport gave Land Rover a hefty 27.5 per cent share of the segment, compared with BMW’s 21.4 per cent.

A newcomer to the segment, the Maserati Levante, has made a contribution of 288 units to class sales in 2017, but not enough to make a real difference to overall sales tallies.

Sales of cheaper large SUVs, below $70,000, have held their own in 2017, up 2.5 percent, while luxury medium SUVs have marked time, up just 0.9 per cent.

At the top of the luxury SUV pile, upper-large vehicle sales such as the Mercedes-Benz GLS wagon and Range Rover have somehow avoided the pitfalls of the one-class smaller variety, climbing 3.7 per cent.

By Ron Hammerton

Read More: Related articles

Read More: Related articles