In a year in which Ford’s production lines fell silent on October 7 after nine decades, and Holden stopped building its Cruze small car on the same day, statistics from the Federal Chamber of Automotive Industries’ VFACTS reporting service show that just 87,096 Australian-built vehicles – across three manufacturers and nine vehicle lines – were registered.

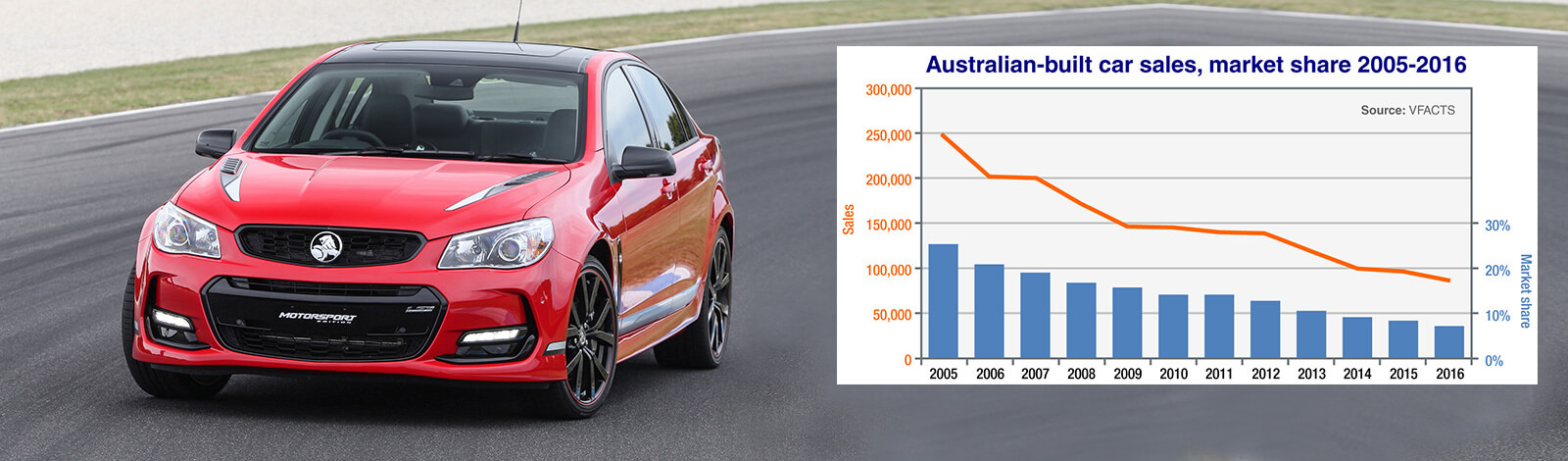

This is 10,347 units fewer than in 2015 and continues a long, painful and uninterrupted decline that only a decade earlier had more than 200,000 cars filing out of factories in Victoria and South Australia – including Mitsubishi in Tonsley Park, Adelaide, which ground to a halt in March 2008.

Australian-built cars accounted for 25.2 per cent of the new-car market in 2005, a time when the industry was closing in on the elusive one-million-unit mark for the calendar year with 988,269 sales.

Last year, the overall market reached a new record of 1,178,133, representing 19.2 per cent growth since 2005, while over the same period demand for Aussie-made cars has fallen a staggering 65.0 per cent.

Mitsubishi’s closure was not necessarily the beginning of the end – the industry could surely sustain three manufacturers, were there enough incentive to remain from corporate headquarters overseas and the federal government – but the graph here clearly shows how the share of locally built cars, which was already steadily eroding, quickly fell below 16 per cent in 2009 (with less than 150,000 sales), had hit 10 per cent by 2013 and was into single figures forever from then on as unit sales slipped to around 100,000 in 2014 and, a year later, to less than 97,500.

This year’s sales tally will struggle to reach 60,000 units and is a moot point, really, given the numbers hinge on the final production schedule already determined – or soon to be finalised – by Toyota and Holden, and both companies are working on an orderly departure.

In announcing its Adelaide factory’s closure date of October 20, Holden last week said that “more than 30,000 vehicles (are) to be built before manufacturing ends” – a number that will include exports and cars that form the basis of brands such as Holden Special Vehicles, but as it stands is right on the mark of the large cars it sold last year (31,616).

As reported, Toyota Australia executive director of sales and marketing Tony Cramb told GoAuto earlier this month that the company was expecting Camry and Aurion sales to fall below 30,000 units this year – the two Victorian-built cars sold a combined 30,318 units in 2016 – which points to a carefully measured exit rather than a final sales blitz.

Sales of Holden’s locally manufactured vehicles fell 9.9 per cent last year to 43,246 units. Cruze was down 15.2 per cent to 12,904, despite a big push with run-out stock in December, while Commodore – still the lion brand’s top-selling model by a country mile – was down 6.9 per cent to 25,860.

The long-wheelbase Caprice sedan was down 27.9 per cent (to 954), while the Commodore-based ute fell 2.7 per cent (to 4802).

Camry might have been the biggest-selling vehicle in Australia last month with 4850 sales, but this was below its performance at the same point last year and Toyota was left 5.1 per cent in arrears for combined Camry/Aurion volume of 30,318 units for the year.

Camry fell 4.2 per cent for the year to 26,485, while Aurion dropped 11.0 per cent to 3833.

Ford finished the year with 13,532 sales of its Australian-built models (-22.6 per cent), with Falcon volume down to 85 units last month as the large sedan drove off into the sunset with 4434 sales for the full 12 months – down 25.3 per cent on the previous year.

Similarly, the Falcon ute only mustered 2170 sales last year, a fall of 18.2 per cent, while the Territory SUV signed off with 6928 sales, down 22.2 per cent. Clearance stock still to be sold will filter through the retail network over the next few months.

Toyota and Holden have a different agenda to Ford as each volume-selling nameplate – Camry and Commodore respectively – is not retired but amplified with the arrival of a fully imported replacement, so both companies will look to keep this year’s production and sales targets around the same mark as last year, albeit with the downward trend factored in.

Just as a new federal industry minister, Arthur Sinodinos, takes up office next week, claiming to be “very optimistic about the future of high-value manufacturing in Australia”, Toyota and Holden are now wholly focused on an orderly and respectful departure and success as a national sales operation – importing high-value products from overseas – from late this year.

By Terry Martin

Read More: Related articles

Read More: Related articles