Despite SUVs looming large in the rearvision mirror of the small-car pack, traditional small sedans and hatchbacks – with the odd wagon thrown in – remain the biggest-selling vehicles as a collective in Australia, accounting for 20 per cent of the entire new-vehicle market with more than 73,000 sales in the first four months of trading this year.

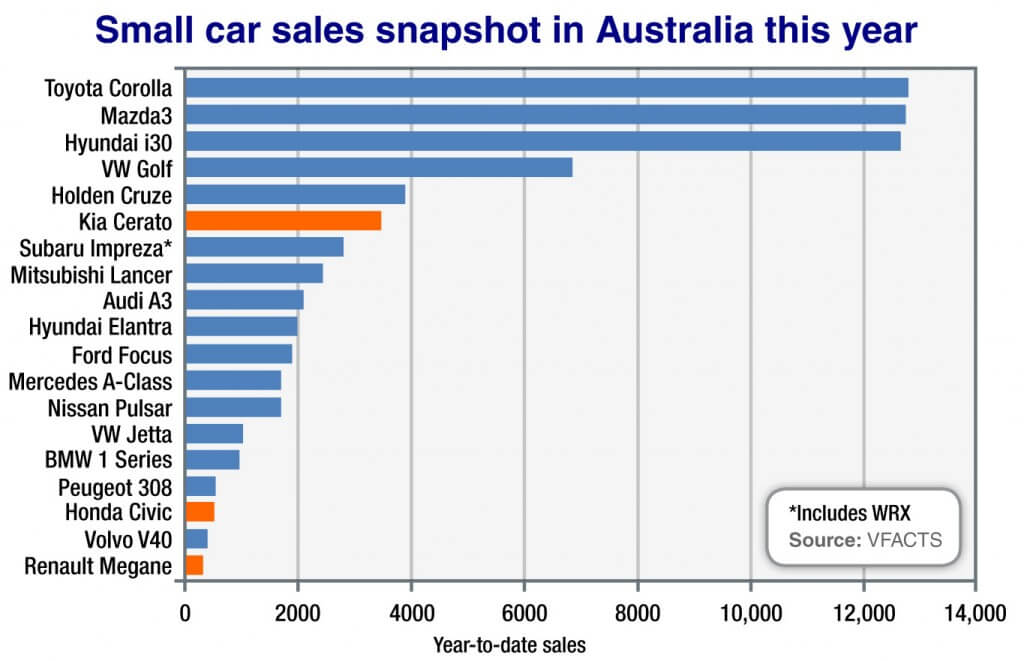

The segment is hugely competitive with around two dozen brands offering at least one model line – several offer more than that – although, as our monthly sales reports routinely indicate, three vehicles dominate the segment: Toyota’s Corolla, the Mazda3 and Hyundai i30, each with a 19 per cent share of the sub-$40,000 class this year.

The only other model in double figures share-wise (10 per cent) is Volkswagen with its Golf, leaving many other brands to work overtime in a bid to remain relevant in the minds of Australian consumers and, given the lower volume, maintain enough margin in each unit sale to ensure their ongoing presence in the segment is sustainable.

Holden with its Cruze, Ford with Focus, Subaru with Impreza, Mitsubishi with Lancer, Nissan with Pulsar (which will have the hatch removed by the end of the year due to market pressures), Peugeot with 308 – these are big names among the mainstream brands that Honda, Renault and Kia have to face as they bring fresh metal to market and look to build sales, share and profitability.

Creating a point of difference, adding specification, adopting a more upmarket position are common themes among brands that refuse to reduce headline prices below $20,000, throwing in automatic transmission and on-road costs as Hyundai has done to great effect sales-wise with its i30.

However, the positioning must be carefully constructed when, on the one hand, buyers are not only price sensitive but have a strong sense of a brand’s worth, while on the other hand are increasingly prepared to step up to luxury marques, all of which have small cars starting around the mid-$30,000 mark.

In particular, Audi with A3, BMW with 1 Series and Mercedes-Benz with A-Class are outselling Civic and Megane, to name just two, while the A3 at more than 2000 sales year-to-date is sitting above the likes of Focus, Pulsar, Impreza (ex-WRX) and Hyundai’s Elantra.

At launch, the new-generation Civic sedan starts out some $4000 upstream of the outgoing model at $22,390 before on-roads and tops out just below the entry-level prestige brands at $33,590. Honda is shooting for a significant sales increase, particularly once the hatch comes on stream next year, but is banking on a premium position and other factors such as the strength of its brand.

Honda’s fortunes with Civic have fluctuated wildly over the past 10 years, reaching a peak of 17,643 sales in 2007 but falling to as low as 4326 units last year – its worst result since 2004.

Note the discrepancy here between 2004 and 2007. The brand has shown before that it can quickly reverse out of trouble, as it did with the eighth-generation Civic in 2006, which took annual sales from less than 5000 at the end of the previous model’s lifecycle to more than 13,500 in the blink of an eye.

So, just as the HR-V has been an instant hit for the brand, Honda is anticipating the 10th-generation Civic will follow suit and act as the driving force behind the brand’s targeted return to 50,000 annual sales in 2017 – up from 40,000 last year and 33,000 in 2014.

Renault has also had mixed fortunes with Megane over the same period, albeit with much lower volume. Although the past seven years have brought an upward trend – from a low of 237 in 2009 to 1426 units last year, which came despite the current model being in its twilight years.

Megane, too, has moved upmarket with the new fourth generation, which is bigger, bolder, far more advanced and has a sporting GT model to bridge the gap between the regular variants and the high-performance RS cars (due in 2017).

Yet Renault also anticipates the new series to snare more buyers than ever before, the company promising a substantial investment in the nameplate and a pricing/specification balance – still to be revealed – that will position it more as a mainstream offering and help the French brand maintain its double-digit annual growth rate.

For Kia, the Cerato is all but certain to remain in the so-called “$19,990 brigade” with the mid-life update of the third-generation series that arrived here in 2013, bringing further sales growth that reached a new high-water mark of more than 10,000 units last year.

There is, however, a greater emphasis these days on the model’s high specification and value rather than rock-bottom pricing, and Cerato – currently in sixth position in the segment – reflects the positive position of the brand overall.

There are plans to bolster the Cerato line-up with a bona fide hot hatch that serves as a replacement for the short-lived Pro_cee’d GT, although this is still to be confirmed and not anticipated until the next generation.

As GoAuto has reported, Kia Motors Australia is also crunching the numbers on offering the European Cee’d here as a premium – and possibly only limited-edition – contender in the small-car segment, covering the higher-margin upper end while Cerato shoulders the high-volume load.

By Terry Martin

Read More: Related articles

Read More: Related articles