But market leadership is more than just about sales volume, isn’t it?

As trite as this might sound, the power and influence that comes with motor industry domination means Toyota is in a position to change attitudes and behaviour – among consumers as well as rival brands – and to establish a significant point of difference in the marketplace, even when sales might not justify the time and expense poured into selling such a niche model.

It would be easier just to keep flogging the stock-standard Corolla, which was the biggest-selling vehicle in the nation last year, rather than diverting resources into a high-end hybrid variant that will appeal only to a small proportion of buyers.

Of course, its environmental benefits mean the vehicle deserves to succeed. We want that to be so, just as we want to believe the company’s sales and marketing chief Tony Cramb when he says there is “enormous potential” for the hybrid Corolla, as proven by its success in Europe where equivalent variants account for more than 50 per cent of all sales of the model.

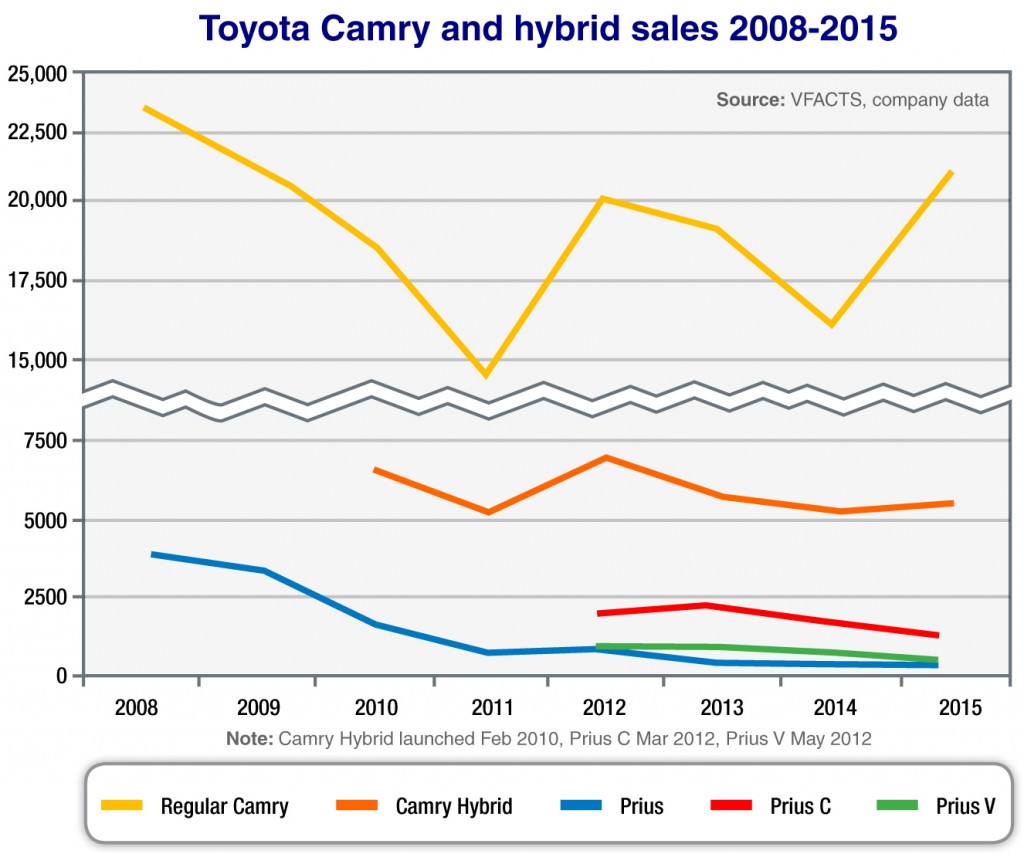

But Australian buyers have overwhelmingly shown a lack of interest in hybrids, as shown with sales of Toyota’s Prius poster boy – including the more recent light ‘C’ and bigger ‘V’ variants – and the locally built Camry Hybrid, and sales of other hybrid cars across the entire market.

The 12,138 hybrids sold in last year’s record-breaking 1.155-million-unit market represent a mere 1.05 per cent drop in the ocean – down 0.02 per cent from a year earlier and down from the short spike (to 1.25 per cent) the market experienced in 2012 when Toyota launched the Prius C and V twins and the second-generation Camry Hybrid, and the company made history by selling more than 10,000 hybrids in a single year (10,787).

Stand by for another upturn this year once the Corolla Hybrid arrives mid-year, and with the new-generation Prius launching in March, although the latter has suffered terribly since the Camry Hybrid launched in 2010, only to be further marginalised in the showroom when the C and V turned up.

Toyota sold fewer than 500 Prius units last year while Prius C (1227) and V (640) were down 25.8 and 11.4 per cent respectively. The C and V have both been trending downward since their initial burst onto the scene, and the 459 from Prius last year – down 5.7 per cent on 2014 – looks positively awful compared to the 3209 units it averaged from 2007-09. The company predicted 4500 Prius sales in 2010 but shifted just 1611.

Even with Camry Hybrid, which attracted heavy government funding and non-private sales, hybrid models as a percentage of Toyota’s overall sales have moved just 0.05 per cent – from 3.93 in 2010 to 3.98 per cent last year.

On the 2015 Toyota scoreboard, that reads: Hybrid: 8207; The Rest: 198,029.

Walking the talk: Toyota’s Corolla hybrid hatch might account for more than 50 per cent of the model’s sales in western Europe (where it is sold as the Auris), but Australia is a much tougher market to crack.

Determining whether the Camry Hybrid ‘experiment’ – one that may well finish when local production ends at Altona next year – has been a success or not depends on who you ask, what you’re told and what you want to believe.

Since launch in 2010, the eco-Camry has never lost its mantle as the top-selling hybrid vehicle in Australia and has amassed 35,896 sales over a six-year period to the end of last year.

That equates to 52.3 per cent of total vehicle hybrid sales in Australia over that timeframe, and, just as importantly, it has averaged 24.6 per cent of total Camry sales.

It has played a role in bringing hybrid motoring to the mainstream, outsold entire brands such as Peugeot and Skoda, and made a positive (but less quantifiable) contribution in areas such as air pollution and, as an Australian-made vehicle, employment and economic growth.

That said, Camry Hybrid has never managed to achieve the 10,000 annual sales Toyota targeted from the outset as the number required to meet its objectives. It has averaged fewer than 6000 a year (5983), with a peak of 7107 in 2012 – the year the second-generation model was launched with a $2000 lower starting price ($34,990) – but since then falling to between 5286 and 5881 units.

While the heavily upgraded Camry recorded a 25.4 per cent surge in overall sales last year to 27,654 units, the hybrid could not keep pace with the regular car, its growth of 11.3 per cent well below the 29.9 per cent for the petrol model.

In a highly specified single model grade, Corolla Hybrid and the mighty Toyota marketing machine will likewise crank up plenty of interest at launch – particularly among corporate and government buyers – but, as history shows us, sales will soon head southward to a modest level that may or may not be maintained unless something dramatic happens in the marketplace.

With the oil price down and Iran’s massive supply coming on stream, it is hard to imagine an immediate rise in petrol prices as a factor.

A $19,990 Corolla Hybrid? Now that would be something, but the smaller Prius C – from $22,990, which is $1500 upstream of the top-spec Yaris ZR and $8000 up from Toyota’s entry-level Yaris Ascent – points to the pricing discrepancies Toyota will have already factored in with the forthcoming Corolla H.

But it is coming. There are no major threats from any other brand, although Honda (with the new-generation Civic Hybrid) and Hyundai (with the all-new Ioniq) will add extra momentum behind the hybrid cause in the small-car segment this year.

Just as it will not let its grip on the overall market slacken, Toyota will not readily give up its dominant 68 per cent share of the brand-enhancing hybrid segment – no matter how small the numbers – as mainstream and luxury brands slowly turn the wheel.

The company failed in its promise made in July 2009 to deliver at least eight new hybrid models over the following four years.

But almost seven years on, Corolla – which was on the original hit-list – is finally coming to market to play its role in the theatre, be it with fewer than 5000 sales a year or, as Mr Cramb, would have us imagine, more than 50 per cent of the 42,000-plus units Australia’s Top Model typically racks up every year.

By Terry Martin

Read More: Related articles

Read More: Related articles