The stated goal for the new model – which has increased in size with its second generation and therefore moves up from the small to medium SUV category – is “at least” 10,000 units per annum, which is around 50 per cent more than the Tiguan nameplate has ever achieved since arriving in Australia in May 2008.

The German motor company that gave the world the so-called ‘people’s car’ (and is now phasing out the 21st Century version of the Beetle in Australia) is using the Tiguan to demonstrate its new local strategy which, in the words of VGA managing director Michael Bartsch, targets the “aspiring middle class” and delivers “premium for the people”.

Michael Bartsch

Mr Bartsch, a former Porsche and Infiniti executive who took hold of the tiller at VGA 12 months ago, is expecting the market to respond favourably to the bigger and better-equipped new model, despite the previous model offering cheaper price points – a sub-$30,000 opening gambit (now up $3000 to $31,990), for example, and all-wheel-drive capability kicking in below $37,000 (now $4500 more at $41,490).

The higher pricetag is seen as a drawcard, not a deterrent; a demonstration of the new model’s significant advancement over the previous version and its new competitors; and a value proposition when compared with compact SUVs from luxury marques further up the ladder – particularly the leading German prestige brands Audi, BMW and Mercedes-Benz.

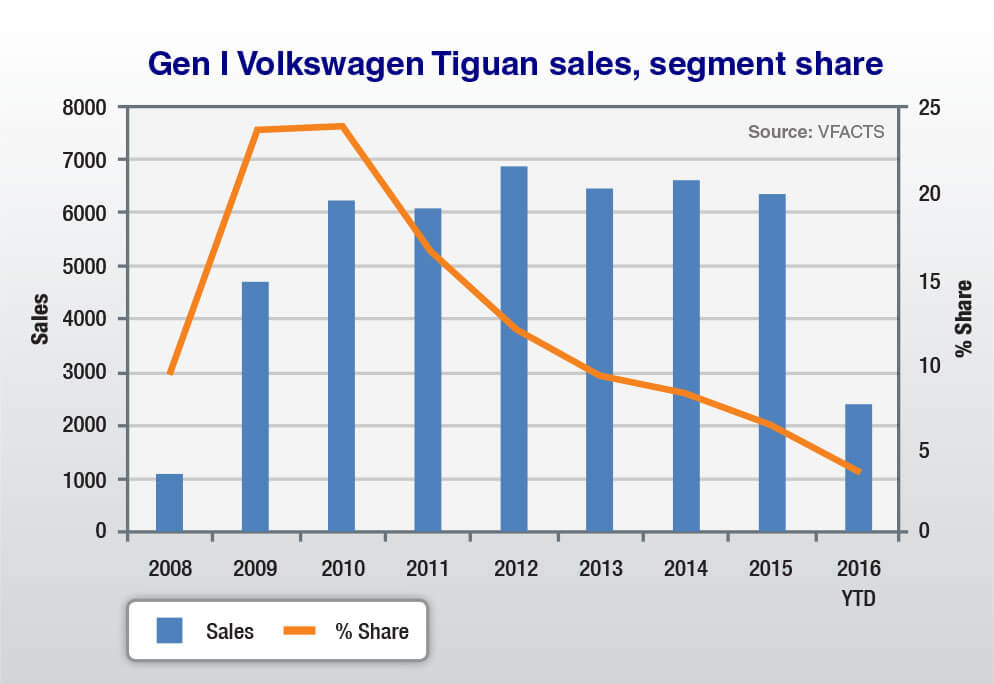

Record sales for the Tiguan nameplate are anticipated, way beyond what was achieved with the first generation.

Class action: The redesigned Tiguan will put VW’s new strategy of targeting the “aspiring middle class” and delivering “premium for the people” to the test.

The past six years have seen the SUV average 6422 units, with a peak of 6871 in 2012 and a low of 6069 in 2011 – a consistent, if not rather stagnant, performance and albeit with a steadily deteriorating share of the segment, falling from 23.7 per cent in 2010 to just 6.3 per cent last year as new contenders entered the market.

This year the first-generation Tiguan’s segment share has dropped to 3.6 per cent, with sales down 48.2 per cent compared to the same period last year.

In the medium SUV segment – the third-biggest class behind small passenger cars and light-commercial pick-ups – the minimum 10,000 sales VW is targeting for the new Tiguan translates to a share of about eight per cent in the volume-selling sub-$60,000 mainstream category.

This mark is managed by only a handful of brands from a pool of around 15 active participants, with the segment-leading Mazda CX-5 last year well out in front with a 19.7 per cent share (from 25,136 sales), followed by the Toyota RAV4 (14.5 per cent/18,435 units), Nissan X-Trail (14.1/17,971), Subaru Forester (9.4/12,029) and Mitsubishi Outlander (8.5/10,884).

To the end of August this year, Hyundai’s new Tucson has become a major force with a 14.0 per cent slice of the segment – placing it third in class, and closing in on RAV4 for second – while Kia’s new Sportage has also brought a solid 32.9 per cent sales increase and a 7.9 per cent overall share.

There is no underestimating the impact of these new-generation models, which have brought substantial improvements across the board in areas such as design, technology and vehicle dynamics – and to which the marketplace has clearly responded.

Renault has also just introduced its vastly improved new Koleos range – maintaining a sub-$30,000 baseline but packing in plenty of value with the cache of a European badge – while Honda will launch its new-generation CR-V next year, bringing to the segment yet another vastly improved model with a broad range (currently starting below $28K) that may well deliver “premium for the people” in much the same way that Volkswagen believes its new Tiguan will influence the market.

Holden is preparing to do the same with the introduction of the Captiva 5-replacing Equinox next year, while there is also plenty of activity with small/medium SUVs among the luxury brands.

Such intense competition from above and below, and with a deliberate strategy not to compete head-to-head with Japanese and Korean brands on price, could make it difficult for Volkswagen to achieve its sales target for Tiguan.

Outside of the Golf, Volkswagen Australia has never achieved more than 10,000 sales in a calendar year for any model in the modern era – that is, since the days when it was a local manufacturer building vehicles such as the original “people’s car”.

The Polo came close last year, finishing just 306 units shy of the mark, but the light car has this year experienced a 19.2 per cent downturn. The current entry point for Polo in Australia’s ultra-price-sensitive marketplace is $17,190 – well above the $14,990 battleground and a far cry from special offers of $15,990 driveaway the model has previously offered.

The days of budget pricing are apparently over at Volkswagen, with the company looking to nonetheless build its sales volume and market share on the back of its German design and engineering, premium status, product excellence and customer service.

That leaves Tiguan as “a lighthouse” of Volkswagen, as Mr Bartsch describes it – a beacon that he believes people will be drawn towards, and aspire to own, like no other mainstream brand in the marketplace.

By Terry Martin

Read More: Related articles

Read More: Related articles