The “Agency Sales Model: Accelerating the future of automotive sales” report canvassed dealers, OEMs and customers in Europe and China.

It said that there was a shift away from a traditional franchised car retail model that the industry is now accepting and that the agency model “will not only drive customer relationships for car manufacturers, but a four per cent increase in revenues.”

Capgemini said that the interest in the new retail system was triggered mainly by the growth in electric vehicles and a desire by OEMs to follow the direct relationships with customers as seen by other industries and in line with the haggle-free online sales process.

It was also driven by the global pandemic.

“Dealers clearly agree that the introduction of a new distribution model is a necessary step in these difficult times,” Capgemini’s report said of the COVID-19 virus.

“This, in turn, can help secure the dealers’ and the OEMs’ survival in the long term. In this context, customer centricity was mentioned as the highest driving force behind the call for action to transform the industry’s current three-tiered sales model.

“The dealers we interviewed were unanimous that the move to an agency model is a central aspect of overall sales transformation.

“Discussing their future role, 80 per cent believe their future will be as an agent, just 11 per cent think they will be classic dealers, and nine per cent service providers.

“More than 80 per cent of the dealers emphasised the lack of price transparency for dealers and consumers.

“Solving this issue was seen as vital for dealers’ future partnership with OEMs and for building a customer-centric approach.”

Capgemini held interviews with 50 retailers in different markets and said 80 per cent had accepted that their future role would be carried out under an agency model, with a handling fee paid to complete sales.

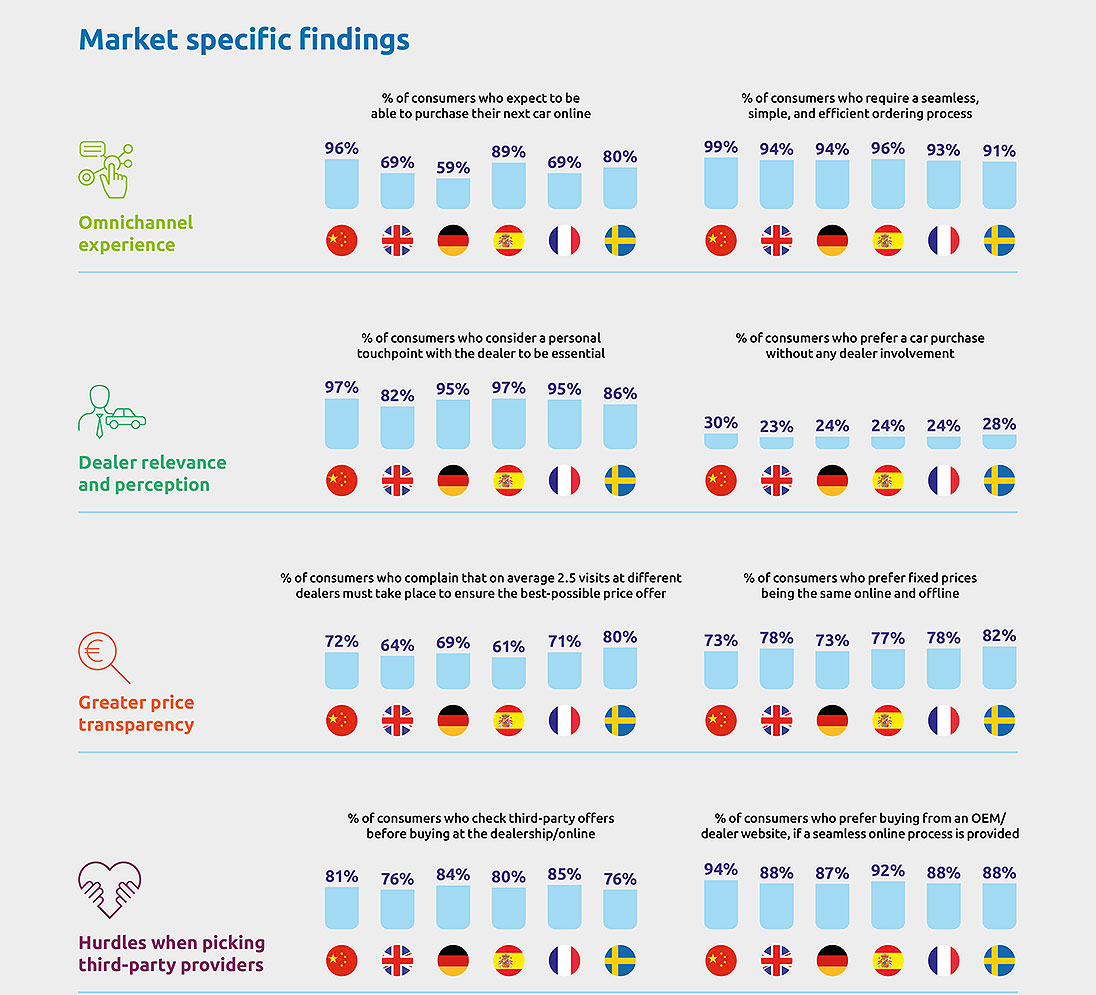

The biggest acceptors of an agency model came from consumers in China. When asked if they would use a dealership when buying through the agency system, 97 per cent of Chinese consumers surveyed said the dealer was essential.

That compares with 82 per cent of UK consumers who would buy through an agency system and use a dealer. In both Germany and France, 95 per cent said the dealer was vital to the sales process. The survey covered six markets but the US was not involved because of its strict automotive franchise agreements.

The research said 85 per cent of dealers who emphasised that the price of the vehicle was uniform between rival dealerships found that consumers appreciated avoiding time-consuming on-site negotiations.

“Even though it might seem counterintuitive, dealers are indeed willing to give away pricing power provided that it applies to the entire dealer network,” the report said.

“A transparent and uniform price guarantees dealers better planning with predefined margins (about 2 per cent) which diminishes traditional intra- and inter-brand competition.

“Dealers also claim that when price transparency is combined with the omnichannel approach, their customer focus is strengthened and the general satisfaction of all stakeholders increases.”

The report quoted a new-car franchise dealer from Germany who said: “Customers want haggle-free prices. With more transparency, we can increase trust in our prices.”

Capgemini said fair remuneration for the dealers (agents), replacing the traditional sales margin, “is considered a central success factor at all levels – headquarters, NSCs, and dealers, with 94 per cent of all dealers surveyed agreeing.”

“Regardless of company size, dealers emphasise the need for all agents to receive the same fee and for individualised customer offers to be prevented.

“From the dealers’ perspective, only a uniform remuneration model and adequate commission can ensure that satisfaction across dealerships will increase, and they are able to focus more on delivering appropriate customer-centricity across the board.”

Capgemini said that the main reason an agency sales model approach was seen as strategic was its ability to create a single customer-centric ecosystem for OEMs, dealers (agents), and customers.

“The manufacturer must design a viable remuneration model that enables economic participation by all stakeholders,” it said.

“This calls for bilateral commitment in development, introduction, and design of the new distribution model.”

The report also said that 91 per cent of dealers interviewed said data transfer between dealers and OEMs was a feature of new retail agreements and that they did not see an agency sales model approach as a threat.

“Rather, they look forward to the advantages of interacting with customers in a more targeted, analytics-based manner,” the report said.

“They indicate that increased transparency in the lead management process and an improved 360-degree customer view will improve the chances of closing sales.

“A consistent IT infrastructure and new processes adapted to digital channels must be established to achieve a successful transformation from the dealers’ viewpoint.”

One of the report’s conclusions was that it was important for dealers and OEMs to devote adequate time up front to defining an overall vision, organisational goals, and success parameters.

“Such preparatory work is particularly vital for larger OEMs, especially if they aim to apply the model across multiple brands or even global markets,” it said.

“In most circumstances, establishing pilots is the right approach. This is not just a matter of deciding whether to start with a pilot market or deploy full scale right from the beginning.

“It is also about choosing a specific product, such as electric vehicles, that allows experience to be gained with a smaller customer group and reduces risks on both the OEM’s and the dealer’s side.

“For dealers, they can gain greater financial security when selling vehicles with alternative powertrains such as battery-electric vehicles and fuel-cell electric vehicles in an agency sales model, owned by the OEM, as the residual vehicle value may be unknown or not yet robust enough.

“New market players, such as Polestar, decided to build their sales model on a market-agent relationship straight from the beginning given that there was no traditional dealer network to be transformed.

“Therefore, when it comes to agency sales, there is no single ‘one-size-fits-all’ solution.

“Agency sales can take many variations and it is crucial for each OEM and market to shape a model suiting both the OEM structure and the dealer network.”

By Neil Dowling

Read More: Related articles

Read More: Related articles