John McConnell

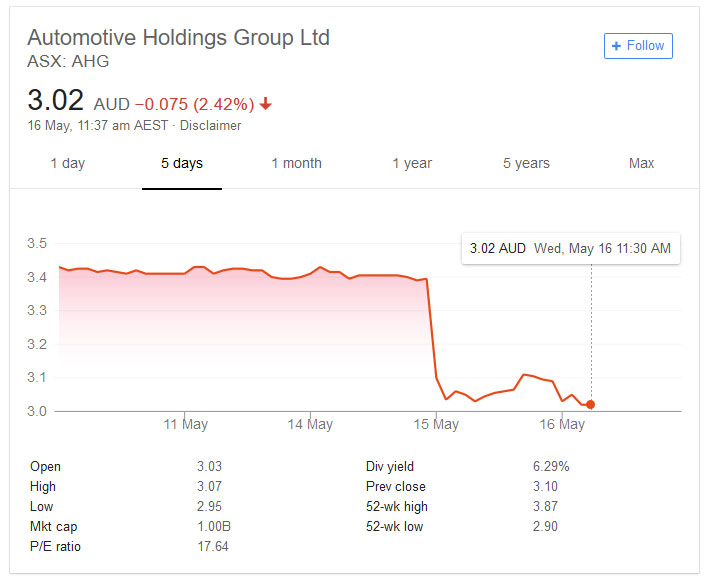

AUTOMOTIVE Holdings Group (AHG) Ltd’s share price slumped 12 per cent on Tuesday as the share market absorbed its statement that it expects falling earnings on “challenging automotive retail conditions” for the remainder of the year.

In a statement to the Australian Securities Exchange (ASX), AHG managing director John McConnell pulled no punches saying the company expects a full-year operating net profit after tax of around $75 million, compared with the 2017 figure of $87.3 million.

The market immediately downgraded AHG, selling shares and pruning the share price to a near-52-week low of $2.99 before trade strengthened and the company closed at $3.10. It ended the previous Friday at $3.40.

Mr McConnell again blamed Western Australia’s lethargic new-car sales as being the primary reason for his depressed outlook, though he has also pointed at the similarly lethargic sale of its refrigerated logistics division.

AHG shareholders were told in November last year that the division, which had caused some pain for AHG as it failed to meet expected financial results over previous years, had been sold for $400 million to Chinese conglomerate and transport company HNA international.

But the deal has been protracted and AHG now sees the sale being completed “on or before” June 30, 2018.

“The business performed ahead of the previous corresponding period in the first half, however second-half trading has been impacted by the sale process and the relatively long lead time to completion,” Mr McConnell said.

“The sale process and associated due diligence has been a major undertaking for the refrigerated logistics management team over an extended period and at a time when the business is going through a significant transformation program and IT systems upgrade.

“We have discussed this with HNA and both parties are working towards completion, as previously advised, by June 30, 2018.”

He added that the recovery in the WA car sales market had affected the company’s prospects.

“Our retail automotive business is adjusting to the changes to finance and insurance sales more slowly than we would have liked and that’s apparent across the sector,” Mr McConnell said in the statement to the ASX.

He said the truck division – seen as an economic barometer to WA’s health because of its link to the resources and transport sectors – remained strong and management remained focused on margin improvement, revenue growth and cost control.

In a review of AHG’s historical performance and the nature of the automotive industry, analysts Morgan Stanley yesterday said car sales were still improving and the reduced contributions from the finance and insurance division had already been factored into the share price. It sees AHG shares valued at around $4.

The WA new-car market rose 7.3 per cent last month, compared with April 2017, which was the biggest rebound of the states and territories. April saw a national average fall of 0.2 per cent in sales compared with the same month in 2017.

By Neil Dowling

Read More: Related articles

Read More: Related articles