Cox Automotive’s ‘Reimagining the Automotive Consumer Experience’ shows that expectations by consumers are getting higher and they are increasingly looking at personalised attention to cater for their individual needs and preferences.

The US-based research found that only one in three (33 per cent) of respondents were “very satisfied” with the dealership model.

While the positive response is low, Cox found it would take only simple changes and minimal disruption to the business to have the potential to reap big improvements to the overall automotive experience.

Cox Automotive’s senior vice-president and general manager of the Autotrader and Kelley Blue Book businesses, Jessica Stafford, said there was a time when product differentiation was a main driver of the purchase decision.

“But as all vehicles have vastly improved over time, we believe the consumer experience, in both buying and owning, has become more important than ever and can be the differentiator in the marketplace and ultimately drive purchase decisions,” she said.

The research covered different levels of consumers but then focused on the wants and expectations of ‘Trailblazer’ consumers. Cox defined these as people most likely to embrace new technology and services.

Cox said that today’s Trailblazers are tomorrow’s average car buyer and that Trailblazer attitudes and expectations will become mainstream within three to five years.

“Trailblazers are more likely to find virtual test drive capability appealing and to embrace the idea of vehicle recommendations powered by artificial intelligence (AI),” the report said.

“Trailblazers want to use voice-controlled vehicle search systems while shopping and are also more likely to rely on AI systems embedded into vehicles to recommend service or maintenance intervals.”

Of the respondents to the survey, Trailblazers made up 17 per cent of the total 2000 participants and nearly half of the Trailblazers were Gen Z or Millennials (under the age of 40) and 63 per cent of this group was “very open” to switching vehicle brands.

Conversely, the survey said that only 37 per cent of average consumers are “very open” to switching brands.

“While these early adopters were a minority of the larger group, it was concluded that Trailblazer expectations would become mainstream by mid-decade,” the research said.

“The key finding fell into two categories. First, consumers are most interested in changes that will reduce unwanted friction in the vehicle buying and service experience – changes that will make their lives easier.

“The message in the research is clear: Consumers want to spend less time at traditional dealerships. They want their experience to be convenient, personalised and easy, based on their preferences and schedule.

“Secondly, consumers are looking for ways to immerse themselves in product details without the help of a salesperson.

“Seven in 10 consumers find the idea of a ‘Brand Experience Centre’ – separate from a traditional showroom – to be an appealing concept. Consumers still want to interact, but they want to do it on their terms.”

The study authors said that it was no surprise that consumers wanted services that helped make their lives easier, terming this the services that “reduce friction”.

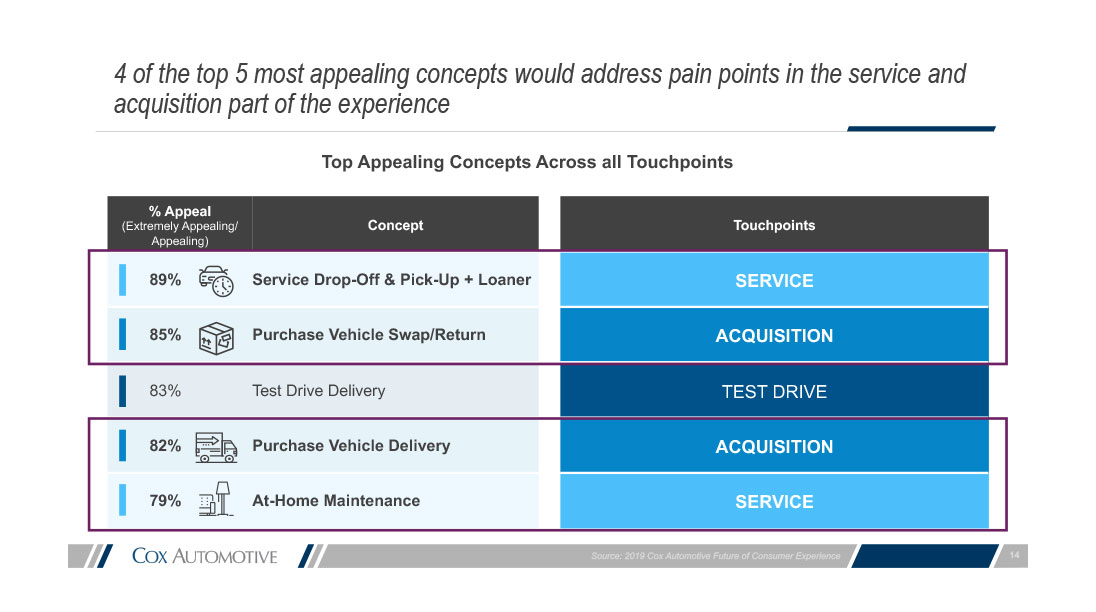

“Consumers indicated the most friction in the current automotive experience is found during the vehicle purchase process (acquisition) and during routine service and maintenance visits,” the report said.

“The services that streamline and improve these areas are most appealing.”

Consumers universally agreed – with a positive return of 89 per cent – that an ideal ownership experience would include a service to pick up a vehicle in need of maintenance or repair and return the vehicle when the work is complete.

“How appealing is the concept? Nearly 70 per cent of consumers would consider switching to a brand offering the benefit,” the report said.

Other top friction-reducing concepts include at-home vehicle maintenance, new-vehicle delivery, and hassle-free return or swap of a newly purchased vehicle.

“While consumers are seeking ways to reduce time spent in acquisition mode or to support routine maintenance, the modern vehicle buyer is also interested in immersive, high-touch experiences while researching a vehicle to buy,” Cox said.

“It is a misconception that consumers don’t want to visit dealerships.

“What consumers don’t want is the hard sell. Six in 10 consumers want help from dealership staff – a product specialist, not a salesperson – to learn more about products.

“For this reason, the concept of Brand Experience Centres performed very well in the research, as the no-sales environment provides a chance for shoppers to experience the vehicle on their own terms.

“Test-drive delivery, where a new vehicle is brought directly to the potential buyer for a test drive – possibly 24 hours in length – was appealing as well.

“The research shows consumers are more likely to trust brands that offer no-hassle experience centres, with product displays and opportunities to drive a vehicle.”

Cox Automotive found that slightly more than half of consumers surveyed indicated they would likely switch to a brand that offered this concept.

The survey said that dealerships could look at changes to their business model within the first year, including:

- Leverage Artificial Intelligence (AI) to identify better targeted leads and enable more personalised marketing messages.

- Incorporate concierge service or mobile service into finance and insurance products.

- Adopt digital retailing tools and include at-home vehicle delivery as part of the experience.

- Develop a network of product specialists to support in-store customer interactions and at-home vehicle deliveries.

- Partner with non-automotive brands to create everyday value for consumers.

Within the next two to five years, dealerships could:

- Enhance the retailer network with alternative retail formats (eg brand experience centres).

- Enable vehicle subscription models.

- Support next-generation digital experience including VR and 360 holograms.

- Partner with other transportation companies (air, train, bike, etc) to create end-to-end mobility solutions.

- Test remote vehicle service update technology and the use of AI in vehicles.

The report was developed by a Cox Automotive team of experts which over 2019 interviewed futurists, established focus groups, developed concepts and surveyed 2000 consumers to measure the merit of each concept.

By Neil Dowling

Read More: Related articles

Read More: Related articles