The Geelong-based company, which includes former Holden chairman and managing director Mark Bernhard as one of its directors, now has a market capitalisation of $331.1 million and said it would be profitable by the last quarter of this financial year.

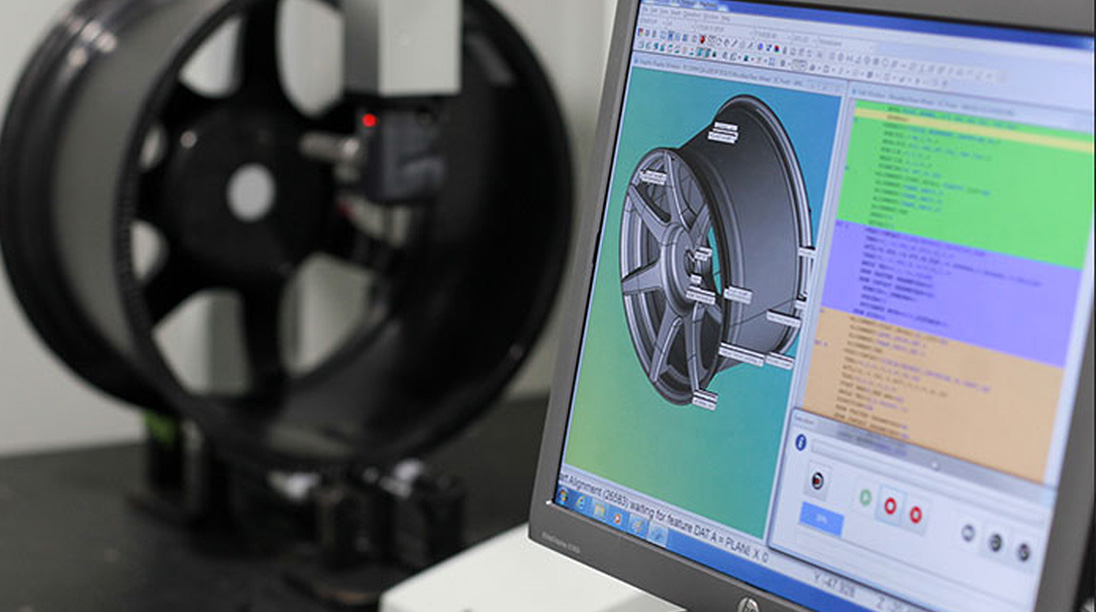

Carbon Revolution (CR) started developing its wheels in 2007. It now claims to be the only company in the world to have successfully developed and manufactured a single-piece carbon-fibre wheel to OEM standards.

It started work with Ford on carbon-fibre wheels in 2014 for the Mustang GT350R and delivered in 2015. During 2015, it delivered 17,300 wheels for about 4300 vehicles.

At August 2019, CR was making an annualised 12,000 wheels per year and has plans to expand production to 32,000 wheels by June 2020.

It now has nine supply contracts for its carbon-fibre wheels with transport and automotive companies, including Ford, Ferrari, Renault and, more recently, an unnamed SUV maker – and is in discussion with other OEMs.

In 2019, it received a $2.4 million grant to design the world’s first lightweight carbon-fibre wheels for the Boeing CH-47F Chinook helicopter.

In its statement on listing on the ASX, Carbon Revolution CEO Jake Dingle said the funds raised would be used in the manufacturing process to reduce the unit cost of the wheels and increase production capacity.

Mr Dingle said the company has formed an alliance with Mitsui Trading Company and has been awarded a federal government grant to adapt CR technology to the aerospace industry.

CR’s main market is in the high-performance and luxury car segments and estimates the market for its wheels is 36-56 million units a year. Global wheel production, including steel and alloy, was 429 million units in 2018.

The company raised $30 million from the public through the issue of 11.5 million shares at $2.60 plus a further raising through the sale of $60 million of shares to existing investors, grossing $90.1 million for the company. It now has 127.3 million shares on issue.

CR reported a loss for the 2018-19 year of $27.21 million on sales of $13.84 million (up from $6.73 million in the previous financial year), on revenue of $15.07 million. The loss was incurred through capital expansion. During the year it issued convertible notes worth $73.37 million which converted to equity on the company’s listing.

It said that the company was in its “pre-profitability stage of its lifecycle and was dependent on capital investment”.

By Neil Dowling

Read More: Related articles

Read More: Related articles