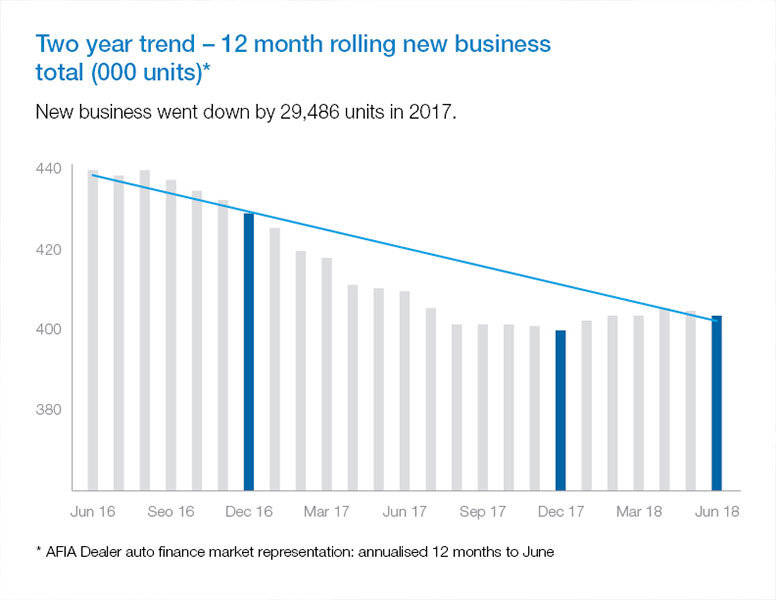

In last week’s GoAutoNews Premium, we looked at how new regulations and customer-centric online tools can help boost the appeal of dealer car finance. While true, it’s important to remember that dealer-sourced retail loans are currently falling* – a trend largely driven by customer and dealership behaviours.

The good thing about most behaviours, of course, is that they can be changed.

For example, the default tendency among customers to go to their bank for credit can be ‘interrupted’ by well-timed sales conversations.

We also know that, of the 54 per cent of customers who pre-arrange finance, over 70 per cent do so to gain confidence in knowing how much they can spend#.

So, what should dealership business managers conclude from this?

Firstly, bring the finance conversation forward. Don’t be afraid to offer quotes early on, even before a test drive.

Secondly, business managers need to help build customers’ confidence in them and their offering. To achieve this, business managers must build a strong understanding of financier credit requirements and processes. Only then can they proactively offer finance solutions for customers at the dealership.

Customers are increasingly demanding convenience and speed, too. While much responsibility for delivering that lies with financiers, dealerships can achieve a lot by improving their own service efficiencies. Remember, if dealerships can’t deliver relatively fast and streamlined finance application processes, customers may retreat to their bank for a solution.

Achieving improved efficiency and transparency requires a team effort by dealerships and financiers. Customers often cite documentation volume as a major bugbear during the application experience. Working with financiers to consolidate, automate and digitise the dealership finance application process can go far to address that perception.

In terms of convenience, emailing a finance requirements checklist to customers before they visit a dealership lets them come prepared, helping reduce potential follow-ups for outstanding documentation.

Another simple solution is to offer flexible settlement and repayment dates to align with customers’ salary payments. Macquarie Leasing’s settlement pre-booking service allows dealerships to provide that flexibility.

Dealerships can also tap into the 54 per cent of customers who pre-arrange finance by getting online. The banks are already there, actively marketing themselves on car classifieds and social media sites. These sites are also excellent places for dealerships to promote finance offers to customers before they step foot in the showroom.

To wrap up, the auto finance industry is heading into an exciting period of change and opportunity. The coming months and years won’t be without their challenges, but it’s important to remember that we all have access to more information and technology than ever before. Financiers like Macquarie Leasing are working hard to harness those resources to provide dealerships and customers with tools that make everyone’s transition smoother and easier.

Russell Bryant is the division director – national manager, strategy & transformation at Macquarie Leasing.

*Source: AFIA Dealer auto finance market representation: annualised 12 months to June 2018

#Source: RFi Group Auto Finance 2018 Market Report

By Russell Bryant

Read More: Related articles

Read More: Related articles