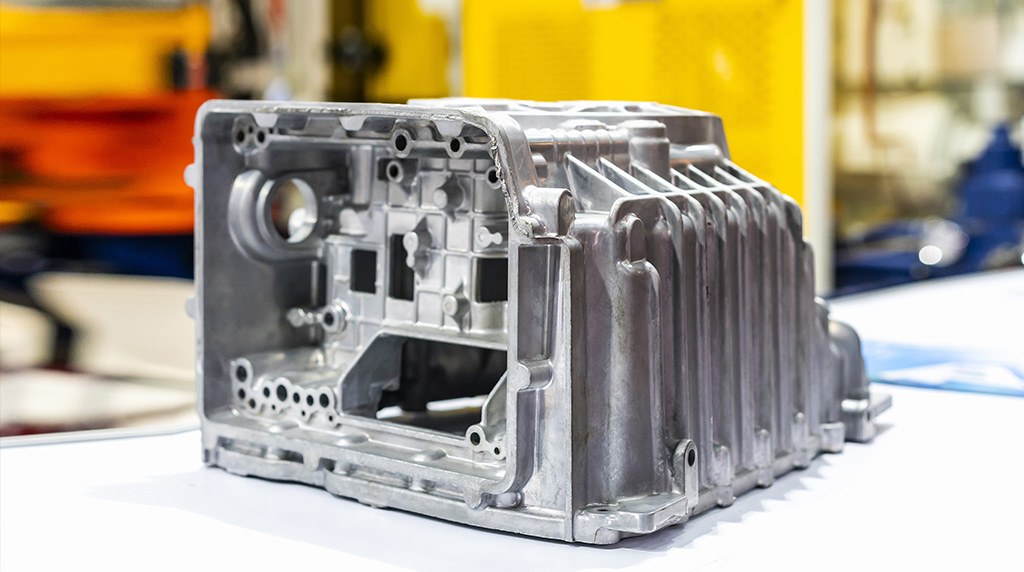

The country is the world’s biggest producer of the metal, used as an aluminium alloy for gearbox and engine castings, wheels and suspension components as well as used in steel production to remove sulphur.

Magnesium production plunged after China cut electricity to high-energy factories to meet environmental targets.

China produces almost 90 per cent of the world’s magnesium with car-makers being one of its biggest buyers. The metal is supplied in an aluminium amalgam.

The European Automobile Manufacturers’ Association (ACEA), along with 11 other industrial trade associations, last month issued a warning about the impending magnesium shortage.

It said that European businesses were expected to run out of magnesium stocks by the end of November “with production shortages, business closures and associated job losses to follow.”

Worse, it said there are no alternatives to magnesium in aluminum billet production.

“China’s domination of the market means alternative sources of magnesium on the scale required should the Chinese shutdown persist simply do not exist,” the ACEA said.

ACEA said global car manufacturers have already been forced to postpone the production of millions of new vehicles in 2021 due to the semiconductor shortage and now an “aluminum crisis could severely compound that problem.”

The metal is sensitive to coal and ferro-silicon prices and supply. Prices recently hit $A12.50 a kilogram when coal mining in China was curtailed and coal-fuelled generators operated on reduced output.

It has now settled back to around $A6.40 a kilogram but European business groups are now saying China will run out of stocks this month. The groups fear European companies will face reduced output, factory closures and job losses.

As supply ends and demand increases, the magnesium price is expected to rise. The last time prices surged was 2008 when China issued restrictions on coal-fired power plant output to minimise air pollution during the Olympic Games.

Prices then rose to the equivalent of $A9 a kilogram.

Nikkei Asia reports that China has an advantage in producing magnesium because of cheaper coal and electricity.

Now customers are increasingly aware that China is a risk as a reliable supplier and Nikkei Asia said there is “increasing demand to buy from other countries.”

Magnesium is also produced in Turkey, Israel, the US, and Brazil.

By Neil Dowling

Read More: Related articles

Read More: Related articles