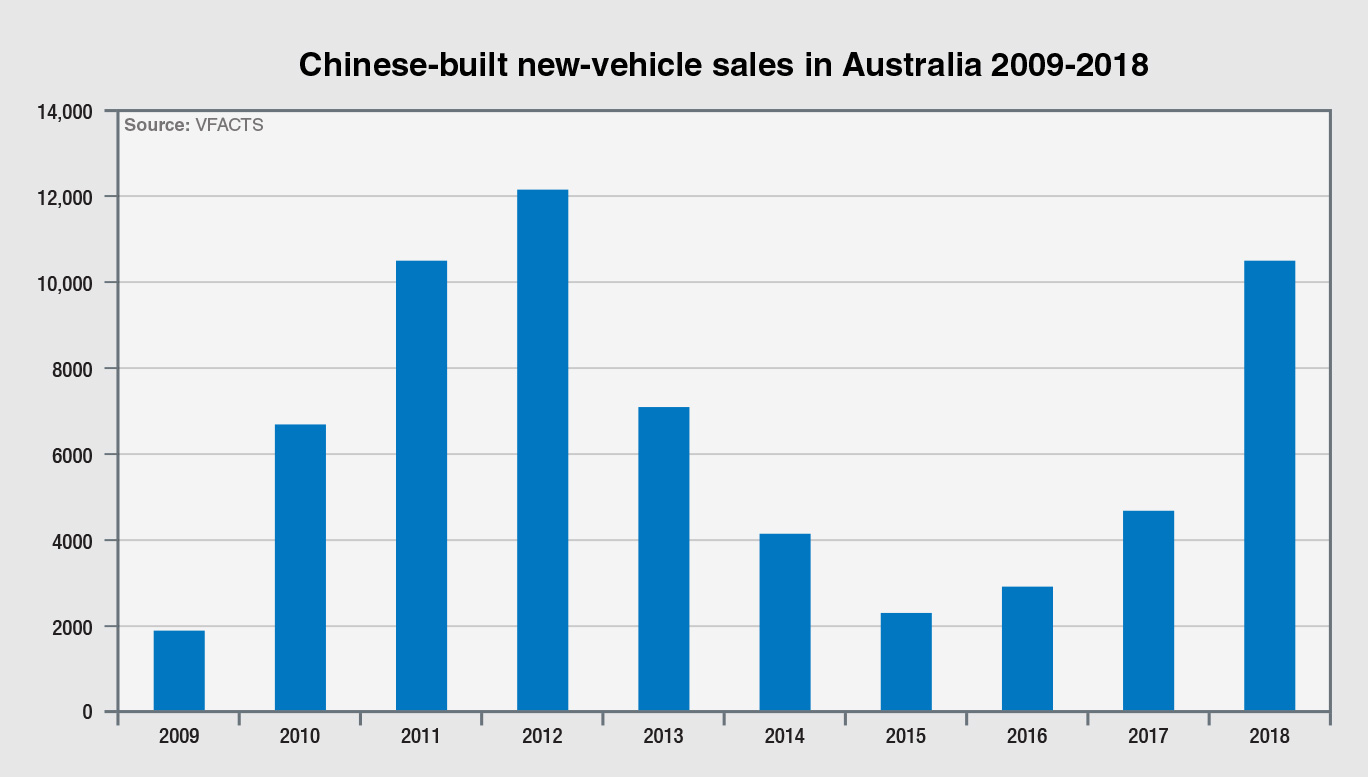

Official VFACTS figures do not include brands such as JMC and Foton, but across those that are represented – LDV, MG, Haval and Great Wall – the combined 10,489 new registrations recorded last year is the best performance from the Chinese collective since the 2012 peak of 12,139 units.

That record came at a time when the pioneering Chinese franchise, Great Wall Motors, hit its straps under independent importer Ateco Automotive, before a stalemate over distribution between Ateco and the factory crippled sales until an agreement was struck and the manufacturer – already operating here with its SUV brand Haval from October 2015 – took control and relaunched with the new-generation Steed ute in September 2016.

Since then, the Steed has returned only modest sales – 404 units in 2017 and 784 last year – while the four-model Haval line-up has likewise struggled to penetrate the ultra-competitive new-vehicle market, with 286 total sales in 2016 and 710 the following year, only to experience a setback last year with a 10.8 per cent fall to 633 units.

Market actions late last year such as sub-$20,000 driveaway versions of the dual-cab Steed and Haval H2 crossover have had a positive effect, along with a seven-year warranty offer, but the manufacturer has admitted that substantial growth really hinges on the next wave of new-generation models, which might not be seen until 2020.

Among the Haval line-up, only the H9 flagship SUV was in positive territory in 2018, with the updated model launched early last year attracting 169 sales (up from 59). The H2 attracted most attention (273, -8.1%), followed by the H6 mid-sizer (180, -41.6%), while the large-size H8 managed only 11 sales.

Ateco, meanwhile, remains the dominant player with distribution rights for LDV (since 2014) which has a burgeoning range that last year racked up 6064 sales – twice as many as any other Chinese brand and representing a 135 per cent increase over 2017, thanks to a full year of trading with the T60 ute (3210 units) and the related D90 large SUV (262).

Supporting cast roles were played by the G10 one-tonne van and people-mover (1337/810) and the larger V80 van (444). Further afield, from 2020, a mid-size SUV and other LCVs including a compact van and an MPV spun off the same platform are expected.

The other major contender among the fledgling Chinese brands is the reborn MG, which recorded 3007 sales last year – well up on the 600 registrations in 2017 (after relaunching in October the previous year) and owing much to a full 12 months of trading with the ZS small SUV (1692), which is its most popular model by a country mile.

T time: The LDV T60 one-tonne ute was the biggest-selling Chinese vehicle in Australia last year with 3210 new registrations, the vast majority of them 4x4s.

Making up the numbers are the GS mid-size SUV, launched in March 2017 but managing only 333 sales last year, while its passenger cars – the MG3, facelifted last October, and the MG6 mid-sizer – mustered 982 units between them (564/418 respectively).

SAIC Motor Australia, the factory operation that took charge of MG after an unsuccessful attempt by independent operator Longwell Motor, is taking a long-term approach to building up its presence in Australia – the same sort of sentiment seen from Great Wall/Haval et al – and, notably, there are no moves at this stage to take in LDV from Ateco, which is part of the Chinese auto giant’s stable.

Talk is of sustainable growth and a carefully targeted expansion of its dealer network, plus building up awareness of its seven-year warranty now that it extends beyond its SUVs to include the updated MG3.

Elsewhere, Foton’s sales are no longer published since it became yet another Chinese brand to move from Ateco into the hands of a small factory operation (Foton Motor Australia), but Ateco at least proved that it could sell more than 1000 examples of the Tunland ute per annum – back in 2015, when the brand was still new to the market – and today the Tunland is sold alongside by the Sauvana large SUV, Cargo van and Aumark light truck.

JMC Motor, too, has the Vigus ute and the Conquer light truck on sale in Australia, while King Long vans are imported for retrofit with an all-electric powertrain by Melbourne-based SEA Electric, which is one to watch now that the company has received substantial government backing and is expanding with a new factory to be built in the Latrobe Valley in Victoria.

Even with sales added from the Chinese brands that are not part of the Federal Chamber of Automotive Industries’ VFACTS reporting service, the total figure is not likely to represent more than one per cent of total light vehicle sales in Australia.

The circa-10,500 combined sales from LDV, MG, Haval and GWM – plus a solitary unit from Chery, which is in recess under Ateco’s control – account for 0.94 per cent of the overall market (excluding heavy commercial vehicles), so China’s penetration remains superficial.

That said, the commitments from the major distributors and the factories are solid, the volume might be relatively small but the sales growth over the past couple of years is still significant and ongoing growth should soon see China among the top 10 countries of origin for new-vehicle sales.

It is currently 11th, but if there are no substantial movements from the likes of Hungary, Mexico and the Czech Republic – all at around 11,500 to 12,000 units – China could be up to eighth by the end of this year, and looking to leapfrog Spain (14,818 last year) to claim seventh before too long.

That would then see the collective from the world’s biggest motor market looking to reel in England and Germany – at circa 33,000 and 91,500 respectively last year – before considering if, and how, it can reach the big guns supplying the Australian market such as South Korea (170K), Thailand (300K, building most of the utes sold here) and Japan (356K).

By Terry Martin

Read More: Related articles

Read More: Related articles