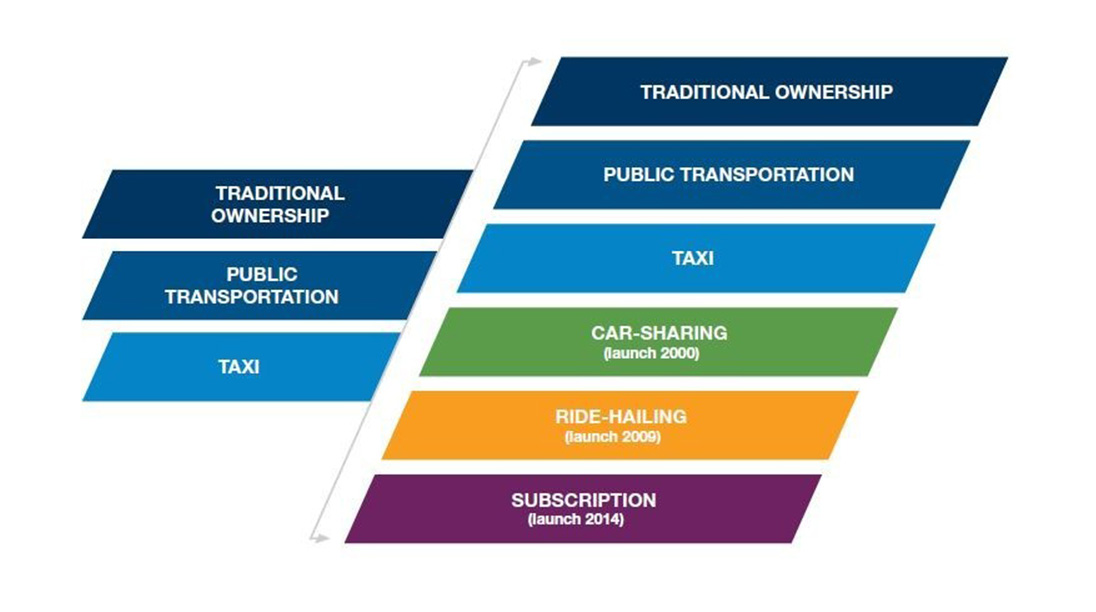

This is pushing them towards newer concepts such as subscription services and mobility providers such as Uber.

The 2018 Cox Automotive Evolution of Mobility Study surveyed 1250 consumers in the US aged 12 years and older, and compared the results to a similar Cox Automotive 2015 Ride & Car Sharing Trend Research Study which surveyed 2464 consumers.

Picture: Uber

The biggest change, Cox reported, was the significant increase in consumers saying car ownership was too expensive. In the latest survey, 55 per cent of Gen Z respondents (born 1995-2015) said owning and leasing was too expensive compared with 46 per cent in the 2015 survey.

For ‘millennials’ (also known as Gen Y and born 1981-1996), 52 per cent said cars were too expensive compared with 42 per cent in 2015. The increase was also noted for Gen X (born 1965-1979) and baby boomers (born 1944-1964), but to a lesser degree.

Cox said the survey results are important indicators for dealerships because of the volume of consumers involved. In the US, Gen Z represents 74 million people (7.35 million in Australia) and millennials are a further 73 million (4.7 million in Australia). All are either car owners or potential owners.

Almost 25 per cent of survey respondents agreed that transportation is necessary – but said owning a car was not.

The awareness and usage of ride-hailing, car-sharing and vehicle subscription services is also growing, according to Cox.

“Collectively termed ‘mobility’, these disruptions to conventional automotive retail are predicted to have a significant impact on consumer vehicle sales over the next five years,” the report said.

“Dealers and OEMs must prepare for this change.”

Why has there been a change in attitude?

Cox said that there is a shrinking disposable income gap – the bit between what you earn and what you spend on necessities. This is putting pressure on consumers’ ability to afford a vehicle which is creating more demand for mobility alternatives.

“The traditional transportation model – comprised of vehicle ownership, taxis and public transportation – will expand to include mobility services that offer the ability to pay by usage. This will precipitate a fundamental shift in the market from vehicle ownership to ‘mobility as a service’,” Cox said.

Additionally, the company gave the following insights into mobility as a service:

Ride-hailing services:

- These include Uber and Lyft and are now mainstream. Nearly 90 per cent of consumers are aware of them and, in the past three years, nationwide usage of ride-hailing services has jumped 17 points to 39 per cent.

- All generations use ride-hailing services.

Car-sharing services:

- Including Zipcar, these were first introduced in 2000, nearly 20 years ago, and have been around twice as long as ride-hailing services. However, only 54 per cent of consumers are aware of them and usage has remained fairly flat over the past three years.

- Unlike ride-hailing, car-sharing growth is limited primarily to Gen Z and millennials.

- Respondents said car-sharing lacked convenience and safety while having higher costs.

- But they said car-sharing provided flexibility to drive the vehicles they wanted.

Subscription services:

- These were introduced in the US in 2014 with the launch of companies like Clutch and Flexdrive. OEMs began to compete in this space in 2017.

- Research shows that this mobility solution is gaining traction among consumers, particularly those looking to forego traditional ownership.

- Twenty-five per cent of consumers are aware of vehicle subscription services but only about 50 per cent are aware of car-sharing services (which have existed for nearly 20 years).

- Ten per cent of surveyed consumers said they would opt for a subscription service over buying their next vehicle. Cox said this suggests there is growing opportunity for this service, particularly among Gen Z and millennials.

- Benefits include access to the latest technology, care-free maintenance and flexibility/ability to drive a variety of vehicles.

Cox said the main take-out points of its report are:

- While personal vehicle ownership is still prevalent, the perception that ownership is necessary is starting to dissipate as mobility alternatives emerge and the cost of ownership continues to rise.

- Ride-hailing has not displaced vehicle ownership to the degree that car-sharing could, if car sharing’s current awareness and accessibility challenges can be overcome.

- While vehicle subscription services are still new to the market, they present a promising alternative to traditional ownership by giving younger generations access to the latest technology, providing a low-maintenance alternative to older consumers and offering consumers the ability to frequently swap vehicles.

- To remain competitive as mobility alternatives become more popular, dealers and OEMs can diversify their operations to create new profit centres with alternative transportation services.

- Stakeholders can acquire new capabilities through partnerships to help successfully manage the integration of these models into the business. This will be critical to reducing the technological and logistical hurdles that cut into profits. For example, Clutch Technologies’ software platform enables dealers, OEMs and mobility companies to provide subscription services that create sustained consumer relationships and generate growth opportunities.

By Neil Dowling

Read More: Related articles

Read More: Related articles