This is especially the case with the younger generation which is questioning the high cost of car ownership via hire purchase or leasing.

According to the 2018 Cox Automotive Evolution of Mobility Study on Alternative Ownership consumers’ attitudes about the necessity of vehicle ownership are gradually changing.

The study said various business models such as ride hailing and car sharing are gaining traction, as are new subscription or flexible lease options.

While respondents are saying that access to mobility is necessary, they are now questioning the need to actually own a vehicle to achieve this.

In fact the number of people holding this view is now just short of 40 per cent of respondents, and this represents a 4.0 percentage point increase over results from 2015.

For urban consumers, 57 per cent indicate access to mobility is more important than vehicle ownership, a 13-point increase since 2015.

Of concern is that nearly half the respondents (48 per cent) perceived the cost of owning or leasing a vehicle is becoming too high.

This means increasingly more consumers are prioritising ride-share technology solutions like Uber that provide easy and more cost-effective mobility over traditional vehicle ownership.

Autotrader executive analyst, Michelle Krebs, said in a statement: “Private ownership still dominates the automotive landscape, but options like ride hailing and subscription programs are increasingly popular with young urban dwellers.

“The trendline for these programs could drastically alter this industry over the next five-to-10 years,” she said.

The study showed that today’s consumers continue to rely overwhelmingly on vehicle ownership as their primary mode of transportation and love the freedom (81 per cent) and convenience (89 per cent) associated with it.

But this is not particularly true with younger generations; 55 per cent of Generation Z (who are 12-22-year-old respondents), and 45 per cent of Millennials, (23-36-year-old respondents) feel transportation is important, but owning a vehicle is not.

Whereas far fewer of older generations – 34 per cent of Generation X (37-53-year-olds) and 28 per cent of Baby Boomers, (54-72-year-olds) – feel the same.

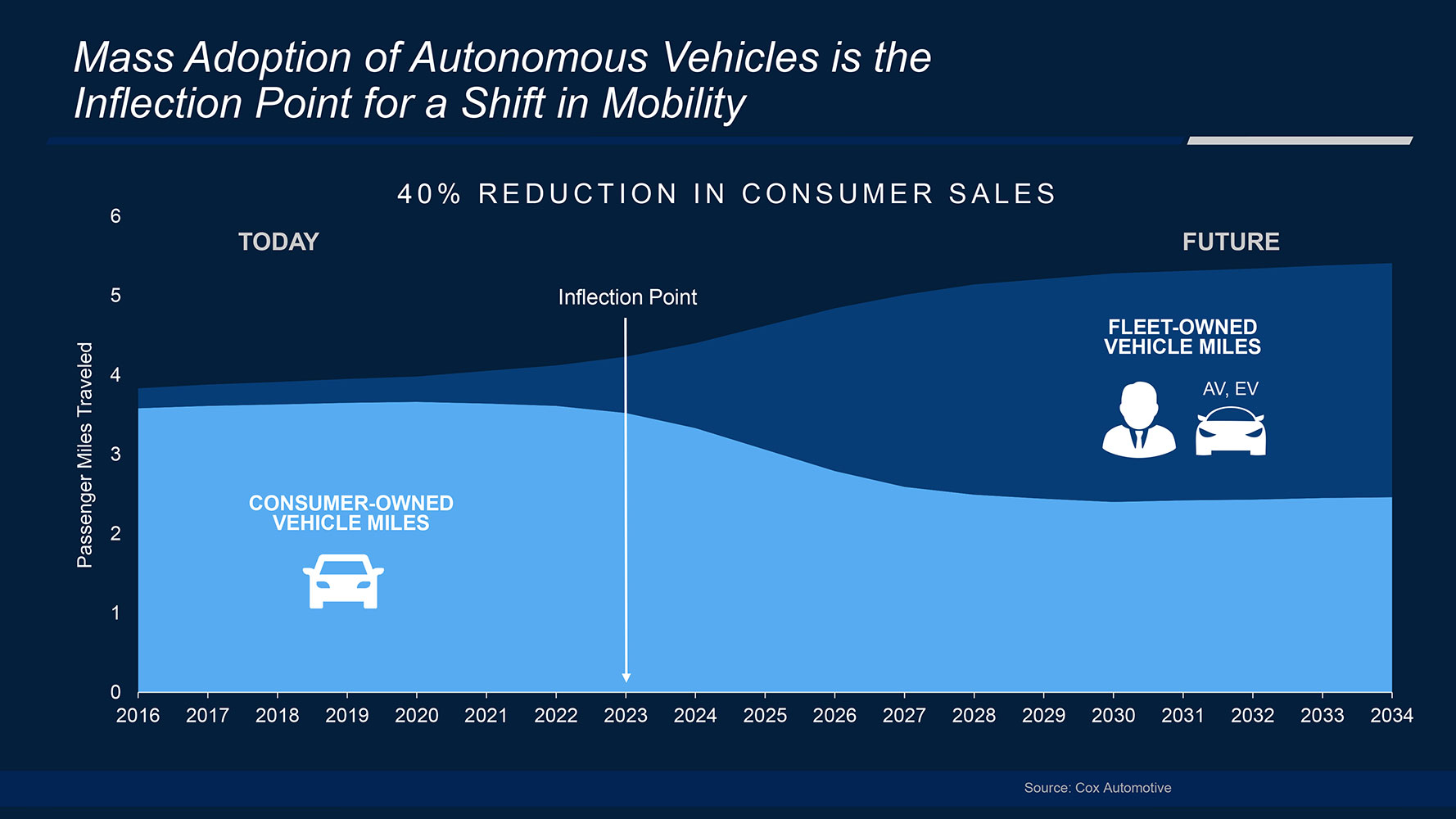

The report said that car-makers like BMW, Mercedes-Benz, Porsche and Volvo and mobility companies like Clutch and Flexdrive were growing an ecosystem of fleet vehicles where commercial owners hold the asset and charge consumers to use them.

Ride Hailing is Mainstream, While Car Sharing Remains Niche

Usage and awareness of ride hailing has hit the mass market, the report said. As much as 88 per cent of respondents were aware of ride hailing regardless of where they lived and more than half of Millennials (55 per cent) use this service.

Car sharing has experienced slower growth (and in pockets) with awareness at 54 per cent including a quarter of Millennials adopting it. Lack of widespread adoption is due in part to car sharing being significantly less accessible than other alternative transportation methods.

In urban areas where car sharing is most prominent, only 44 per cent of consumers find it accessible versus the 85 per cent of consumers that find ride hailing accessible.

The car sharing space also is fragmented with many players offering consumers a lot of different options and leaving no clear leaders in usage. Ride hailing is less crowded, with Uber (30 per cent) and Lyft (18 per cent) as the clear front runners in terms of usage among respondents.

Car Subscriptions Gaining Traction in Early Stages

Car Subscriptions Gaining Traction in Early Stages

The newest alternative ownership model is car subscription services, described to consumers taking the survey as a service that gives users control of a vehicle (similar to leasing), but also offers the ability to swap the vehicle weekly or monthly.

Users pay a one-time membership fee and a subscription payment for their vehicle access (either weekly or monthly) that includes all expenses (except gas) such as insurance, maintenance and roadside assistance.

While only beginning to gain traction and currently only available in select markets, 25 per cent of consumers (18-64 years old) have heard of car subscription services. Comparable to car sharing, it is most appealing to young males and new-vehicle buyers, with 10 per cent of consumers indicating they would be open to a vehicle subscription service instead of purchasing or leasing a vehicle the next time they are in the market.

Access to the latest technology is the key draw to subscription services (44 per cent) – worry-free maintenance (36 per cent), the ability to swap vehicles based on your needs (35 per cent), and flexibility (35 per cent) also are strong benefits.

The release of the data ties in with Cox Automotive’s recently announced formation of its Mobility Solutions Group.

The new business division will focus on developing and investing in solutions that will fuel new models for consumer mobility and enable fleet management solutions for its partners and clients.

Additionally, Cox Automotive announced the acquisition of Clutch Technologies, which joins Flexdrive, Getaround, Ouster and Ridecell as companies that Cox Automotive has invested in.

“Car subscriptions are gaining traction among Millennials, and it’s anyone’s game at this point,” said Cox Automotive Mobility Solutions Group president, Joe George.

“Our clients are already shifting some of their focus to mobility with automakers and dealerships getting into subscriptions, as well as car-sharing and fleet management.

“Our strategy is to enable our clients to grow their business and stay relevant as the automotive industry evolves.”

By John Mellor

Read More: Related articles

Read More: Related articles