The survey said that although dealers were concerned about the weak trading conditions in the first six months of 2018, they were slightly more optimistic about the rest of the year at the time of the survey.

The half-yearly Cox Automotive Australia Dealer Sentiment Index (CAADSI) survey, launched by Cox Automotive in conjunction with the Australian Automotive Dealer Association (AADA), seeks to understand dealer perceptions of current retail vehicle sales and sales expectations for the next six months in categories of “strong”, “average” or “weak”.

The survey also asks dealers to rate business conditions with a focus on new and used-car sales as well as parts and service.

It looks at key drivers including consumer traffic, inventory levels and price pressures and responses are used to calculate an index.

Cox Automotive Australia’s director of marketing and communications Mathew McAuley said many factors were responsible for the poor view of the first six months of the year.

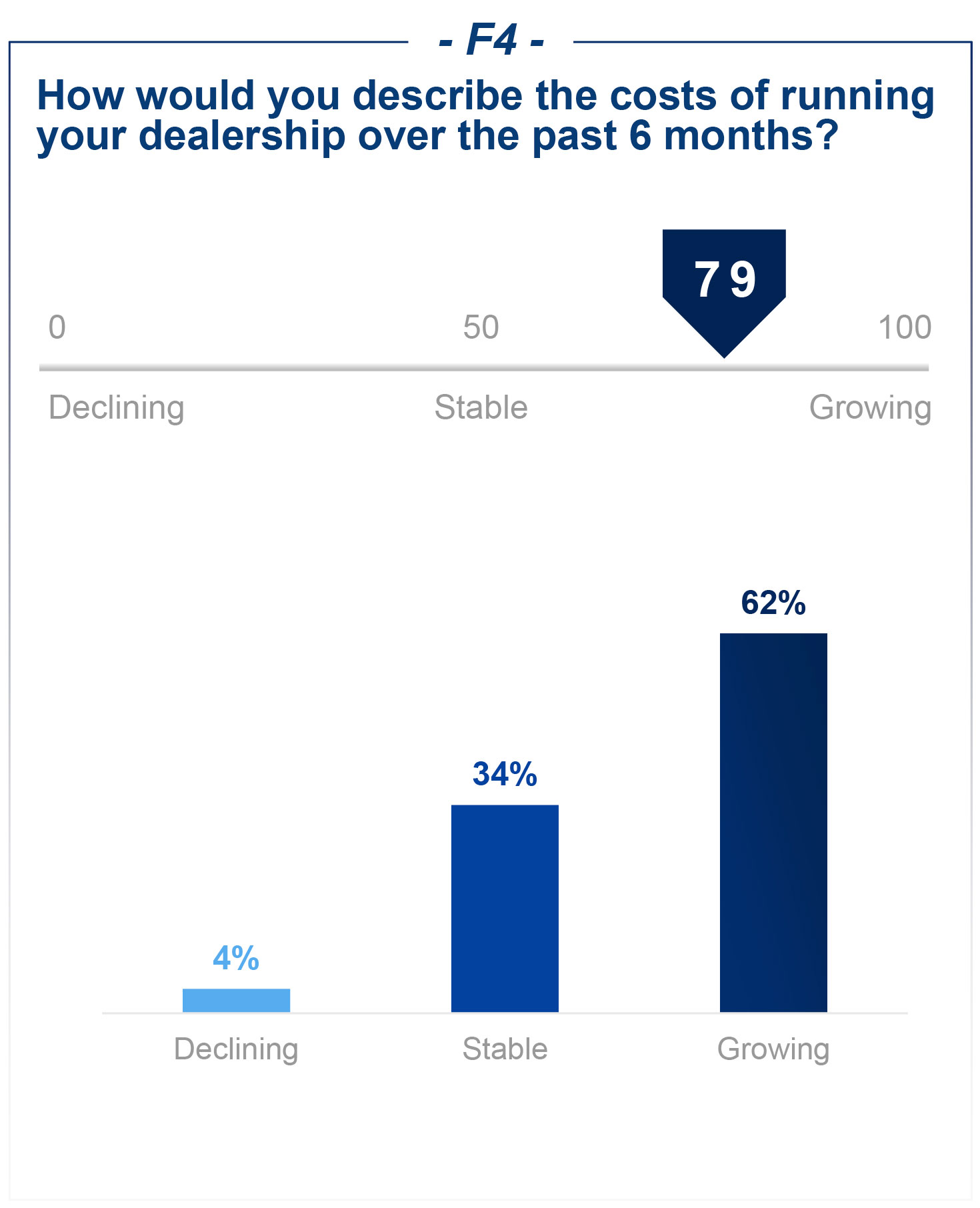

“Surveyed dealers cite strong pressure to lower prices (index score of 80), combined with rising costs and growing inventory levels,” he said.

“Almost two-thirds (62 per cent) of dealers told us that the cost of running their dealership had increased since the start of the year and 42 per cent told us their new car stock levels had increased.”

One of the lowest indexed scores was in relation to the dealer’s view of the new-vehicle sales environment, recording a low score of only 28/100.

Used vehicles fared much better with an indexed score of 42, with 50 per cent of dealers describing the used sales environment as “fair” and 17 per cent as “good”. This was supported by stable used vehicle inventory levels.

“The survey also looks at profit levels within different departments at the dealership and we found dealers had a fairly negative view of their F&I profitability over the past six months,” Mr McAuley said.

“With an indexed score of 33, half the surveyed dealers rated F&I profitability as ‘poor’. In light of the ASIC changes to finance rules that started today (November 1), this is not surprising.

“They did however have a far more positive view of parts (index score of 59) and service (index score of 66) which means they see the aftersales area in a far more optimistic light than the new and used car departments when it comes to delivering results to the bottom line.”

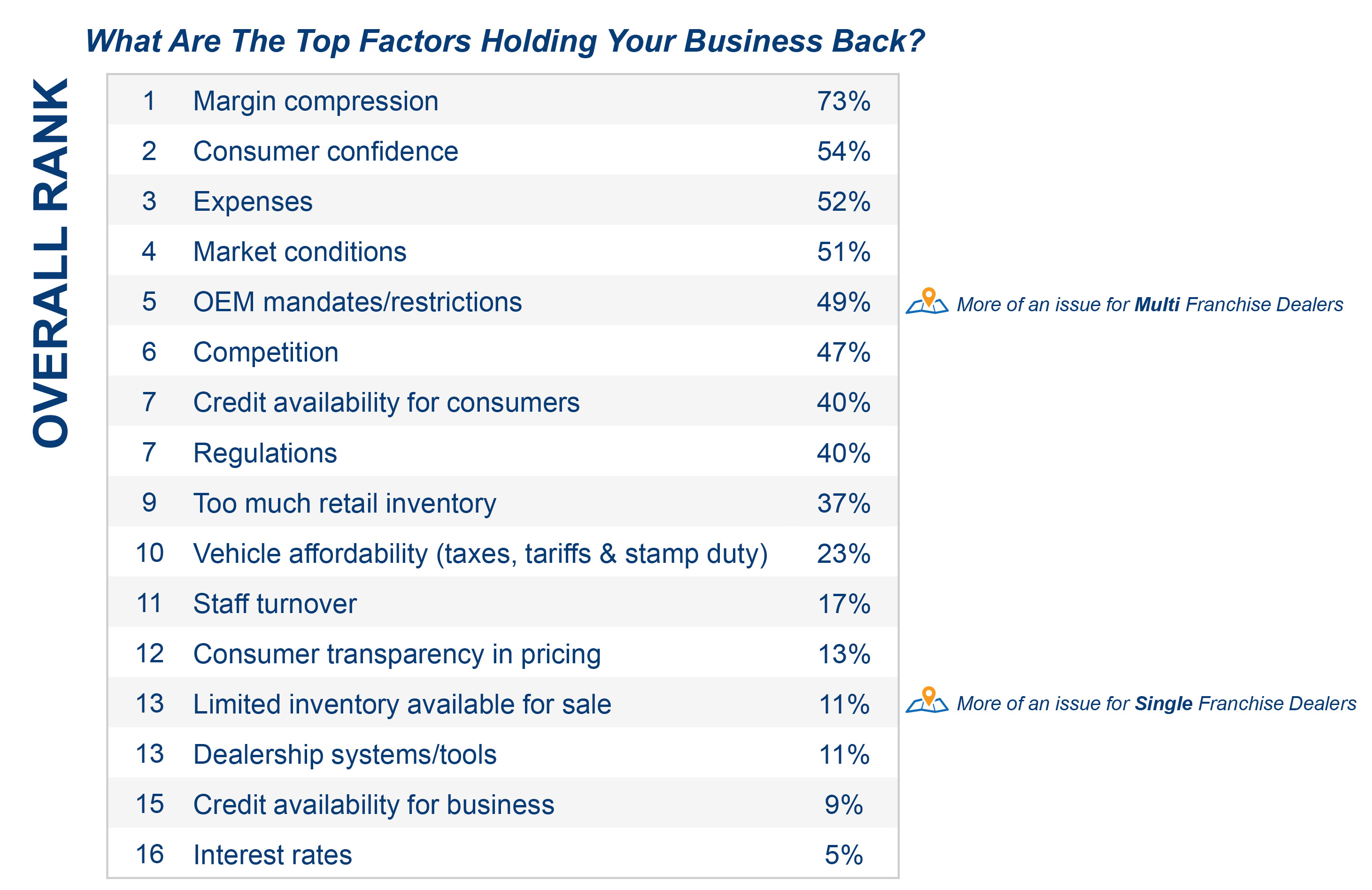

The survey also asked dealers to rate the top factors holding back their businesses in the first six months of the year.

Coming in at top spot was margin compression which 73 per cent of responding dealers cited as the number one reason affecting their business.

Consumer confidence was in second spot at 54 per cent followed closely by rising expenses at 52 per cent.

Fourth and fifth spots were hard to split with general market conditions coming in at 51 per cent and restrictions or mandates from OEMs at 49 per cent.

“It will be interesting to see how the Top Five compares to the survey results for the second half of the year and to track the overall sentiment figures into 2019,” Mr McAuley said.

“We will work with the AADA to survey dealers twice a year and we look forward to publishing more results in early 2019,” he said.

Key Survey Takeaways

- Any number on the index over 50 indicates that more dealers view conditions as strong rather than weak

- Market conditions: 36/100. Dealers responding to survey had a low-to-moderate reaction to the market in the first six months of the year, with an indexed score of 36. However, future projections for the second half of 2018 are stronger with an indexed score of 41

- Customer traffic: 32/100: Dealers said customer traffic to dealerships was rated as below average with a score of 32, with 46 per cent of the dealers who responded rating dealership traffic as “weak”

- Dealer profitability: 30/100: The news doesn’t get any better with respect to dealer profitability, with more than 50 per cent of respondents describing profits as “weak” resulting in an indexed score of only 30 out of 100

- Data for the Cox Automotive Australia Dealer Sentiment Index research is gathered via an online survey of privately owned and publicly listed franchise automotive dealers. Data was used to calculate an index where a number over 50 indicates more dealers view conditions as strong or positive rather than weak or negative. The first-half 2018 results were based on 92 dealer respondents across the country from August 6 to August 24, 2018. This is the first published report.

By Neil Dowling

Read More: Related articles

Read More: Related articles