Amid the grey-cloud outlook came some pertinent advice for dealerships to concentrate on core parts of the business and take a longer-term approach rather than focusing largely on short-term profitability brought through finance and insurance.

Deloitte MIS directors Ben Hershman and Sam Venn described it as “a challenging environment ahead.”

Net profit on sales for dealers last year was 0.9 per cent but in the last half of 2018 it fell to 0.4 per cent.

“The second half of 2018 showed an average dealer profitability of 0.4 per cent,” Mr Hershman said, after Deloitte collected data from 800 dealerships around the country.

“In 2012, when the market experienced strong growth in Australia, the profit measured by return on sales was 2.3 per cent.

“It slipped to 1.9 per cent in 2013 and 2014, rose to 2.2 per cent in 2015, then down to 1.8 in 2016, 1.6 in 2017 and 0.9 in 2018.”

The Deloitte data shows that the average dealer made $70 on a new car in 2018. The gross profit was $2390 made up of bonuses and incentives and other incomes.

But it cost $2320 in expenses – salaries, advertising, cost of running the dealership and so on – to sell that car.

Ben Hershman

In real terms, the new-car selling gross profit – what’s left after direct expenses – has fallen 87 per cent since 2016, according to Deloitte.

“Dealer profitability in 2017 showed 27 per cent of dealers had a return of more than 3.5 per cent,” Mr Hershman said.

“But in 2018, the percentage of dealers with that return declined to 21 per cent.

“In 2017, 34 per cent of dealers had a negative return compared with 36 per cent in 2018. So the situation is getting worse.

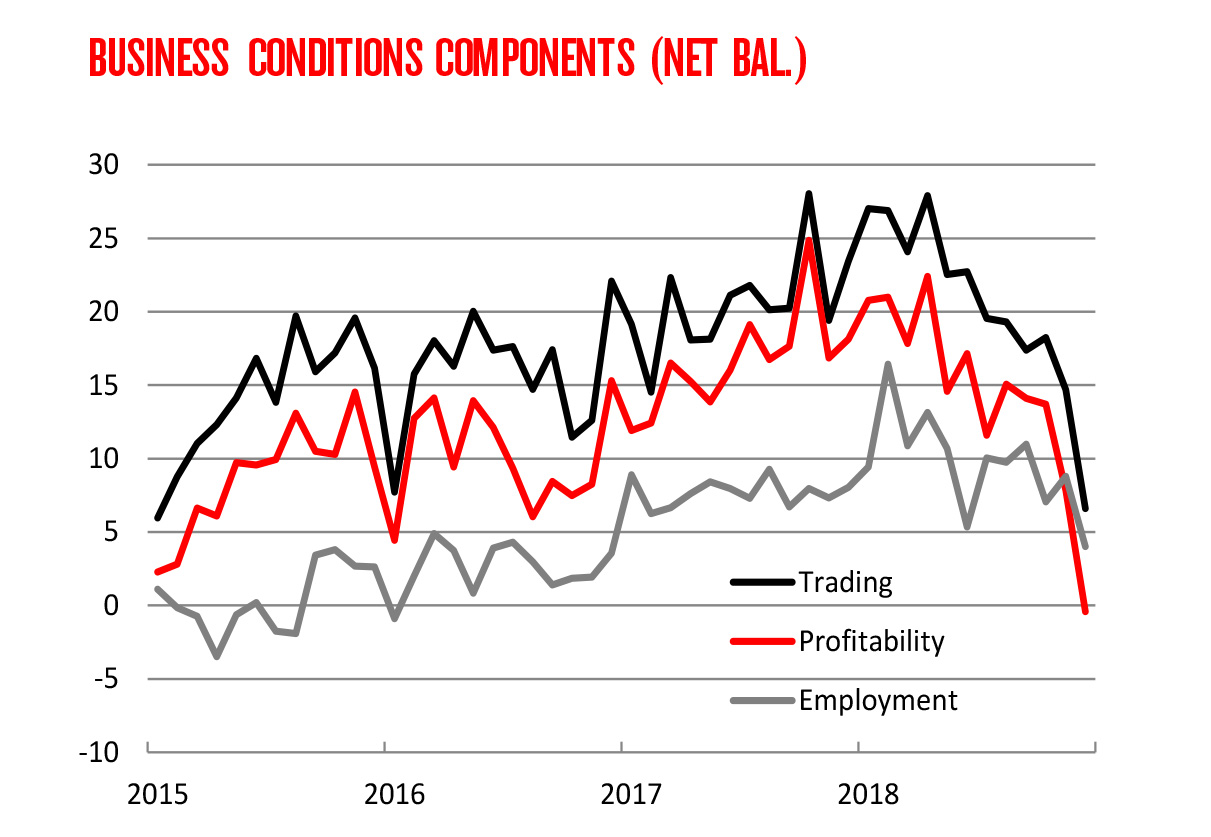

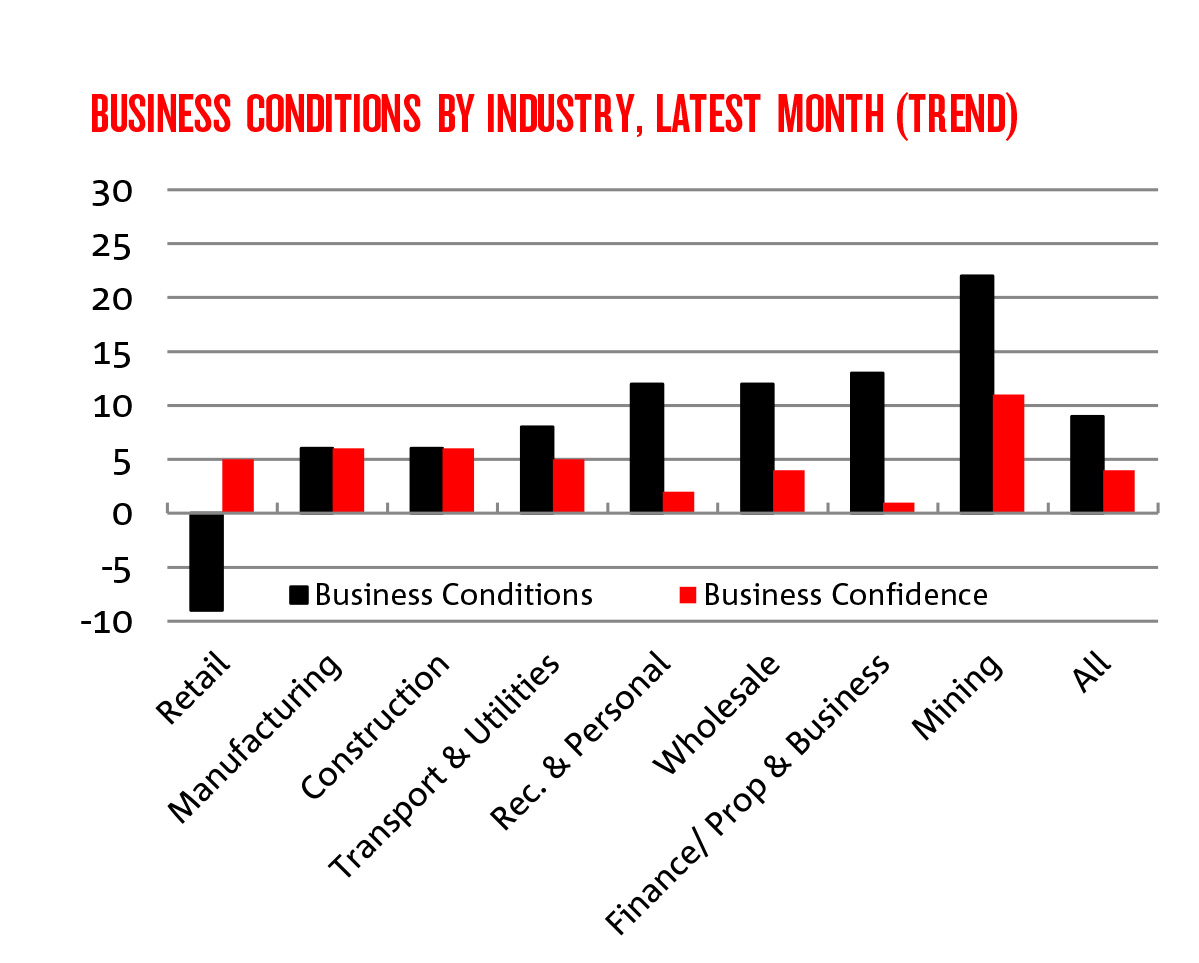

“Yet all the indicators show a strong economy – the interest rates are very low at 1.5 per cent, unemployment is stable at five per cent, and the GDP is three per cent which is solid.

“Against that we have only a small population growth, sliding house prices, low wages growth and business conditions – trading, profitability and employee numbers – are falling.”

Deloitte said that dealers should be aware that:

- 52 per cent of gross profit generated goes directly to overheads.

- Service revenue was up 23 per cent between Q1 of 2016 and Q4 of 2018, and 46 per cent of this increase was due to warranty work.

- F&I fell by 20 per cent between 2017 and 2018.

- Bonus payments were down eight per cent between 2017 and 2018.

- A dealer in 2017 made five times more profit from parts and service than from new and used car sales; now it’s eight times.

- Used cars had a ratio to new cars of 1.4:1 in Q4 2017; it was 1.1:1 in Q4 2018.

Sam Venn

Mr Hershman said that to ensure they survive in 2019, dealers could look at a number of factors to improve their financial performance.

“The consensus is there will be more sellers than buyers in the market in 2019,” he said.

“Where we have had strong consolidation over the previous five or six years, a lot of the larger groups are looking at their failure to properly realise economies of scale and acquisitions.

“Some brands are performing poorly and they may be sold or handed back.

“It is a challenging environment that we are coming into but where there are challenges there are opportunities and what the really smart operators have been doing is bunkering down on their actual strategy.

“It is vital that dealers know exactly how their brand and their PMA is performing and budget accordingly.

“As a generalisation, we are too short-term oriented. We are more interested in short-term F&I than ongoing new-car relationships.

“F&I is still not a core part of the business and it is the dealers who are focused on the core – new, used, service and parts – who will get the best outcome.

“In general, those focused just on F&I exposure have not done as well.”

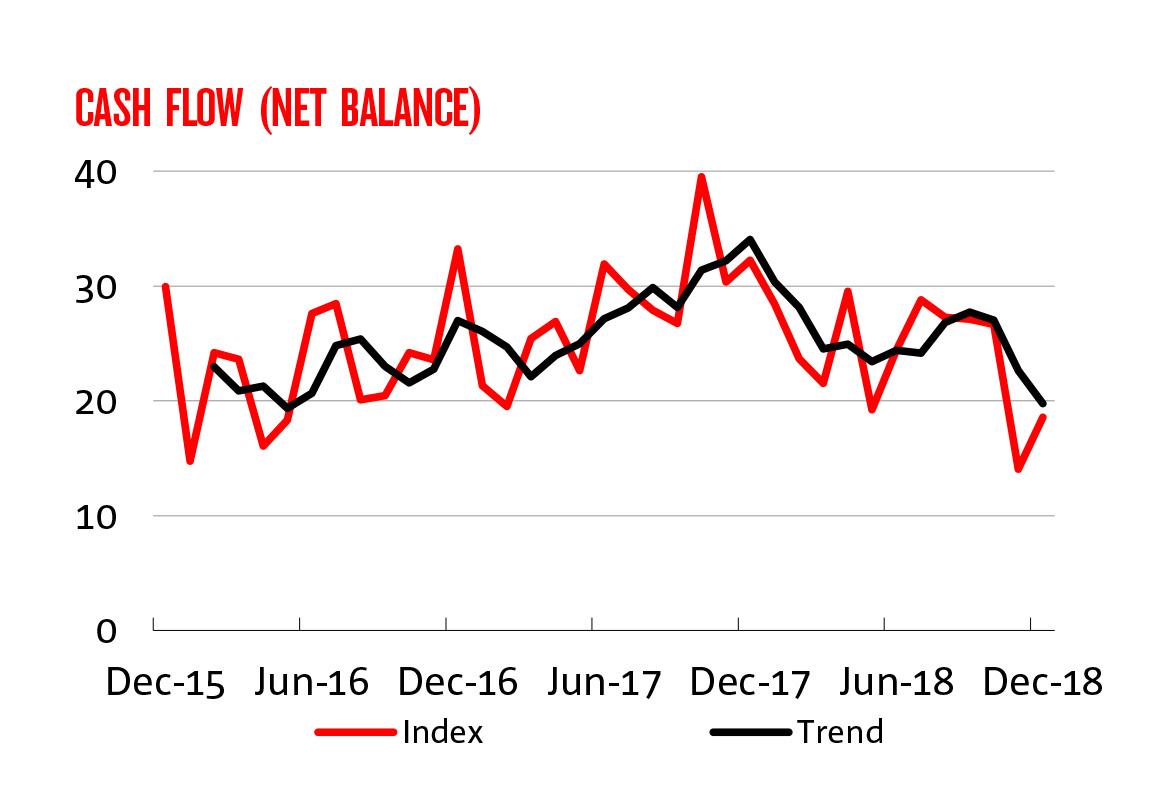

Mr Venn said floorplan costs are “monumental” and should be targeted for reduction.

“Many dealers are holding too much stock for too long,” he said.

“Stock management is critical. Dealers are losing a lot of money on floorplan costs in an environment where the cash rate has never been better.”

What can dealers do in 2019?

“We have seen some of this before in 2014,” Mr Hershman said.

“The average number of units sold per month now is around 90,000. In 2014 it was fairly similar.

“What was critically different is that net profit as a percentage of sales. Then it was 2.3 per cent and now it is 0.4 per cent.

“We should not just be looking at the number of cars being sold but rather at the core business as a whole.

“Warning signs we have to watch for include wages growth remaining low, house prices remaining weak and negative policy that could impact on population growth.

“The growth in the population is a key to increased vehicle sales.”

Mr Hershman said dealers should now look at the next 20 years and ask: ‘What brands do I want to be representing? Do I want a single-franchise focus?’

“By building up the cashflow, dealers can capitalise on the opportunities because for a large majority it is a short-term focus on cash to make short-term payments possible.”

Dale McCauley, a partner at Deloitte Private, told GoAutoNews Premium that “the market is not without its challenges”.

Dale McCauley

Some of these include:

- The least profitable year on record

- Regulatory reforms causing lower returns from F&I

- A highly competitive market putting downward pressure on margins

- A business model that is ‘cost heavy’ and continually rising costs.

But, he said, even in challenging times, there “are still dealers earning five times the profit of an average dealer. They achieve this through stronger core operations such as new cars, used cars, service and parts; and are less reliant on F&I and OEM incentives for profit”.

By Neil Dowling

Read More: Related articles

Read More: Related articles