Dealers also said they thought it would be more than a year before stock levels matched demand and that they are battling severe shortages of staff because of COVID-19 and a lack of skilled workers.

The fifth Cox report surveyed 54 dealers representing close to 300 rooftops across Australia and found that their view of the current market conditions were similar to that in the previous survey nine months ago, but optimistically, their perception of business conditions in the next six months are even better and, said Cox, “has reached a record high”.

It said that staff turnover and recruiting were “significant challenges” for dealers. More than half of those surveyed said they have less staff because of the effects of COVID-19 and more than nine out of 10 dealers found it “very challenging” to recruit staff.

Dealers (85 per cent) said that their service departments were the most impacted by the current skills shortage with seven per cent of dealers citing shortage in F&I, in parts two per cent and six per cent in sales.

When asked what was holding back growth in their businesses over the past six months, the most common response was vehicle stock delays.

Cox said dealers stated that the customer wait for their vehicle was an average of 153 days.

“It’s not surprising dealers again rated inventory availability as the top factor holding their business back, followed by staff turnover and OEM mandates and restrictions,” the report said.

“Last year business impacts from COVID and availability of credit for customers were among the top-three factors holding back dealerships.

“In this wave, those factors have dropped to fourth and sixth, respectively, with staff turnover becoming the second biggest factor, after vehicle availability, holding back business for dealerships.”

The survey was conducted by Cox Automotive in conjunction with the Australian Automotive Dealer Association (AADA).

AADA CEO James Voortman said dealers were optimistic about business conditions and remained bullish about future trading conditions “but severe staff shortages are a major concern.”

“Limited inventory remains a concern for many automotive dealers and almost 60 per cent of respondents believe it will be more than a year before the situation improves,” he said.

“This combination of limited stock and associated longer wait times and staff shortages make for a very challenging operating environment for the automotive retail sector.”

Cox Automotive Australia’s chief customer officer Kirzsten Pountney said: “In many of the major survey categories, the indexed results were not dissimilar to the previous results in Q3 2021, demonstrating Australian dealers’ ability to adapt to changing conditions to meet the needs of their customers.”

“Surveyed dealers report strong conditions and dealership traffic for new and used sales and they believe these conditions will continue for at least the next six months, however they also indicate that the restricted availability of both new and used vehicles is the biggest factor holding back their business and they’re not expecting vehicle availability to improve for over 12 months.”

Key survey takeaways:

- Dealers responding to the survey rated their sentiment to the current market as extremely high, with an indexed score of 75 (compared to 76 in Q3 2021).

- Future projections (six months from now) reached an all-time high this wave with an indexed score of 68 (slightly higher than Q3 2021 at 66).

- Profits remain strong with an indexed score of 69 but this was a significant decline from the all-time high of 86 in Q3 2021.

- Customer traffic, and new and used-vehicle sales environment also experienced some slight declines compared to Q3 2021 but remain above the threshold of 50.

- New and used-vehicle inventory levels continue to be well below the threshold of 50 but improved slightly since Q3 2021. Fifty seven per cent of dealers feel it will be more than a year from now before vehicle inventory levels improve.

- Staffing levels declined significantly in this survey period. Over half of dealers said they have fewer staff now at their dealership due to the impact of COVID-19.

- Limited inventory available for sale continues to be the top concern for dealers with 83 per cent citing it as a factor holding back their business. Dealers reported that only four per cent of customers showed no understanding of the reasons for long delivery delays, 74 per cent were somewhat understanding and 22 per cent were very understanding.

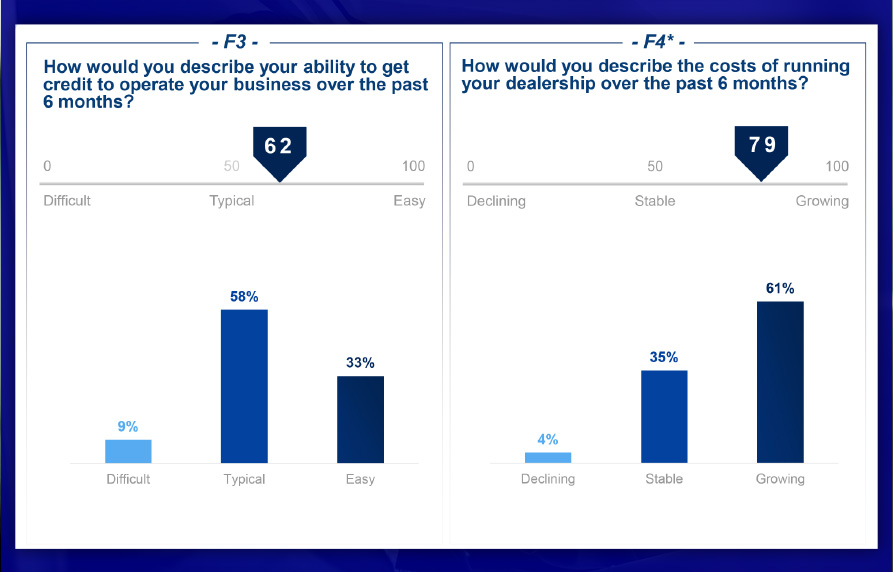

- Lack of credit availability for customers was a big concern in the first quarter of 2019 (70 per cent) has shown up as much less of a concern in the latest survey (26 per cent).

The survey seeks to understand dealer perceptions of the current retail automotive market and sales expectations for the next six months as “strong”, “average” or “weak”.

It also asks dealers to rate business conditions with a focus on new and used-car sales as well as parts and service.

Responses are used to calculate an index where any number over 50 indicates that more dealers view conditions as strong rather than weak.

Data for the Cox Automotive Australia Dealer Sentiment Index research is gathered via an online survey of privately owned and publicly listed franchise auto dealers.

The data is used to calculate an index wherein a number over 50 indicates more dealers view conditions as strong or positive rather than weak or negative.

By Neil Dowling

Read More: Related articles

Read More: Related articles