Here are eight key actions dealers need to consider in the next two to five years as the sales models transition:

1. Transform your dealership staff in line with the change in sales model and EV ascension. Following the OEM’s transition timeline will be important to getting the timing right.

The heaviest impact will be on the frontline sales force; however, the entire dealership’s staff need to increase productivity and dealers will need to find cost savings for the financial models to stack up.

2. Go big in used cars. Once agency and then direct sales models are implemented widely, these businesses will be used car dealerships that also represent new car brands (agent or otherwise). It’s a complete 180-degree shift in mindset for dealers which will take time for them to process.

3. Support parallel imports and new to market vehicles. Our experience is that about 50 per cent of new car sales completions are primarily influenced by the dealer…it’s the gentle nudge or enticement at the dealership that consummates the sale.

OEM product and advertising doesn’t overcome procrastination from customers when their current vehicle is still in good running condition. Dealers can direct these sales to their near new, parallel business. Parallel also solves the used vehicle stock conundrum for dealers.

4. Re-think F&I. The OEM captive will now be capturing most finance at the start of the consumer’s journey online. Will they share with the dealer?…I would hazard to guess many OEM captives will not.

Therefore, dealers need to pivot their businesses to online transactions with their 2nd line financiers (primarily for used cars) and be prepared to finance the ‘sub-prime’ customers when they make it to the dealership needing finance.

5. EV charging and maintenance plan packaging. There will be a huge opportunity for dealers to package charging, maintenance, finance, insurance and residual values at the point-of-sale. This will likely require an ACL or becoming a representative of an ACL holder.

The OEMs and their captives will likely try to dominate this opportunity. However, there will be customers who will want a more local approach and a local provider. This will also bleed into the used car business the dealers will need to develop.

6. Property portfolio and dealership footprints. Under agency and direct, the foot traffic and required footprint for the new car brands should reduce dramatically for reasons we have documented previously. Dealers need do the following when strategically thinking about their property portfolios:

- Do not commit to capital expenditures for OEM brands without iron clad (in writing) assurances from the OEM that they will not be transitioning to agency or direct sales models.

- Reassess all dealership footprint requirements under EV and agency/direct.

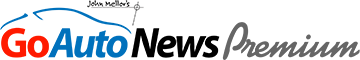

- Consider moving all agency and direct brands to a single hub (1 property) as an experience centre with stock, PD and all other back end services offsite. We would suggest a minimum of five brands or up to 10 brands on one site.

- Consider the impacts on servicing and the size and type of service departments that will be needed as EV transition…it will be more like a factory floor plan than a traditional service department.

- Excess property holdings in the group’s portfolio should be sold or redeveloped for their highest & best use (HBU)

7. Mobility. Dealers need to move down the value chain into mobility as a service (subscription, rental, leasing, etc.) which will provide them revenue channels that currently are being occupied by “disruptors.”

8. Horizontal motor industry sectors will provide opportunities to own dealerships that are likely to remain franchises for a much longer horizon. Recreational vehicles, trucks, motorcycles, boats, agriculture equipment and construction equipment dealerships will provide ample opportunity for dealer groups to diversify their businesses.

Next week we’ll cover the EV workshops/sessions at the 2022 NADA Show.

NADA – Part one: New car prices in US up 34 per cent

NADA – Part two: Dealership of tomorrow update

NADA – Part three: Eight key actions to handle transition

Steve Bragg is the lead partner for motor industry services at Pitcher Partners Sydney reporting from the recent National Automobile Automobile Dealers Association convention in Las Vegas.

By Steve Bragg

Read More: Related articles

Read More: Related articles