In its latest Automotive Currency Report, Roy Morgan Research found that in the March quarter 1.889 million Australians participating in its survey said they intend to purchase a new vehicle in the next four years.

But the figure is down by 435,000 – or 19.1 per cent – from the same time last year.

Roy Morgan’s communications director Norman Morris also it is well below the 17-year long-term average of 2.155 million.

Mr Morris said that in addition to weakening year-on-year levels of vehicle buying intentions that showed up as a 19.1 per cent decline, one-year intentions were down by 136,000 (or 22.2 per cent) over the same time last year.

“Currently, 476,000 intend to purchase a new vehicle in the next 12 months, well down from the 612,000 last year and the long-term average of 611,000,” he said.

“These low intention levels are a further indication that 2019 is not looking positive for new-vehicle sales.”

Mr Morris said the data showed that the new-vehicle market “is facing a number of real challenges”.

“There is currently some concern about the slowing economy, lack of wage growth, energy price escalation and declining home values,” he said.

“In addition to these potential economic constraints on new vehicle demand, the rapidly changing technologies with the resultant fuel choice decisions adds to the complexity of decision-making in this market.”

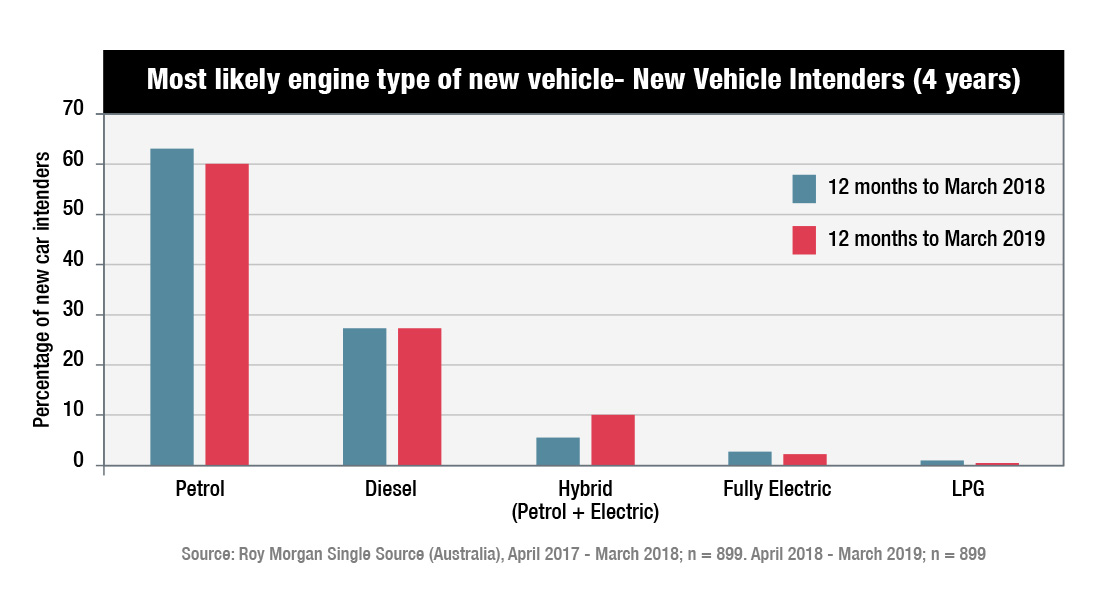

But he noted that while intentions are well down, an increasing proportion of people say that their next vehicle is most likely to be a hybrid, up to 10.1 per cent from 5.6 per cent a year ago.

“We are now also seeing the early stages of major trends in this market identified in the 2017 Roy Morgan ‘State of the Nation – Spotlight on Automotive and Urban Mobility Report’,” he said.

“This report predicted that the new-vehicle market was also likely to face major market disruption with trends away from personally owned and driven cars, shared driving or pooling, driverless cars, shared driverless cars and the rapid growth of Uber and similar ride-sharing options.

“This research has highlighted the need to understand the generational differences in likely fuel choice as the market changes.

“For example, the early adopters of changing vehicle fuels are most likely to be millennials as they appear to be more likely to move away from the traditional petrol-engine cars.”

The Roy Morgan data shows that all other fuel types – except hybrids – have shown declining preferences over the past year, with petrol showing a drop of three percentage points to 60 per cent of the vehicle total, LPG down 0.8 percentage points to 0.2 per cent, fully electric down 0.5 percentage points to 2.3 per cent and diesel down 0.2 percentage points to 27.4 per cent.

The survey was based on data collected from Roy Morgan’s Single Source Survey (Australia) which is from in-depth personal interviews conducted face-to-face with over 50,000 Australians per annum in their homes.

By Neil Dowling

Read More: Related articles

Read More: Related articles