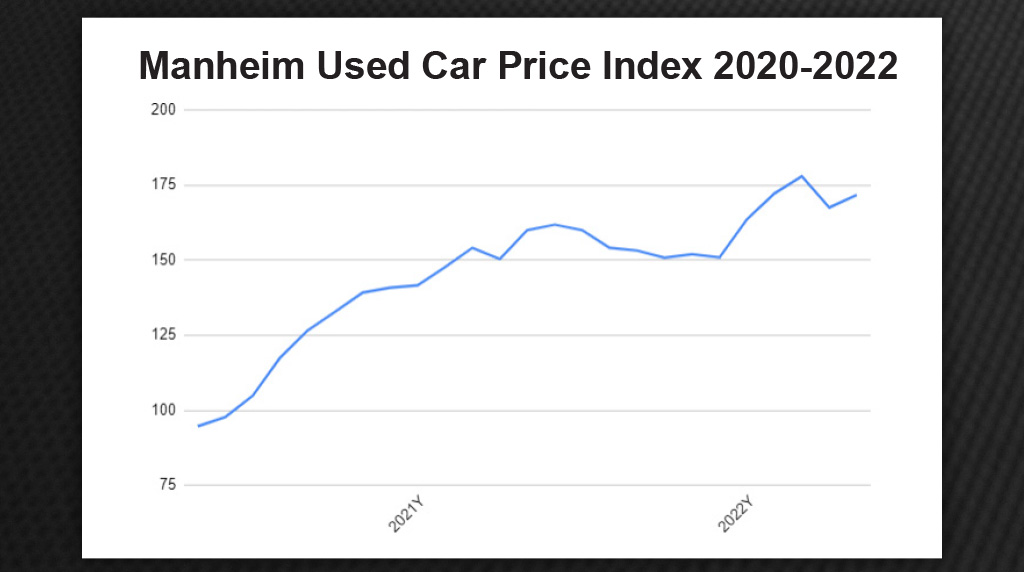

The Manheim Used Vehicle Value Index for May was 171 per cent of the index, which began in January 2006. This was a recovery from the April number of 167, which was 10 percentage points down from the all-time high in March of 178.

So far this year, the index has been averaging 170 per cent compared with the average for all of 2021, which came in at 153 per cent.

While that indicates the underlying strength of auction values, observers in the wholesale car industry are noting that the big increase experienced this year has levelled off with the big reversal in April. This was followed by the recovery in May, but that recovery could not get back to the all-time record level achieved in March.

Analysts are citing the recent drop in consumer confidence from 108 per cent this time last year to 95 per cent in May – driven by increases in interest rates and higher fuel and food prices. There are also reports that many Australians have cancelled interstate family holiday plans as they move to shore up family budgets against increasing household costs.

These trends are thought to potentially dampen demand for used cars, but this needs to be set against the waiting list for new cars which is averaging 146 days – another all-time high.

Picking the peak of the price increases is important because there is such a huge upside in used cars wholesale prices at the moment, some might call it a bubble, that any reversal could take hold quickly and cost dealers thousands of dollars a car.

Looking at the retail end of the market, May figures released by Cox Automotive Australia’s data solutions division show the average price at which cars are being delisted from dealer websites (indicating the price at which the car was sold) has risen to $35,350.

This is approximately $12,750 more than average prices before the COVID pandemic and supply shortages hit the retail motor industry.

So, when supply shortages are put behind us, it seems logical that the $12,500 currently being paid over the odds will progressively evaporate and, unless dealers keep on top of clearing stock purchased at these historical highs before (or as) the prices fall, they face thousands of dollars in losses per car.

The pause detected in the monthly Manheim data is also reflected in similar (weekly) price trends collected by the Datium Insights used-car price index, which shows prices for used cars softened in the past few weeks although Datium’s pricing trend remains at historic highs.

The index of prices for used vehicles fell 0.8 per cent last week compared with the previous week, with the biggest fall noted for repossessed vehicles, which was down 7.9 per cent.

In holding onto its high levels, the index has traced a see-saw pattern showing a real hesitation in the market to push prices higher.

The numbers also showed some big winners this week that were losers the previous week.

The Mitsubishi Outlander, for example, showed the biggest price change this week, up 4.59 per cent in its three-year residual percentage to 74.7 per cent. Yet, in the previous week, it was one of the biggest losers with a 3.99 per cent drop in its price with a residual rate to 70.1 per cent.

Holden’s Colorado also showed a drop this week; it was down 4.03 per cent to a three-year residual of 78.4 per cent, contrary to the previous week that saw it gain 3.04 per cent to 82 per cent.

The Toyota Camry slid 3.62 per cent to show a three-year residual of 72.5 per cent. In the previous week, it was also down, falling 3.03 per cent.

The trend shown by the Camry reflects the easing of the passenger car sector in the Datium Insights’ index. Passenger cars are down 3.9 per cent and light commercials are down 1.3 per cent, but SUVs remain used-vehicle buyers’ favourite with a 1.8 per cent increase for the week.

Datium Insights said the prices for the top 15 traded vehicles for the past week were mixed, showing the price rise of the Outlander, along with the 3.29 per cent rise of the Isuzu D-Max.

Clearance rates for the week were down slightly (down 1.2 per cent) on the previous week, as was the volume of sales that slid 4.4 per cent.

Despite the slightly softer prices, the market remains strong with demand outstripping supply in the used market as a flow-on from supply restrictions that still affect the new-car sector.

Moody’s Analytics this month reported that used-car prices were up 65 per cent in the first quarter of this year compared with the corresponding period in 2019.

Prices also rose by 18.4 per cent in the past three months compared with the last quarter of 2021.

By John Mellor and Neil Dowling

Read More: Related articles

Read More: Related articles