The lion brand is attempting to turn around its fortunes after its sales slumped 33 per cent last year in the wake of its exit from local car manufacturing in October 2017, launching a fresh initiative last week in the form of a brand marketing campaign dubbed ‘This is how we SUV’.

In announcing the latest campaign, the company said one of its key focus areas for 2019 was to grow its share in SUV and light-commercial vehicle segments and that these vehicles would, combined, comprise more than two thirds for a targeted 70 per cent of all sales achieved this year – 35 per cent each, with passenger cars making up the rest.

Placing a figure to this growth position is difficult when Holden’s sales and market share do not appear to have hit rock bottom yet, with its January sales down 27.1 per cent compared to the same month last year, which back then was down more than 20 per cent compared to January 2016.

But assuming the latest campaign and other actions hit their targets, enabling the company to at least stop the flow of negative annual returns and post a similar figure to last year’s 60,751-unit total, this would see an increase of almost 6000 sales across both its SUV range and for the Colorado ute.

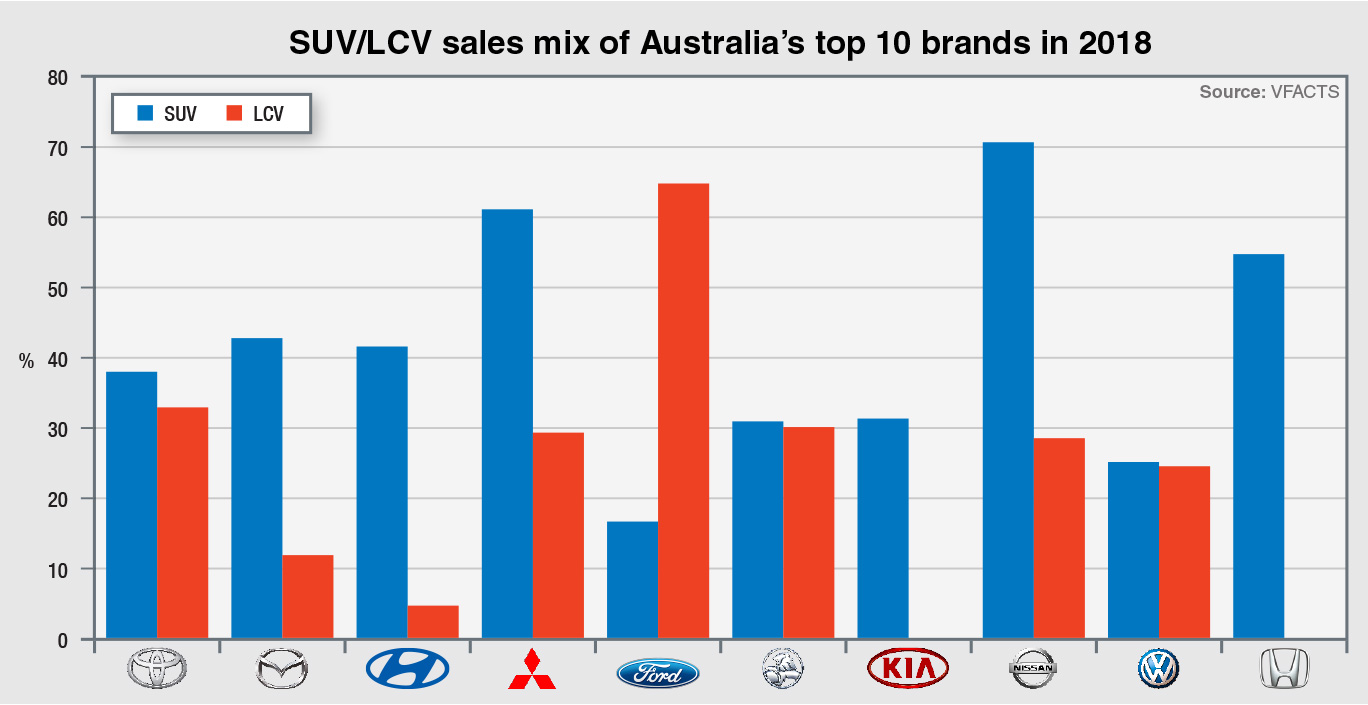

Last year, Holden’s SUV lines – Trax, Trailblazer, the run-out Captiva, its Equinox replacement and the all-new Acadia – accounted for 30.9 per cent of its sales, and the Colorado pick-up made up 30.1 per cent, for a combined 61.0 per cent of the brand’s overall sales.

This percentage mix was lineball with Toyota’s combined SUV/HiLux ute sales, but with all light-commercial vehicles factored in, the market-leading brand’s SUV/LCV mix was 70.9 per cent, at 38.0/32.9 per cent respectively.

Toyota’s ratio is the most even spread across the major categories among the leading brands in Australia but it, too, will look to strengthen its SUV position this year with key new models such as the all-new RAV4 launching soon.

Elsewhere, the ultra-competitive nature of the current market, combined with shifting consumer sentiment away from traditional passenger cars, has forced many of the high-volume car companies to redirect their sales and marketing resources, and cut back their respective model range, to reflect the trends while still attempting to push overall sales up to new heights.

Push up: Holden is hoping the new Acadia (pictured) will help see SUVs account for at least 35 per cent of the brand’s total sales this year, up from around 30 per cent in 2018.

The SUV/LCV sales mix among the top 10 brands in Australia last year clearly illustrates this, and the new environment in which Holden now finds itself as a middle-tier player rather than one of the top two or three.

Ford, which pulled out from local manufacturing a year earlier than Holden, had 81.6 per cent of its sales from either SUVs (at a notably low 16.6%) or LCVs (64.9%), indicating just how much the Blue Oval brand now relies on its Ranger pick-up, which alone accounted for 61.0 per cent of total sales last year – the same mark as GMH’s entire combined SUV/LCV percentage.

Mitsubishi, too, as a former Australian manufacturer – albeit one that closed its factory doors in 2008 – now points with satisfaction at its successful transformation to a brand well known for not only its Triton ute but various popular SUVs, posting all-time record sales last year and predicting solid growth ahead.

The triple-diamond brand’s SUVs accounted for 61.2 per cent of its sales last year, and the Triton 29.3 per cent, for a 90.5 per cent combined share.

Among the top 10 brands, this was only surpassed by Nissan which has not had the same success in outright sales terms as alliance partner Mitsubishi and others, and last year had 99.4 per cent of its volume taken up by its all-important SUV lines – heavily relied upon for 70.8 per cent of its sales – and the Navara ute making up most of the rest (28.5%).

Nissan now only has the niche 370Z and GT-R sportscars as bona fide passenger cars in its stable, but still managed to turn its sales around last year to a positive position – up 2.0 per cent – after a 15.3 per cent downturn in 2017.

As much as Holden might now accept that it is no longer a leader but more of a “challenger brand”, the company will still be looking to Mazda as a full-line role model with an incredibly popular – and ever-expanding – SUV range and a ute that adds important, but not make-or-break, incremental volume.

Last year, Mazda’s combined SUV/LCV sales were at 58.7 per cent, with SUVs 42.8 per cent and the BT-50 ute at 11.8.

This mix points to Mazda’s solid all-round performance across virtually every segment in which it competes, hence its position as the number-two brand in the marketplace.

Hyundai and Kia are also working overtime on increasing their SUV sales via new models while hanging on for a long-hoped-for pick-up.

Hyundai has the iLoad van contributing to its bottom line, with its SUV/LCV mix at 41.6/4.6 per cent last year for a 46.2 per cent combined total, while Kia, which no longer has LCVs in its range, is expecting a major turnaround as a new small SUV approaches and enables it to improve on last year’s SUV return of 31.3 per cent.

Honda, which also does without LCVs, had 54.8 per cent of its sales going to SUVs last year, while Volkswagen, as the other key player among the top 10 brands, has acknowledged that it, too, needs to improve its SUV standing, which was at just 25.1 per cent of its total sales last year.

The Amarok ute accounted for 16.4 per cent of VW’s overall volume last year, while its van range pushed its full LCV total up to 24.5, so with SUVs added the combined figure came in at 49.6 per cent – not enough on either front, as evidenced by a variety of product actions already introduced this year.

Just outside the top 10 last year, Subaru’s SUV range accounted for 71.5 per cent of its total volume.

By Terry Martin

Read More: Related articles

Read More: Related articles