“Sales-wise we’re positioned where we want to be,” Honda Australia director Stephen Collins told GoAuto at the recent launch of the new Civic Type R hot hatch.

“Our growth is … double-digit this year versus a market which is pretty flat, so we’re growing our share and heading in the right direction.

“Still plenty of work to do, but we’re heading the right way.”

Mr Collins said the double-digit sales growth would taper off and that next year the company was expecting to consolidate its position in the marketplace, with a strong focus on growing sales among private buyers.

“We’re still finalising it, but I think our number will be similar next year,” he said. “We’ve launched a lot of cars this year so I think it will be a bit more of a consolidation year at around about that same number (48,000).

“We measure ourselves very much on private market share because that’s our real focus.

“For most of our core models we want to be in the top three (for) private sales, and HR-V is definitely in there and Civic and CR-V are pretty close to being there.”

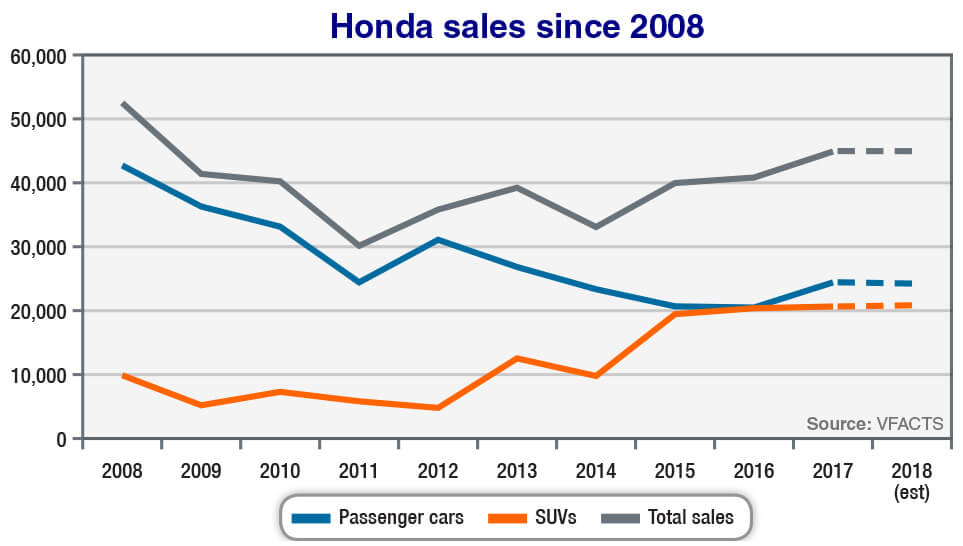

Growing pains: With a fresh model onslaught in 2017 – including the introduction of the Civic hatchback – Honda will likely record a sales total of around 45,000 units.

For the first nine months of the year, Honda’s sales tally has reached 33,441 units – a 12.6 per cent increase over the same period last year – averaging 3716 sales per month.

Sitting at the top of Honda’s line-up is the Civic small car – the new generation of which was launched in sedan guise last year, hatchback body style earlier this year and is now topped by the return of the Type R – with 10,270 new registrations to the end of September, a 133.3 per cent increase on the same period last year.

Mr Collins said that the Civic, which last month found 1497 homes, was “pretty much where we want it to be” but the 10th-generation small car still trails rivals including the Toyota Corolla (28,665), Mazda3 (25,457), Hyundai i30 (21,103), Kia Cerato (14,671) and Volkswagen Golf (13,126).

The recently launched new-generation CR-V is also undergoing a sales uptick of 0.4 per cent to 6157 units year to date – last month’s 1191 registrations marked a 61.4 per cent rise – in the competitive mid-size SUV segment dominated by the Mazda CX-5 (19,187 YTD) and Hyundai Tucson (18,981).

However, the remainder of Honda’s model range – including the Accord mid-size sedan, City light sedan, HR-V small SUV, Jazz light hatch and Odyssey people-mover – are down year-on-year ,with the biggest percentage slides attributed to the Accord and City.

With a 53.1 per cent drop in sales compared with the same period last year, Honda has sold only 289 examples of the Accord this year.

A 10th-generation Accord revealed in July for the US market could reinvigorate local sales of the nameplate, but Mr Collins says Honda Australia is still studying its business case.

“Look, it’s a really tough segment, everyone knows that, we’re working on the next model Accord,” he said. “I’m hopeful we’ll have a decision by the end of this year on the next-generation Accord.

“The major hurdle is: where is the segment going? We know that the trend is pretty clear, but where is it going to be in the next few years?

“Clearly that segment is, and has been, dominated by Camry, so that’s probably the biggest one (hurdle) and we just need to have business case that stacks up.

“Accord has a huge and long history around the world and in Australia, so we’re really keen to get the next one. We’ve just got to make sure that it stacks up.”

Similarly, Honda has sold only 669 examples of the City to the end of September – a 45.3 per cent slide – but the brand is still committed to the low-volume model despite light sedan competitors including the Mitsubishi Mirage, Ford Fiesta, Holden Barina and Toyota Yaris withdrawing from the segment.

“Yeah, we’re still committed to City,” Mr Collins said. “It’s a small segment as you know, so our share of the pie is pretty good, although the pure volume is quite low.

“We’re still very much committed to that car; it’s probably one of the lesser competitive segments mainly because the volume is so low, but we’re pretty happy with what we’ve seen.”

While Honda has updated the mechanically related Jazz hatchback in early August, the full impact on sales is yet to be seen with the light car totalling 5368 units YTD, an 11.2 per cent drop over the same period last year.

The HR-V small SUV has also slowed this year, down 2.9 per cent in sales to 8988 units, but currently commands fourth place behind the Mitsubishi ASX (13,785), Mazda CX-3 (13,693) and Nissan Qashqai (10,257) in the competitive small SUV segment.

Lastly, the ageing Odyssey has slipped 16.1 per cent to 1699 sales this year against its Kia Carnival rival that holds 4443 sales and a commanding 46.6 per cent of the sub-$60,000 people-mover market.

However, Honda will update its Odyssey next year with a new look and boosted specification that should renew interest in the model.

By Tung Nguyen

Read More: Related articles

Read More: Related articles