The study by the National Platform for the Future of Mobility (NPM) on behalf of the German government said the job losses represent more than half of the country’s 800,000 workers in the automotive and related industries.

Germany makes one third of Europe’s 16 million annual vehicle output.

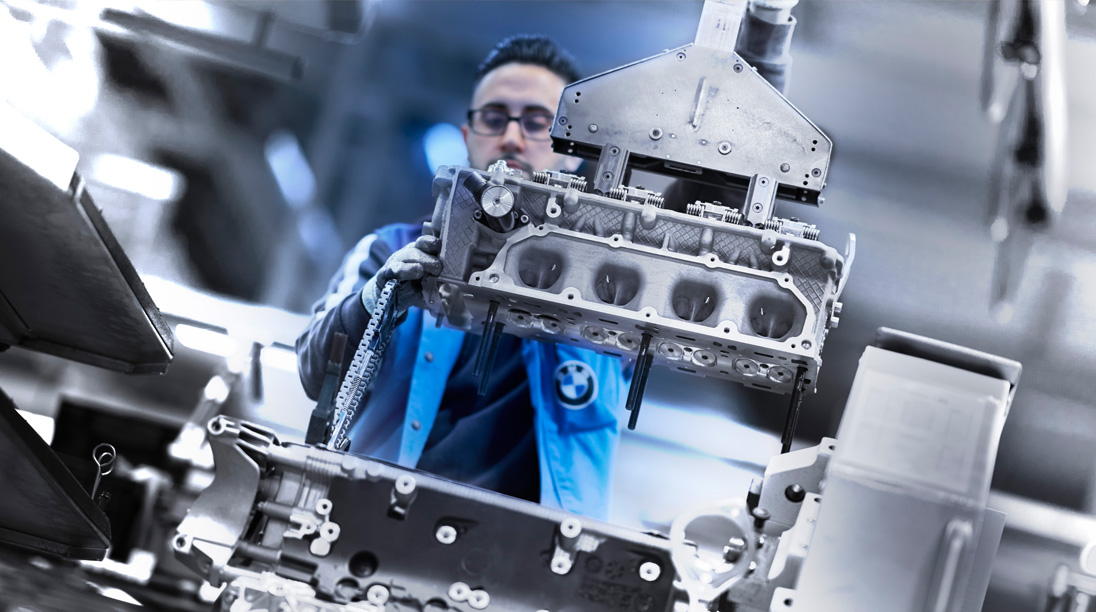

More specifically, the NPM report said 88,000 of those lost jobs would be in engine and transmission production alone.

The NPM based its estimate of job losses on the fewer components in electric cars compared with traditional cars with internal combustion engines (ICEs).

There are about 20 components in an EV drivetrain compared with about 2000 in an ICE drivetrain. That means less workers in the production and supply chain.

But the 410,000 job-loss figure has been disputed by the German Automobile Association.

In a report in the UK’s The Telegraph newspaper, the association’s managing director Kurt-Christian Scheel said the NPM report was “based on an unrealistic extreme scenario”.

He said it assumed that German production of both batteries and EVs would remain limited for 10 years and that the majority of EVs would be imported.

But he said German car-makers are expected to triple the number of electric models they produce to more than 150 by 2023.

Battery production and autonomous technology alone have been predicted by the German Automobile Association to potentially add 125,000 jobs.

Volkswagen said it aims to have produced one million EVs by 2023, and increase that to 1.5 million by 2025.

Tesla is targeting production of 500,000 units per year in Germany, once its planned Gigafactory outside Berlin is running at full capacity.

Jobs, however, are being targeted. Daimler AG, parent of Mercedes-Benz and manufacturer of cars, trucks and buses, has said it will sack about 10,000 workers worldwide, partly because of EVs and a planned cost-saving drive, but mainly on flagging global vehicle sales.

Daimler said it wanted to save $A2.3 billion in staff costs as it invests billions in EVs and other environmentally friendly vehicles and technology.

Volkswagen Group said it will shed about 7000 jobs in this quarter with the savings going to EV investment, while subsidiary Audi this month announced it plans to cut about 10,000 jobs, which is about 10 per cent of its global workforce.

Ford intends to sack 5000 workers in Germany as part of a wider restructuring, and parts suppliers Continental and Bosch aim to cut more than 7000 staff between them.

German media has reported that BMW could eliminate 6000 jobs as part of a plan to save $A19.4 billion.

BMW is partnering with Great Wall Motors to build a $A1.05 billion factory in the Chinese city of Zhangjigang.

This plant will produce future electric versions of the Mini at the rate of 160,000 cars per year, potentially replacing the Mini plant in Oxford in the UK that six months ago started making the Mini EV.

Oxford employs 4500 people and accounts for 65 per cent of the annual Mini production of 360,000 units.

Meanwhile, EV sales are rising quicker than ever. Germany is now Europe’s biggest market for battery-powered cars, overtaking Norway. EVs accounted for 19.2 per cent of the German car market in 2019, beating Norway’s 18.9 per cent.

German automotive analyst Matthias Schmidt, speaking to Handelsblatt newspaper, said: “Although 2019 levels continue to appear large from a historical standpoint, the current view is that the market will more than double in 2020 compared with 2019 levels in order to meet key CO2 targets.

“This is set to fuel the introduction of new models and increase production output that has essentially been in limp mode up until now.”

Car-makers are racing to produce less-polluting cars to meet tough new emission rules being introduced in the EU, China and the US – the world’s three biggest markets.

From this year and effective from January 1, 2021, the EU fleet average CO2 emission target for new cars will be 95 grams per kilometre.

This corresponds to a fuel consumption of around 4.1 litres per 100 kilometres of petrol or 3.6L/100km of diesel.

The average emissions level of new cars registered in 2018 in the EU and Iceland was 120.4g/km. Since 2010, the average emissions have decreased by 20g/km (14.2 per cent).

A failure to meet the new average emission levels will incur heavy fines from 2021, with Moody’s research predicting major car-makers could face global fines totalling $A19 billion unless they introduce more environmentally friendly cars.

The issue is further complicated by other factors, including the global slowdown in vehicle sales and potential trade wars that would push up tariffs and therefore car prices and component prices.

By Neil Dowling

Read More: Related articles

Read More: Related articles