Speaking with GoAuto at the national media reveal of the Range Rover Velar in Sydney last week, Mr Wiesner said it was difficult to gauge the true extent of the market shift from passenger cars to SUVs as well as the “true selling price” and actual demand for premium mid-size and large sedans in the current environment.

“There’s a market there (with premium sedans), no question,” he said.

“The challenge is, in both that medium and large premium sedan market, does anybody know what the (sales) numbers really are? The behaviour in that space is not ideal, so the trading behaviour in those two segments makes it very difficult to find out exactly what the true demand is and actually what is the actual true selling price of cars in those segments.

“We don’t have as deep of pockets as our competitors, so we’re kind of between a rock and a hard place competing in that space. What would those segments settle down to be if everybody didn’t do what everybody does? I don’t know.”

Asked to clarify whether he meant certain competitors were heavily discounting products to inflate sales, Mr Wiesner replied: “Let’s just say that the broader offers that are available, depending on what the products are, where they are in a particular cycle of their life that they may well be in, vary dramatically.

“The recommend retail price doesn’t mean a lot when that sort of trading behaviour happens. Which is a shame because all of those cars, whether it’s ours or let’s face it the Benzes, the Beemers, the Audis, and our Jaguar offerings, they’re all damn good cars and quite frankly deserve better.”

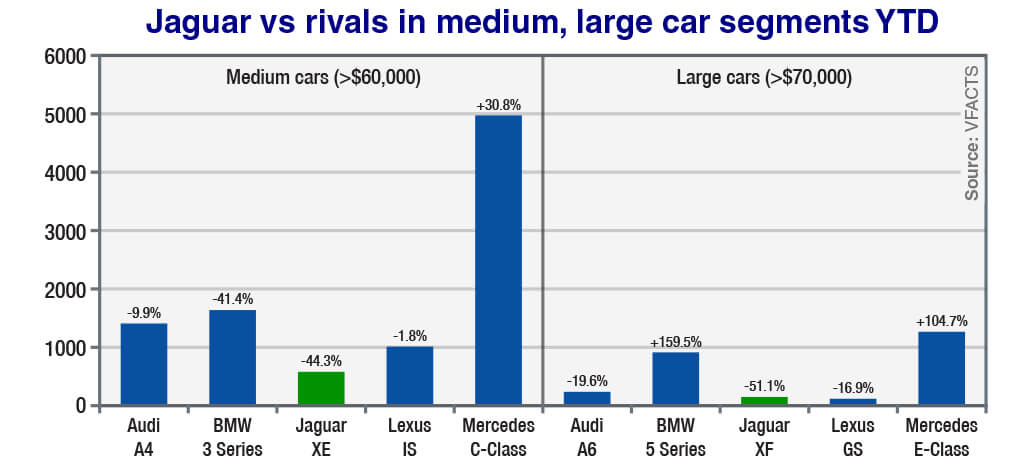

VFACTS industry sales figures to the end of July this year show that the premium medium sedan and wagon segment is down only 5.7 per cent to 13,413 units, despite every model except the Audi A5 Sportback (332 sales, up 22.1%) and Mercedes-Benz C-Class (4980, +30.8%) – and the all-new Alfa Giulia (348) – suffering a downturn.

Other key models in the segment that have fallen in sales so far this year include the Jaguar XE (571, down 44.3%), BMW 3 Series (1633, -41.4%), Audi A4 (1399, -9.9%) and Lexus IS (1005, -1.8%).

Mr Wiesner admitted that some buyers in the medium car segment were “absolutely” leaving Jaguar showrooms because an equivalent XE model grade is not available at the aggressive deals of some competitors.

Middle child: Showroom deals, as well as the shift to SUVs, have impacted sales of the premium sedans such as the Jaguar XE and XF, according to JLR Australia boss Matthew Wiesner.

“And XF’s the same,” he said of the large sedan segment, in which something of a duopoly has emerged in the local market.

The premium large car segment has soared by 33.3 per cent to 3023 units to the end of July this year, but the figure is inflated only by the new BMW 5 Series (903 sales, +159.5%) and Mercedes-Benz E-Class (1257, +104.7%) that combined have snared more than two-thirds of total volume in the class.

Rivals such as the Jaguar XF (137, -51.1%), Audi A6 (226, -19.6%), Maserati Ghibli (133, -40.9%), Lexus GS (103, -16.9%) and Volvo S90 (33, new) are well off the pace by comparison.

But Mr Wiesner also admitted that “the SUV products that are on offer today certainly puts a lot of pressure on that sedan business” with Jaguar joining Land Rover in dominating in the medium, large and (soon with E-Pace) small classes.

“But there’ll always be, I say always, for at least for the next period of time, there’ll always be a reasonable market there of those that like driving traditional sedans,” he said.

“And if this trading behaviour continues in that space, there will continually be outstanding deals and opportunities for people to purchase cars in those segments across all brands, because supply generally outstrips demand.”

The premium medium SUV segment has snared 17,371 sales to the end of July this year, up only 0.9 per cent but still 3958 units clear of the $60K-plus medium sedan segment.

The Land Rover Discovery Sport (2876, +9.5%) leads the BMW X3 (2073, -10.7%) and Mercedes-Benz GLC (2070, -30.2%) in that SUV class.

While the Germans have been bolstered by the X4 (1024, +6.6%) and new GLC Coupe (625), Land Rover exceeds both as well with the Evoque (1854, +14.6%) and Jaguar with its still-fresh F-Pace (880).

The premium large SUV segment, meanwhile, with 12,775 sales is a dominant 9752 sales clear of the premium large sedan and wagon class despite the greater percentage growth driven by the new 5 Series and E-Class.

In that segment the Land Rover Discovery (576, -67.2%) is yet to fire with the new-generation model only just arriving. Yet combined with the Range Rover Sport (1833, -1.8%) the duo are still only 117 sales adrift of the BMW X5 (2228, -18.6%) and X6 (298, -22.2%) that have continued to snare class honours so far this year.

By Daniel DeGasperi

Read More: Related articles

Read More: Related articles