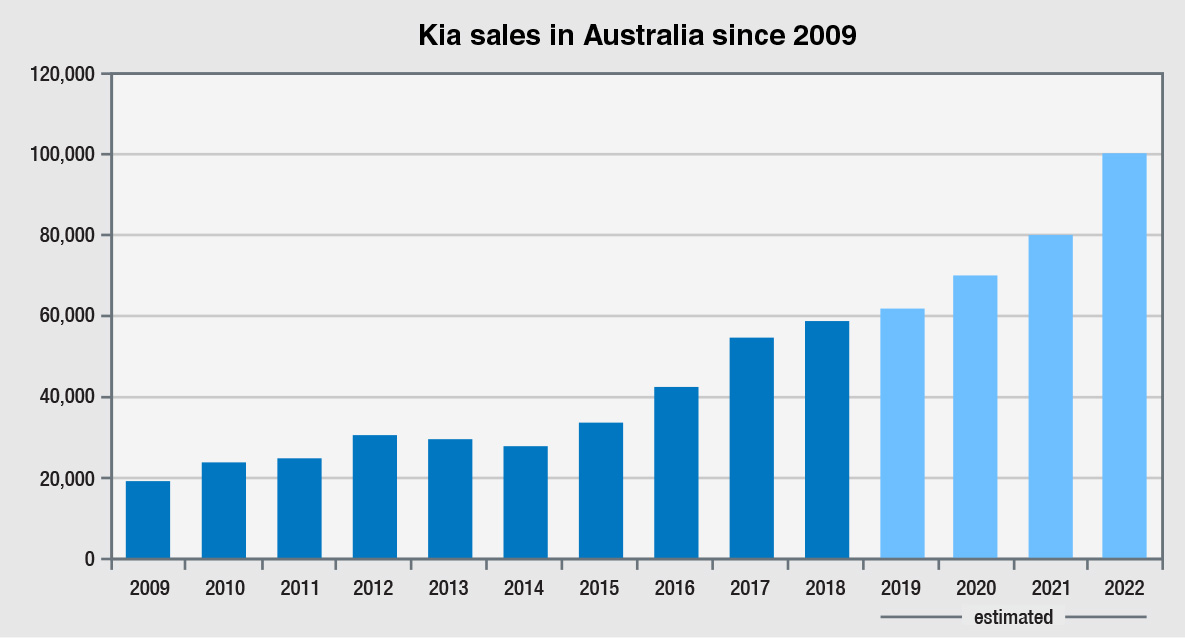

But one mainstream importer in Australia – Kia Motors – has never given up on its sedans, hatchbacks and people-movers, making gains where others see only pain.

In the past decade, the South Korean company has increased its passenger car sales volume from 15,797 units in 2009 to 40,388 in 2018, while at the same time increasing its passenger car segment share from 2.7 per cent to 12.9 per cent.

The strategy has been instrumental in Kia’s rise from the ranks of the also-rans to sixth on the new-vehicle sales ladder with a 6.0 per cent market share.

So far this year, Kia’s passenger car sales are up 7.4 per cent, even though the segment is down 15.9 per cent.

If it can maintain that course, Kia might overtake Mazda in passenger car sales by year’s end, and be nipping at the heels of sister brand Hyundai, which is currently in second place behind passenger car market leader Toyota.

According to official VFACTS sales data, Mazda passenger car sales are down 8.8 per cent in the first five months of this year, although the Japanese company now has an all-new version of its Mazda3 small car in its armoury to steady the ship.

Hyundai passenger car sales have fared even worse, down 13.3 per cent year to date.

Even Toyota, which has a legendary ability to steamroll bumps in the market, has suffered a 12.2 per cent decline in its passenger car sales this year, mainly due to falling sales of its now-imported Camry medium sedan.

Toyota’s sales in passenger cars have fallen by more than 40 per cent in a decade, largely in line with the overall decline in demand for sedans and hatchbacks.

But the hardest hit by the passenger car decline has been Holden which – with the demise of the large-car segment and axing of its local manufacturing operation – has seen its passenger volume slump by more than three-quarters, from more than 90,000 units a year to just 23,345 last year.

Unless Holden can reverse its 2019 rate of decline – down 43.2 per cent to the end of May – it will struggle to achieve 14,000 sedans and hatchbacks this year.

Price is right: Sales of Kia’s Cerato are up 10.2 per cent this year as the South Korean importer maintains the value equation on its small car.

Meanwhile, Kia has whistled past Holden in passenger car sales, buoyed by consistent sales growth in four of its main passenger car models – Cerato, Carnival, Rio and Picanto.

Sharp pricing and value for money keeps Cerato keeping on in the small-car segment, with sales up 10.2 per cent this year, to 8541 units to date.

In the people-mover segment, the Carnival stands like a colossus, now holding a 56 per cent share. With 2902 sales this year, the family bus has not rested on its laurels, putting on 12.0 per cent more volume and singlehandedly keeping the segment in the black.

In the light-car segment, Kia’s Rio is only a middling performer, but it has been one of the few cars to swim against the tide, improving sales by 2.5 per cent as the segment has slumped 11.6 per cent.

In the smallest category, micro, the Picanto is the giant, currently holding almost 80 per cent share with 2361 sales. While several manufacturers have bailed out of the segment, saying it is all too hard, Kia has achieved a 17.0 per cent sales gain this year, along with many plaudits from motoring critics for the competence of its baby model.

Not all Kia passenger cars have enjoyed increased demand from buyers, with the Stinger large car down 14.1 per cent this year, to 770 sales. However, that is against a backdrop of a 31.3 per cent crash in national large car sales this year, with the segment-leading Holden Commodore down 36.1 per cent.

Kia plans to euthanise its slow-selling mid-sized sedan, the Optima, by the end of the year, while at the same time replacing its boxy Soul with an electric-only version of the new-generation Soul in a two-pronged EV attack with the e-Niro in the first quarter of next year.

In the SUV market, Kia’s year-to-date volume is down 8.1 per cent, compared with the SUV market decline of 4.6 per cent. That is mainly on the back of an 18.3 per cent fall in Sorrento sales – its contender in the large SUV segment.

Kia’s top-selling model, the Sportage medium SUV, is not faring too badly, as its 5532 sales this year represents a 4.6 per cent decline – exactly in line with the SUV market.

And Kia has SUV reinforcements riding to its aid in the form of its all-new Seltos small SUV – its first entrant in a class that has done better than most other SUV classes in recent times.

The Seltos – a name derived from Celtos, the son of Greek god Hercules – is due to be revealed globally within weeks ahead of an on-sale debut in Australia in the second half of this year.

Ultimately, Kia Motors Australia also has its collective fingers crossed for a pick-up truck to add to its line-up by 2022 to take the LCV fight up to the major players.

By Ron Hammerton