The ageing Lancer small car has continued its downward slide this year – its 5784 sales to the end of September represent a 15.6 per cent decline on the same period last year, and there is no replacement model on the horizon – while the Mirage light car is likewise struggling, down 33.3 per cent (on 2039 units) in hatch form, and managing just 150 sales of the sedan year-to-date (-87.1 per cent).

Mitsubishi Motors Australia Limited (MMAL) sales and marketing director Tony Principe told GoAuto last week that the company was now more heavily engaged in selling SUVs – the small ASX, mid-size Outlander and large Pajero and Pajero Sport – and the venerable Triton ute than its passenger cars, with positive signs ahead as the Japanese manufacturer prepares to launch new-generation SUVs and crossover models over the next few years.

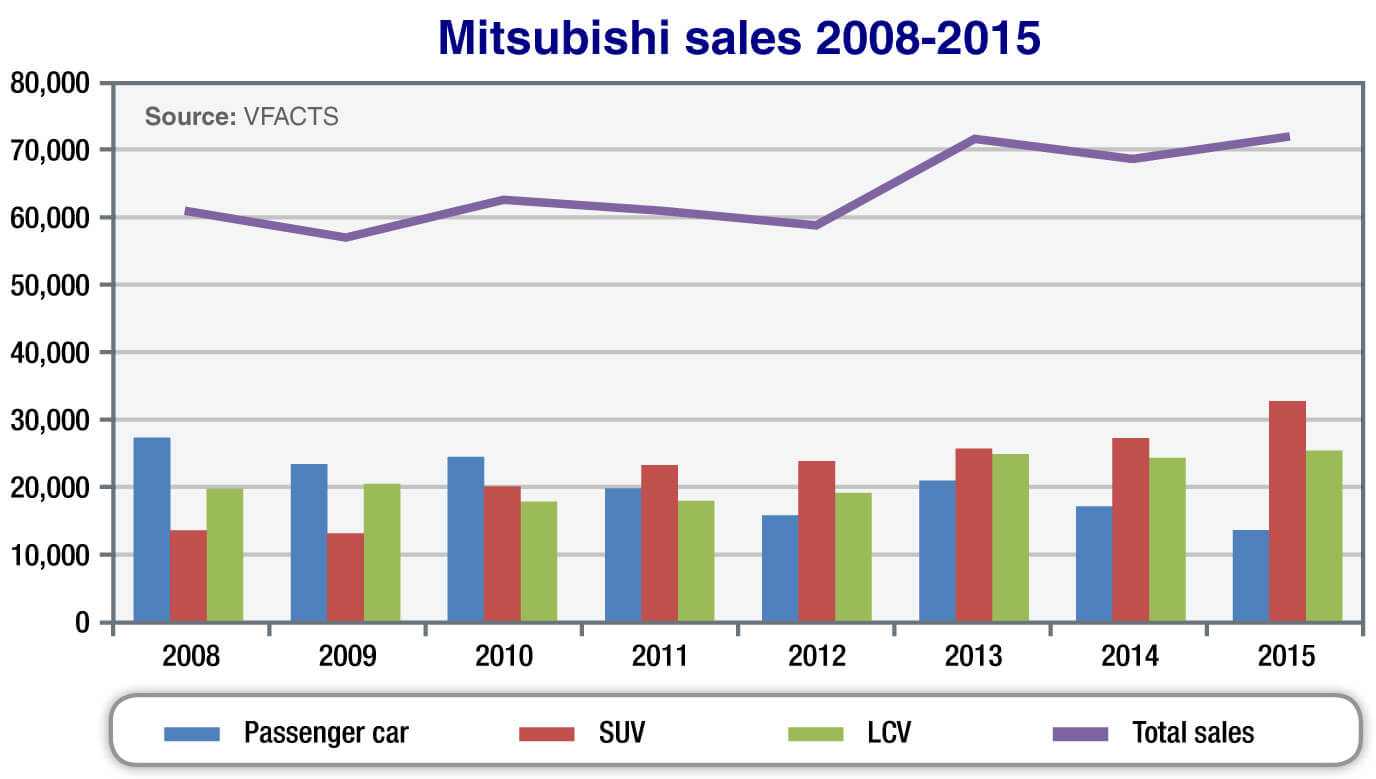

“Prior to 2013, we had periods where we averaged 5000 a month, 60,000 a year … since then we have been holding at 6000 a month, 70-71,000 a year,” he said.

“We were heavily reliant on things like Lancer. As you can see, our passenger volumes have dropped but our total volume is up – we’ve become a lot more SUV and LCV centric, our ASX volumes have increased dramatically, the Outlander as well, they are both at record levels this year, and Triton has been a solid success for us.”

Out there: Sales of Mitsubishi’s Outlander are up 18.7 per cent to the end of September, trading at record-high levels as buyers flock to the mid-size SUV segment which is up by a similar margin this year.

While its passenger car sales are down 28 per cent this year (to just 7973 units), and Triton has taken a 13.1 per cent tumble (still its top seller at 17,338), Mitsubishi’s SUV sales are up 34.1 per cent (at 30,203) to keep the triple-diamond brand in positive territory overall, up 3.6 per cent with 55,514 sales YTD.

Outlander sales are up 18.7 per cent with 8854 units, the new Pajero Sport has contributed 4415 sales, the ASX is second only to Triton in terms of sheer volume – up 45.1 per cent on 13,462 units – and the ageing Pajero continues to chip in with handy volume: 3312 units YTD, although this is down 10.8 per cent on the same period last year.

Mr Principe said the company was aiming to match, if not slightly exceed, its overall 2015 tally of 71,743 units come December 31, finishing at around the 73,000 mark.

“We’re aiming to hold our position,” he said. “The Lancer and Mirage are coming down but we’ll hold our total volume … unless something really goes wrong we will. Everyone is pushing for more volume.

“We’d be looking around 73,000 – we don’t like doing less than the previous year, so we’re trying to slowly improve in the low 70s. It’s a number we’re optimally operating at given our network and the way the market is.”

Notwithstanding a level of uncertainty caused by Mitsubishi officially joining the Renault-Nissan Alliance this month, Mr Principe is optimistic about future models already in the pipeline, particularly three new SUVs.

While there is no replacement for the Pajero in sight, Mitsubishi has previously announced that the next-generation Outlander will push up into the large segment and the ASX will move down a notch, leaving room for an all-new mid-size SUV.

The combined effect of the ongoing increase in SUV sales in the Australian new-vehicle market and the incoming new models could prompt MMAL to look nearer 80,000 units per annum, according to Mr Principe.

“If suddenly SUVs and LCVs … are 70 per cent of the market instead of 60, maybe we start thinking about 80,000,” he said.

“We’ve had consistent volume growth and have maintained a consistent financial position, our product focus in the current market puts us in good shape to continue to deliver consistent and sustainable volume and profitability,” he said.

Mr Principe also predicted that the total SUV market could represent more than 475,000 units a year by 2018.

“Our estimate for the full year is medium segment up, small and large stable – all have grown over the last four or five years,” he said.

“The small SUV segment has basically skyrocketed, it’s tripled since 2010, medium has doubled and the large has gone up 50 per cent. There’s a lot of growth across the board.”

By Stuart Martin

Read More: Related articles

Read More: Related articles