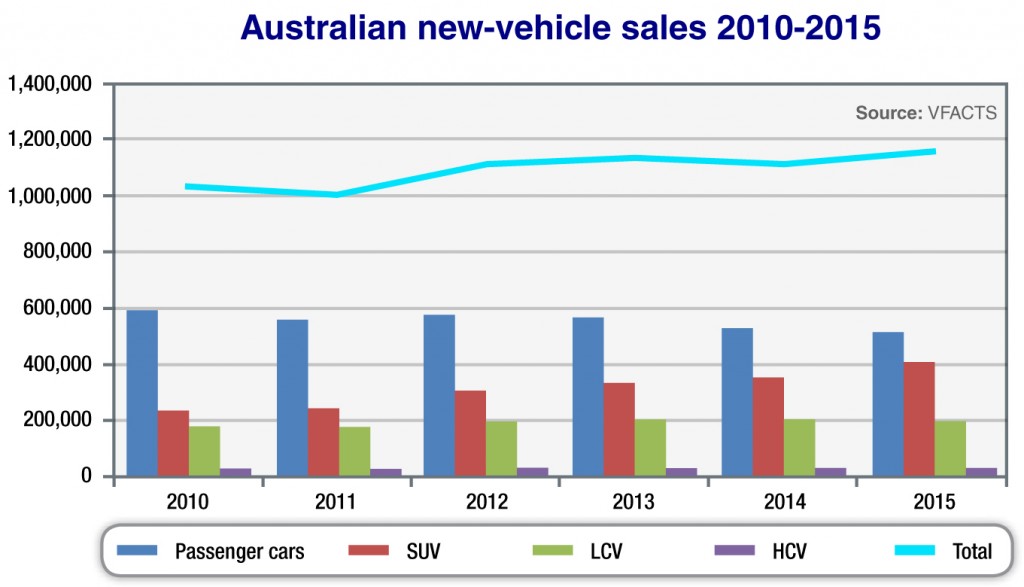

Last year, Australian consumers bought 1,155,408 new passenger cars, SUVs and light-commercial vehicles, outpacing 2014 by 3.8 per cent, or slightly more than 42,000 units.

Speaking with journalists at the announcement of the 2015 sales results, FCAI chief executive Tony Weber said 2016 would mark another year of growth for the local market.

“The Chamber sees 2015 as a very strong result, a very strong result indeed,” he said. “On the back of record sales, we expect motor vehicle sales to continue to be strong in 2016. The real winner is the consumer with access to high quality vehicles at world competitive prices.”

When asked if there was any chance of a dip after such a strong year in 2015, Mr Weber said he was confident that 2016 market conditions would ensure another robust year of sales.

“When you have a record year three out of the last four, you wonder where the market will obviously go but we see all indications that the market will remain very strong in 2016.

“Because interest rates are low, there is more and more product coming onto the market, there are over 400 models in the Australian market, which is quite remarkable in a market of 1.1 million (sales). We see it remaining strong into the future.”

Mr Weber said it was difficult to predict how much the Australian market will grow in the future, but suggested that factors such as free-trade agreements will continue to have a positive impact on sales levels.

“You look at the environment we operate in today – two thirds of cars coming into this country are tariff-free. There are discussions with the Europeans around free-trade agreements which will take another 12 per cent into that market. There are basically no non-tarrif barriers that exist in this nation.

“There are brands constantly looking to enter the Australian market. We are a very significant player in international terms. It is quite a substantial market by world terms. I just see continual growth going out into the future. Where that will end, I don’t know.”

As reported by GoAuto, Chinese-owned British brand MG will re-enter the Australian market next year, while other Chinese manufacturers, including GAC Motor, are also expected to try their luck here in the coming years.

Sales star: The Australian new-car market, led by the Toyota Corolla, hit 1,155,408 units in 2015 and the FCAI is expecting some growth in 2016.

Mr Weber said the arrival or more brands into the Australian market – which already has about 65 car-makers jostling for market share – will benefit consumers in the long run.

“There is no doubt that the winner from competition is the consumer. And I would stress the point, it is not just competition in terms of price, it is also the quality of the product and it is the experience post the purchase. And a lot of it is about the service delivery post buying the product.”

Mr Weber expressed confidence that Ford and GM Holden can maintain their market share after they shut their manufacturing operations in 2016 and 2017 respectively.

“The market is what it is. It is incredibly buoyant. General Motors Holden and Ford are multinational organisations. They are spending a tremendous amount of money on R&D around the world and in Australia – they are very significant R&D investors in Australia.

“A lot of movements relate to your model cycle and where you are in that model cycle. I am sure they will deliver a lot of quality product as they have done in the past in the market, and they will be strong players in the Australian market for a long time among a raft of other competitors.”

In terms of the Luxury Car Tax, Mr Weber said the FCAI would continue to lobby the government for its removal.

“The Luxury Car Tax has very few supporters in this world. You only have to look at the Henry review of taxation – Dr Henry’s paper was very critical from a theoretical sense. I don’t know of any quality public or private sector economists that actually supports the Luxury Car Tax.

“We recognise it raises a lot of revenue, at about $500 million per annum. But we think it is something that should be removed because it does distort people’ s buying behaviour and it moves people away from safety and environmental outcomes and to buy a lesser vehicle than what they would do if the tax wasn’t there. It has no economic merit whatsoever.

Mr Weber said the federal government understands the FCAI’s concerns and expressed confidence in its eventual removal.

“Clearly the government understands the lack of merit in the Luxury Car Tax, the problem is the revenue base and our fiscal position. But I think common sense will prevail and the Luxury Car Tax will be eliminated at some point.

By Tim Nicholson

Read More: Related articles

Read More: Related articles