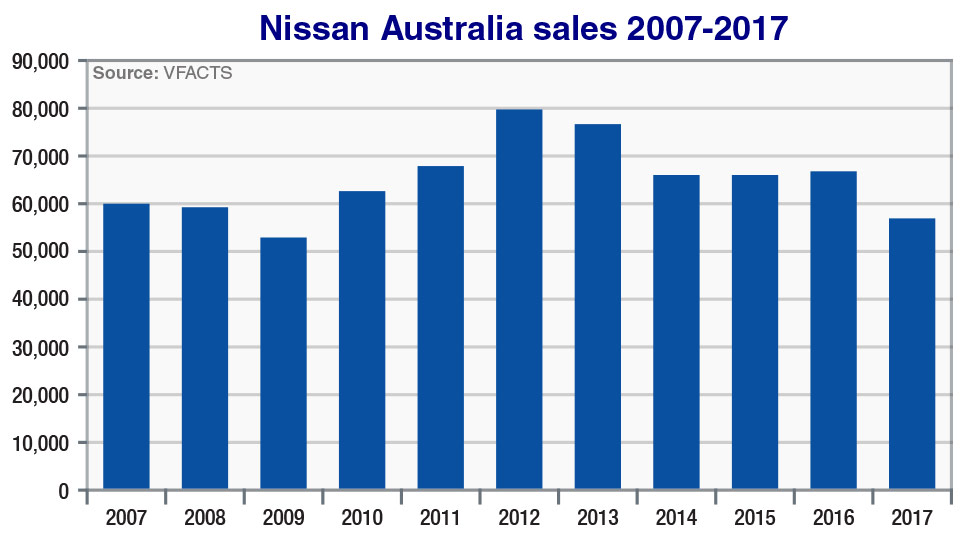

Since 2013, Nissan’s sales have dropped by 26 per cent, or about 20,000 units, after posting just 56,594 new registrations last year – a figure that was down 15.3 per cent over 2016.

Under previous Nissan Australia boss Richard Emery, the company cut several underperforming models from its line-up, including the Micra micro car, the Y61 diesel-powered Patrol (due to emissions regulations), the Pulsar hatch and later sedan, the previous-generation Leaf electric car and the Altima mid-sizer.

The remaining models in Nissan’s arsenal are the Juke, Qashqai, X-Trail, Pathfinder and Patrol (petrol) SUVs, the Navara pick-up and the 370Z and GT-R performance cars.

Speaking with Australian journalists at the Nissan Futures event in Singapore this week, Nissan Australia managing director and CEO Stephen Lester said one of his immediate priorities was to formulate a product plan that would ensure the company covers more segments.

“It is very obvious what we need,” he said. “We need greater market coverage. The segments that we play in right now are growing, so there is great opportunity in those segments.

“And what we are in the process of doing is reaching out around the world to understand what other products may be available to us that weren’t previously discussed or not in play, and figuring out ways that we can get those vehicles in play that are in segments that are growing.

“Obviously there is no need to look at segments that have declined to such a rate or such a level that there is no real growth opportunity. But I still think that there is opportunity in the passenger car segment.”

When asked what product the dealers would want right now, Mr Lester identified the sub-$25,000 sector, adding that an entry-level Nissan model could be a crossover or a traditional passenger car such as a hatchback.

Trail blazed: Sales of the X-Trail only increased by 0.3 per cent last year, despite being in a growing segment and receiving a mid-life refresh.

“I think that they (the dealers) would probably say the most obvious one is an entry-level passenger vehicle,” he said.

“I would be a little bit more vague about it and say entry-level vehicle because I don’t think the consumer’s mindset today is so conditioned that it has to be a car versus a crossover SUV.

“The reality is that about 25 or 30 per cent of the market is under the $25,000 mark, and I think this is really what the retailers want to see from a volume perspective. And this is the entry point then into the rest.

“It’s that sub-$25K, sub-$20K even, where there is volume. And entry level, that’s where we should challenge ourselves to play.”

Stephen Lester

While it is unclear which new models Nissan plans to introduce, a version of the new Kicks crossover is being considered, as is the Note and Micra light cars.

Another growth opportunity will come from increasing Nissan’s fleet business beyond rental company sales, Mr Lester said.

“We don’t really play in the fleet space at the moment, from a rental standpoint, in a very significant way,” he said.

“Fleet is all about balancing it against your new-car retails and having strong remarketing program, so we are in the process of building that up, building up some infrastructure around how we treat used cars, or a certified program if you will.

“The angle for fleet is about managing the proportion in lockstep with your retail and not letting one channel dominate another. I believe it is a fundamental part of our business so it is not something that if you ignore that you can take a holier than thou stance, it is something you have to accept as a part of the business and utilise and leverage.”

According to Mr Lester, one model that could benefit from a fleet push is the X-Trail, which only grew its sales by 0.3 per cent last year, despite being in the hot mid-size SUV segment and benefiting from a mid-life refresh last May.

“Observationally from the time I have arrived, I think there is some work we can do in the (sales) channel to look at where opportunity is, to grow outside of just pure retail,” he said.

“And if you look at the market from a pure retail standpoint, the market is flat at best in any given month and so I think it’s somewhere we may have to focus our opportunities a little bit differently.”

In terms of sales growth in the coming years, Mr Lester said it was difficult to compare Nissan’s year-on-year sales given the loss of product in the past couple of years, and said he was now focusing more intently on the performance of individual models in their respective segments.

“There is no use going off and pouting in the corner about what (models) you don’t have. What we do have can make a significant impact in the performance of the TIV (trade-in value) and of the market.”

Mr Lester said that one of his immediate challenges after starting the role five months ago was to re-engage dealers, some of whom were not supportive of the decision to drop so many model lines.

“Probably the immediate challenge was getting some of the engagement back and excitement back in the dealer network and within the organisation and I think we have done a good job of invigorating some of that by listening to the dealers, getting out and talking to the dealers and that will of course continue,” he said.

“What do I want to achieve? Well of course I want to grow sales here, I want to grow aftersales, I want to increase and improve customer satisfaction, dealer satisfaction and leave the business in a much better place whenever my time is up.”

He added that Nissan Financial Services – which is managed by Nissan Australia veteran Peter Jones who held the role of managing director and CEO on an interim basis prior to Mr Emery’s appointment – also offered several opportunities to build customer loyalty and offer a point of difference from other car-makers.

“It supports our dealers, it supports us. I think it also plays a tremendous role in supporting customer satisfaction at the end of the day. And will inspire much greater loyalty for our brand as we go forward,” he said.

“If we don’t keep everything in-house we are losing profit opportunities, we are losing opportunities to grow the business through loyalty and we are risking customer satisfaction. So these are all things that will help grow confidence in the Nissan brand.

“It all comes back into the one-stop shop and how the process connects. If you feel like you are going in and you are getting a straight honest good value deal and it has nothing to do with discounting, it has everything to do with trust and believing that the person across the table has your best interest at heart. When you feel that, you buy.”

By Tim Nicholson

Read More: Related articles

Read More: Related articles