The shake-up to the industry could see insurance companies move to a pay-by-hour model or even private investors insuring drivers or autonomous vehicles through online specialists which raise money online and administer the risk to cover the claims.

International professional services firm Deloitte Touche Tohmatsu says that ride-sharing and autonomous vehicles will not only threaten the future and profitability of automotive insurance companies, the change-up will stretch into the car retailing industry, private car ownership, vehicle fleet management and vehicle repair.

International professional services firm Deloitte Touche Tohmatsu says that ride-sharing and autonomous vehicles will not only threaten the future and profitability of automotive insurance companies, the change-up will stretch into the car retailing industry, private car ownership, vehicle fleet management and vehicle repair.

In a major report on the future of the insurance industry, Deloitte University Press (DUP) found that car insurers will have to rethink their relationships with drivers, owners and vehicles.

“For future underwriting models, insurers will likely need to consider the advent of safer vehicles, new vehicle designs and new sources of risk and liability,” the Deloitte report said, noting that the US automotive insurance industry is worth $280 billion a year.

So invasive will the shake-up be that it will stretch its changes into the car retailing industry, to private car owners, to vehicle fleet managers and even to vehicle repairers

“This likely means a decrease in the frequency and, over time, the severity of loss events, changes to vehicle repair and replacement costs, new customer categories, and the creation of new insurance products.”

The spark for this potential paradigm shift is the dramatic reduction in the inherent risks of mobility.

An autonomous car removes the human element of control and replaces it with a self-drive function, using wireless connectivity to communicate with fellow vehicles, buildings, road traffic systems and even pedestrians.

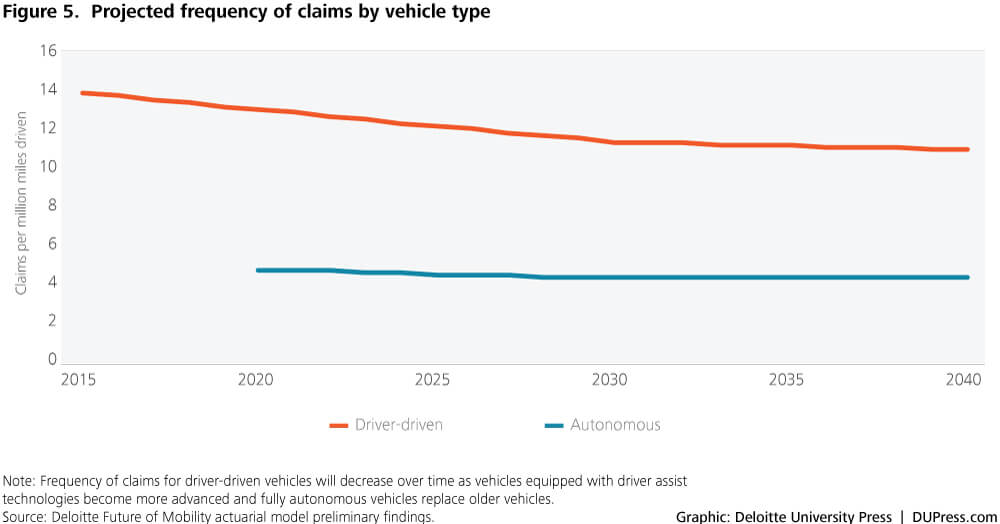

By diminishing the risk of an accident to people and property, motor vehicle insurance loses a substantial amount of risk resulting in substantially reduced premiums.

“We project that over time, total auto insurance premium needs could decline by up to 30 per cent from current levels,” the DUP report said.

“This decline is driven by two primary factors: the reduction in frequency of loss events and the decline in the total number of vehicles due to the efficiencies of vehicle sharing.”

For insurance companies, that indicates reduced profitability.

However, Deloitte Touche Tohmatsu Australia actuary partner Rick Shaw told GoAutoNews Premium that he remains optimistic about the future of the insurance industry.

“I’m confident about the future of the industry because I am confident that people will continue to take risks,” he said. “Risks encourage entrepreneurship and there’s always a future for people who take risks.

“Where there is risk, there will be a need to offset that risk.”

Mr Shaw said the shift in mobility – with the advent of autonomous cars and car-sharing – will undoubtedly change the future of insurance and companies will need to adapt.

“The change will be quite disruptive and it’s something every major insurer is now considering,” he said.

“It’s a change of culture and it won’t happen overnight. There’s a lot of understanding and preparation needed about the future.”

Mr Shaw calls it “the fuzzy future” because it is not yet known if future autonomous cars will be owned by individuals or by fleet management companies which lease the vehicles.

This affects insurance because the lease could be on small-time periods, a per-hour or per-day basis for example, or the more traditional three-year periods.

There is also a grey area in insurance that applies to ride-sharing because it’s a private car being used in a commercial application.

There is also a grey area in insurance that applies to ride-sharing because it’s a private car being used in a commercial application

“If there’s an accident, are the occupants insured? The ride-share industry is only going to increase so I believe the insurance industry itself will have to change to suit the new environment,” Mr Shaw said.

“If we look at Uber today, each trip has an insurance component. So $1 for example, of the tariff covers the passenger.

“So the insurer has to be flexible enough to adapt to this type of cover. That’s part of the future trend – the ability to segment the insurance cover.

“I think P2P (person-to-person) insurance has potential here, though it is yet to take off like P2P banking.

“But it has to be understood that while small lots of insurance will become the norm in the future, there always needs to be an insurer at the top.”

The DUP report said that “while widespread availability and adoption of fully autonomous vehicles may be a few years away, car-sharing and ride-sharing are already gaining traction, particularly among the young or those living in higher-density urban environments”.

The report said that for insurers, shared mobility reduced the number of vehicles per capita, challenged vehicle-centric underwriting and would likely give rise to large fleet operators.

This means a shift in the product and premium mix for passenger vehicles from individual buyers to commercial buyers, the expansion of driver-centric (rather than car-centric) policies and introduction of per-use policies and an increase in the prevalence of self-insurance by larger fleet owners as an alternative to purchased coverage.

Deloitte said it was important to note the speed of the shift in technology and the uptake of this technology by the public as ride-sharing trips nearly tripled in the US over the past five years.

DUP believes that there are four states of future mobility and each would need different insurance cover.

The first state is personally owned driver-driven vehicles in which insurance policies will likely resemble the all-inclusive coverage bundles offered today.

The second state is shared driver-driven vehicles focused mainly on fleet, taxi and car rental firms where the owners will be covered with policies for commercial operators. Separate policies may be needed to cover both the owner and the operator.

The third state is personally owned autonomous vehicles where vehicle owners may need comprehensive coverage, even though technological advancements may significantly decrease loss frequency in this category. There are three main stakeholders each requiring insurance – the car’s owner, the car’s manufacturer (for mechanical operational performance) and the companies responsible for designing, building, and maintaining the hardware and software comprising the autonomous vehicle operating system.

The fourth state is shared autonomous vehicles which juggles many stakeholders including mobility providers (the company providing the ridesharing service), owner of the vehicle, the vehicle’s manufacturer and the operating system company.

DUP said that because of the range of stakeholders, the size and composition of the market in terms of premiums will change.

“Insurers will need new operational capabilities to underwrite policies and assess claims in a more technologically advanced and diverse environment,” the report said.

Car sharing and autonomous vehicles will introduce many customers to fleet owners, who will demand the protection of insurance and the policies will not look the same as today’s insurance model.

DUP said that insurance companies will face new opportunities and will be subjected to shifting customer needs and improvements in vehicle safety.

The safety aspect will likely reduce, reallocate or eliminate a substantial amount of today’s insurance premiums.

The safety aspect will likely reduce, reallocate, or eliminate a substantial amount of today’s insurance premiums

At the same time, opportunities would arise to meet the needs of new customers as new and expanding models of mobility become more widely adopted and increasingly mainstream.

DUP said that insurers should now evaluate the potential impact of the change in mobility needs.

“Connected and autonomous vehicles will present insurers with entirely new classes of data about where, how and when a vehicle is being driven,” the report said.

“To price policies effectively, insurers should understand these data points’ risk implications and correlation with losses.

“Insurers that become early adopters by collecting and analysing this data may gain a significant advantage.”

By Neil Dowling

Read More: Related articles

Read More: Related articles