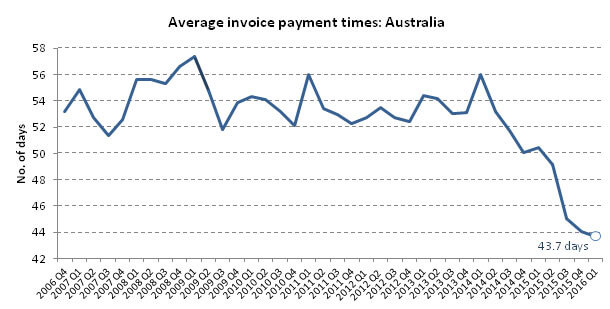

In its Trade Payments Analysis – a quarterly report on payments – credit information company Dun & Bradstreet said invoices are being paid quicker than ever on strong cash flows and low interest rates.

But it also notes that payment times vary across the nation, with the worst being the Australian Capital Territory at 50 days, followed by Western Australia with an average period of 46.1 days. The national average for the first quarter of 2016 was 43.7 days, down from 44.1 days in the previous quarter.

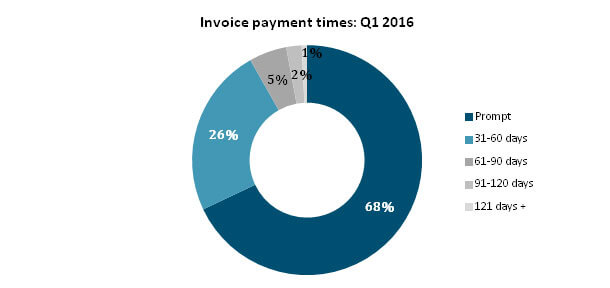

Most accounts, however, are settled in less than a month. The first quarter of 2016 saw 68 per cent of businesses settling their invoices within 30 days, unchanged from the previous quarter but a significant improvement on the 56 per cent recorded a year earlier.

Dun & Bradstreet economics advisor Stephen Koukoulas said the fall in trade payment times suggests that firms are cashed up and are able to pay their bills in a more timely manner.

“These results, which pre-date the most recent interest rate cut from the RBA, suggest that interest costs were not a problem for most businesses,” he said.

He added that further interest rate cuts, if there were any, would therefore “not help the business sector all that much from a perspective”.

He said that the results come during a period of mixed economic signals and in an environment “marked by increasingly cautious sentiment amongst businesses leading into the federal election”.

“Apparent in the analysis is the existence of disparate trade payments behaviour based on business size,” he said.

“On one hand, small- to medium-sized businesses are clearly cashed up through low borrowing costs, relatively low input costs and non-existent wage growth, and are paying their invoices with unprecedented swiftness.

“Businesses with between six and 19 staff settled their invoices at the fastest average rate of 40.2 days. This is despite a rise in business failures recorded over the same period.

“Conversely, those businesses with more than 500 employees are flexing their muscle and paid their invoices at the slowest average rate of 52.4 days.”

Mr Koukoulas said that the Australian economy was seeing a lot of conflicting news.

“The favourable news on trade payments times is in sharp contrast to the slump in business expectations and the softer tone evident in the economy in the past few months,” he said.

The results of the analysis have confirmed some of the results of Dun & Bradstreet’s March Business Expectations Survey. This survey found that 51.2 per cent of businesses would choose to miss a payment to a trade supplier if they were unable to pay all of their bills.

“The survey found that 38 per cent of businesses have had a customer or supplier become insolvent or otherwise unable to pay them during the past year,” the Dun & Bradstreet report said.

The Trade Payments Analysis said that most states and territories recorded slower average payment times compared to the fourth-quarter of 2015, with WA businesses increasing their average payment rate by almost four per cent to 46.1.

“Businesses in Victoria experienced the most improvement on the previous quarter, with an average rate of 41.9 compared to Q4 2015’s 44.1,” it said.

“However, all states and territories, excluding WA, reported significantly faster rates on the same period last year.”

By Neil Dowling

Read More: Related articles

Read More: Related articles