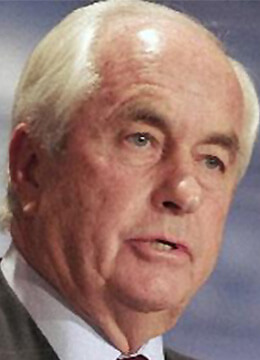

Roger Penske

SELECTING a suitable business partner or acquisition by buying an initial shareholding is the key to thriving expansions in the automotive industry, according to highly- successful businessman Roger Penske.

Mr Penske told a National Automobile Dealers Association (NADA) audience recently that “road testing” overseas partners or acquisitions before making a full investment allowed each party time to develop common ground.

It is a philosophy Mr Penske has adopted over the past 20 years in acquiring assets for his US-based Penske Automotive Group, which has 53,000 employees.

Mr Penske outlined how the international dealer group has expanded through buying initial equity stakes in target businesses.

These include a 49 per cent joint venture with the Nicole Group in Yokohama, Japan, which Mr Penske said was expected to be increased.

Penske Automotive Group also shows a preference for prestige brands. In Italy it is expanding to become the country’s biggest Porsche, Audi and BMW dealer group after buying eight dealerships in the Emilia-Romagna region that includes Bologna, Modena, Parma and Rimini.

In 2015, after forming a joint venture 10 years earlier, it took a majority share in the 15 north-west German dealerships of Jacobs Gruppe which has brands including Audi, Maserati and Volkswagen.

Penske also has a 50/50 joint venture with Autohaus Nix, and owns dealerships representing Aston Martin, Lamborghini, Bentley, Ferrari, Maserati and Porsche.

About 40 per cent of its businesses are international and 77 per cent are prestige brands.

By Neil Dowling