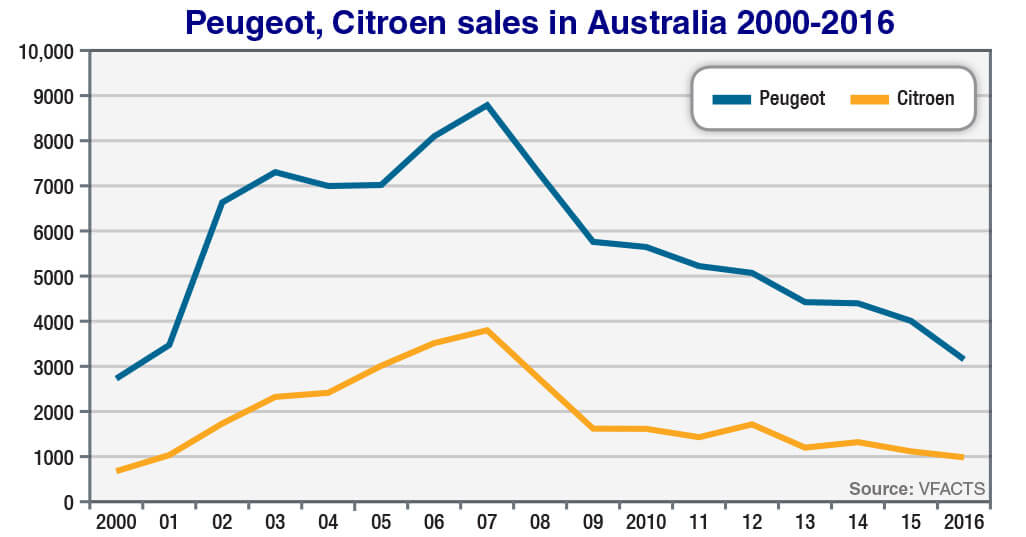

The two brands, Peugeot and Citroen, are currently at their lowest point for almost two decades, the sales of each brand down 48 per cent to the end of July after posting their worst annual result last year – with 3129 and 965 sales respectively – since the turn of the century.

Both brands have been on a downward trajectory for the past 10 years, with Peugeot falling every year since 2007 when the brand, which has been operating here nationally since 1949, posted its best-ever annual total of 8807 new-vehicle registrations.

Citroen also peaked in 2007 at 3803 sales, and while posting a few positive returns over the same period, it has never managed to repeat the effort in the subsequent year nor move back beyond about 1700 annual units.

Independent distributors for both brands have come and gone, and now with the Inchcape era underway there were no bold assertions emanating from the 3008 launch last week about a rapid return to combined sales of more than 12,000 units – more a quiet confidence that the French galleon would, at long last, begin to turn around.

Inchcape has this month moved to stimulate sales of its 208 light car and 2008 crossover, cutting prices of the two compact models that together account for 38 per cent of all Peugeot sales (197/249 sales YTD respectively and 610/359 last year), while the new-generation 3008 is offered with a broader range but maintains its position as a premium entrant, starting from $36,990 plus on-road costs.

The all-new seven-seat 5008 SUV due around the end of the year will help Peugeot’s cause, while the updated 308 small car – the brand’s biggest-selling model by a country mile, accounting for 40 per cent of all sales (464 YTD/1237 last year) – will play a crucial role in the turnaround when it arrives in October.

Less significant, but still with the task of generating incremental sales volume, will be the redesigned 508 large sedan and wagon range due later in 2018 – though possibly not arriving until 2019 (65 YTD/165 in 2016).

For Citroen, Inchcape has already moved to bring the new-generation C3 light hatch back to market in October after pulling out the previous model in 2015, and has committed to launching the C3 Aircross crossover next year.

Keeping up appearances: Peugeot is maintaining a premium position with its new-generation 3008, which will limit sales but should still stimulate much-needed volume growth for the struggling French brand.

The Dispatch mid-size van is also locked in for a return to the market, while the larger Relay van is under consideration.

The slow-selling C4 Cactus small SUV continues (46 sales YTD/226 2016), as does the C4 Grand Picasso people-mover (48 YTD/126 2016), but the regular C4 Picasso has been removed from the line-up after managing only 27 sales to the end of July and 77 last year.

There are also no DS-branded cars (DS3, DS4, DS5) in active service for at least another year, nor the regular Citroen C4 or C5, which leaves only the Berlingo compact delivery van to continue as the lynchpin of the entire double-chevron brand – a role assumed only since the downfall of others and with just half the number of sales it was accumulating a decade ago (133 YTD/315 2016).

A redesigned Berlingo is due in about a year.

The numbers presented here make it abundantly clear how much work lies ahead of the new management team if Peugeot and Citroen are to return to the heights seen in 2007, when a single model – the 307 small car – accounted for 4500 sales and received solid support of more than 2000 units from the 207 light car and almost 1500 from the 407 mid-sizer.

This was a range that covered the key passenger car segments – SUVs were a notable exception – and found success with a premium but value-oriented mix that traded on the badge, heritage, styling, dynamics and diesel powertrain options (accounting for 52 per cent of sales at the time).

Sporting and niche convertible model variants also boosted Peugeot’s sales and appeal, while its entire dealer network had been put through the global ‘blue box’ visual identity program.

Citroen’s importer, too, had plenty of reason to be optimistic at the time with more than 1500 sales of the C4 small car and useful contributions from the minor players – C2 (200), C3 (700), C5 (400), C4 Grand Picasso (300) and, of course, Berlingo (600-plus).

A decade on, the two French brands at least now have a presence in fast-growing SUV segments and clearly still have support from loyal customers of core models such as 308.

But the competition is intense, many of the mass-market brands have pushed into the premium end of the market and bona fide prestige marques are also now hunting in Peugeot and Citroen heartland.

Renault was only half a dozen years into its market resurrection when the PSA brands were at their peak – and still had a way to go before achieving solid annual sales growth – but, outside of Volkswagen, is now the ‘mainstream’ European brand of choice, and the number-one French brand, with more than 11,000 sales in each of the past two years.

From its full-scale relaunch in 2001, Renault took 13 years to reach 10,000 annual sales in Australia.

We can really only imagine how long it will take for Peugeot, and perhaps Citroen, to reach that mark.

By Terry Martin

Read More: Related articles

Read More: Related articles