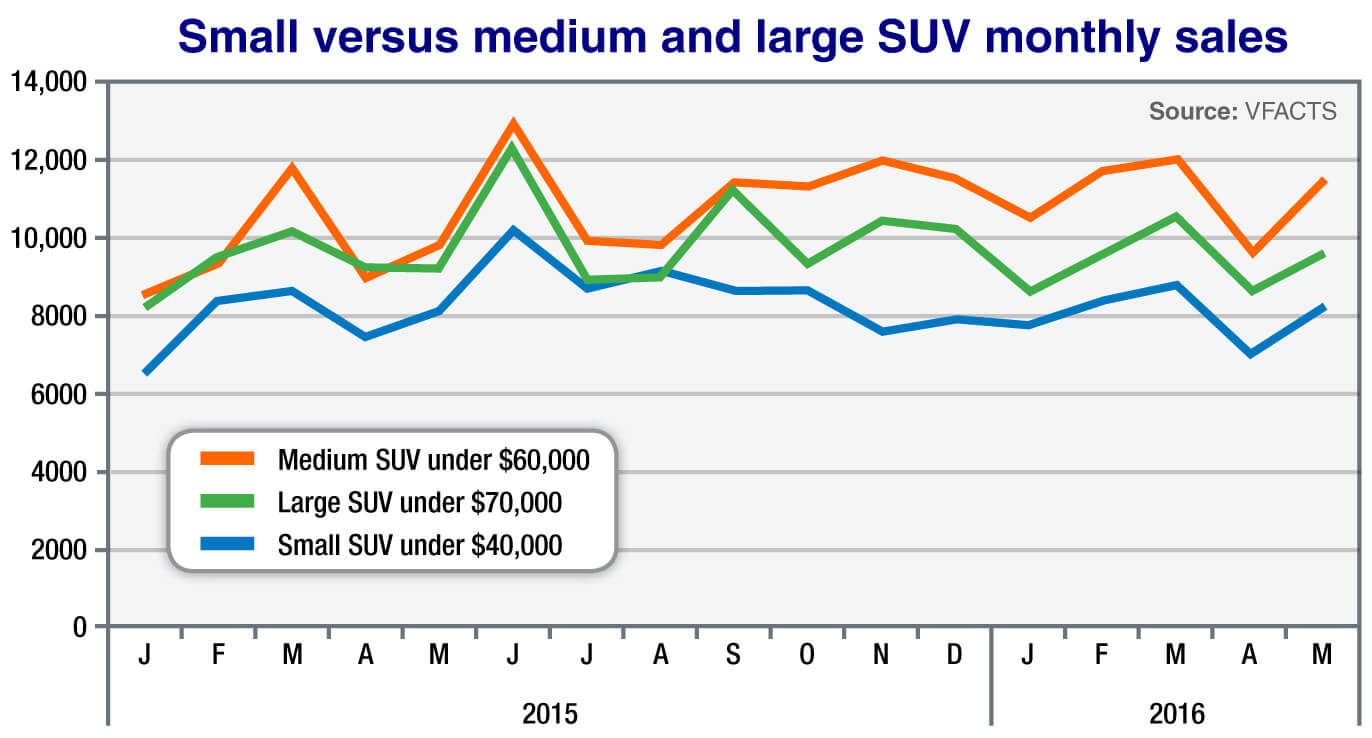

Last year, sales of small SUVs below $40,000 grew an outstanding 23.8 per cent, making them the stars of the industry, with almost every car company clamouring to get on board the gravy train.

This year, however, the growth rate has fallen to just 2.9 per cent – below the overall industry growth rate of 3.8 per cent – and slipping.

Ford Australia CEO and president Graeme Whickman today described the small SUV segment as “pretty stagnant”, despite strong growth by some contenders such as Mazda’s segment-leading CX-3.

He said pent-up demand could explain the CX-3’s sales rise – up 130 per cent this year – helping the segment to achieve a 2.9 per cent sales increase year to date.

“But I don’t think the segment has grown,” he said. “I think the energy in that segment has abated a little bit and people are looking to different derivatives.

“Right now we have started to see what I would call small SUVs – the likes of (Toyota) RAV4s and (Ford) Kugas – actually descending in price at the very same time.

“They are starting to sit on top of some of those mini utilities (SUVs), and customers are starting to look at those and go ‘should I buy something down here, should I buy a CX-3 or should I buy a CX-5 or the equivalent in each across each of the OEMs (original equipment manufacturers).

Once were warriors: Small SUVs such as Ford’s EcoSport are starting to struggle as bigger medium-sized vehicles come down in price.

“You can get a pretty well specified small SUV these days for not a lot of money.”

Toyota is advertising its two-wheel-drive RAV4 GX manual for $29,990, while Mitsubishi’s Outlander LS 2WD manual is $2000 less, at $27,990 driveaway.

Sales of medium SUVs in the price bracket up to $60,000 are up 14.2 per cent this year.

Ford’s contender in the small SUV segment, the Indian-built, Fiesta-based EcoSport, has shown 7.2 per cent sales growth this year, but last month it managed just 98 units, down 52 per cent on the same month last year.

It was ranked just 11th in its segment for the month, with the CX-3 (1451 sales in May), Mitsubishi ASX (1244), Honda HR-V (1149) and Nissan Qashqai (1015) way ahead.

As GoAuto reported in March, Ford Australia has decided not to import a more refined, facelifted version of the EcoSport that is going to Europe, instead sticking with the current version that was launched here at the end of 2013.

Mr Whickman today said Ford Australia would work hard to “do the best we can” with EcoSport.

“We have a regular volume that clicks through, but our projections in terms of that mini utility (EcoSport) haven’t grown as much as we first thought,” he said.

“If you look at the numbers, you are actually seeing what I call the medium traditional and medium crossover (vehicles) getting some of the larger gains, about 15ish per cent.

“We are seeing some of the gains in our numbers there, whereas the mini utilities, the numbers haven’t grown as quick as estimated.”

Sales of Ford’s mid-sized Kuga are up 19.2 per cent this year, against a segment rise of 14.2 per cent.

Its sales tally for the first five months of 2016 is 1854 units, but that is well behind segment leaders such as the Mazda CX-5 (9950), Hyundai Tucson (8128) and Toyota RAV4 (7640).

Ford’s biggest-selling SUV, the large locally made Territory, has achieved 3062 sales this year – down 21.8 per cent – while its new 4×4 off-roader, the locally developed Everest, has picked up 1486 sales.

Despite these sales, Ford’s SUV market share is just 4.1 per cent this year, behind its overall market share of 6.8 per cent.

Ford is expected to announce the import replacement for its Territory next month, four months out from the end of local production.

Most pundits expect the replacement to be Ford’s Canadian-built Edge. However, as GoAuto reported earlier this year, the Edge name trademark is owned in Australia by Toyota, so the Territory name is expected to be carried on.

Mr Whickman said discussions were on-going about the same, with Ford “working through the nomenclature”.

By Ron Hammerton

Read More: Related articles

Read More: Related articles