Sales of sportscars have fallen 34 per cent in the first half of 2018 compared with the same period of last year, with the rate of decline accelerating to 40.4 per cent in June.

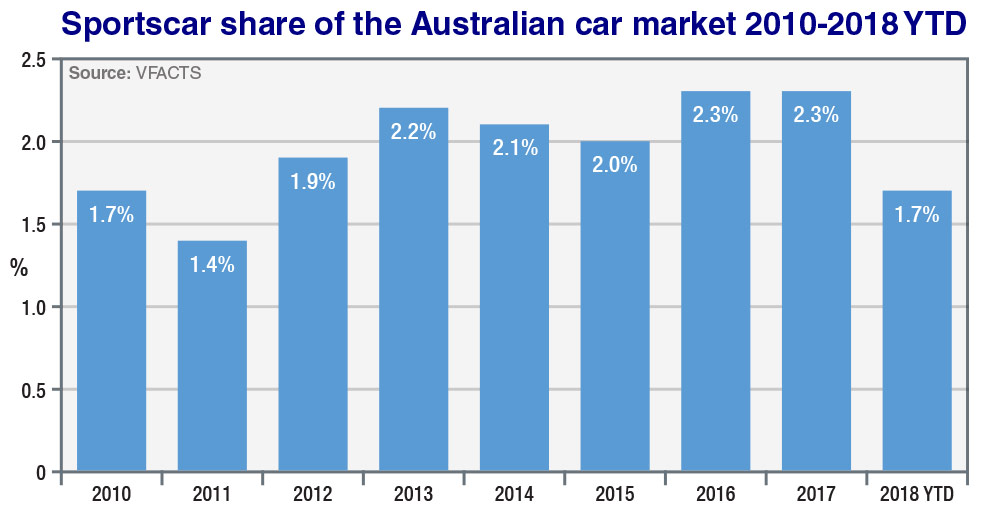

Expressed as a percentage of all vehicle sales in Australia, sportscars have slid from 2.3 per cent of the market over the past two years to just 1.7 per cent so far in 2018 – its lowest share since 2011.

The overall motor market is still 1.0 per cent up on the first half of last year, but has softened in recent times, falling 2.9 per cent in June.

In sportscars, the entry-level variety below $80,000 have been worst hit, with sales falling 42.4 per cent year to date, culminating in a 52.4 per cent drop in June.

Some of this decline can be sheeted home to last month’s change of model for Ford’s American-built Mustang, which is by far the biggest-selling sportscar in the country.

Mustang sales plummeted by half in June compared with the same month last year – from 1276 sales in June 2017 to 635 units last month – dragging the popular pony car’s year-to-date decline to 42.2 per cent.

But tellingly, despite the Mustang’s sales fall because of supply shortages, its share of the sports segment below $80,000 actually increased, from 56.4 per cent in June 2017 to 59 per cent last month, as other models dived even more.

The question is whether a revitalised Mustang can help to lift the segment back to healthy levels in the second half of the year, especially after the souped-up Bullitt variant arrives in October.

Another sports model expected in the second half is the all new Hyundai Veloster. Currently in run-out, the three-door coupe achieved just 16 sales in June – a 95 per cent fall over the same month last year when 322 Velosters found buyers.

Changeover: Ford’s Mustang has dominated Australian sportscar sales in recent years, but a model changeover in June has contributed to a sales slump in sportscars across the market this year.

Sales of the Toyota 86 fell 35.8 per cent in June, while Subaru’s corresponding BRZ dropped 28.2 per cent.

BMW’s 2 Series coupe and convertible range fell 27.2 per cent, while the rival Audi A3 convertible took a 68 per cent hit.

Even the evergreen Mazda MX-5 was down by 45 per cent.

On the bright side, sales of the Mini Cabrio and Nissan 370Z were up, by 8.8 and 40 per cent respectively, but both with relatively small volumes.

In the sports segment above $80,000, a healthy showroom performance by Audi’s newish A5 has helped to ease pain, restricting the segment decline to 19.6 per cent year to date and 9.4 per cent in June.

A5 sales increased 46.5 per cent in June, from 43 sales in June 2017 to 63 last month. Year to date, the A5 is 37.8 per cent ahead of last year after six months.

Also, the segment’s heaviest hitter, the Mercedes-Benz C-Class coupe/cabrio, recovered somewhat in June, recording 260 sales, which is down just 4.4 per cent on the corresponding month last year, but it still trails the 2017 year-to-date performance by 35.4 per cent, 1064 to 1646.

Sales of the one-size larger Mercedes E-Class coupe and cabrio were down 14 per cent in June, which put a dent in the year-to-date gain that now sits at 31.4 per cent.

At the super-luxury end of the sportscar market, vehicles priced above $200,000 tend to be more immune to chills in the economic climate, but even these high-end sports machines tripped in June when sales fell 10.2 per cent.

Year to date, the segment is still ahead of last year, but only by 1.9 per cent, mainly because of a healthy 82.3 per cent jump in sales of the Mercedes-AMG GT, from 62 in the first half of last to 113 this year.

The segment-leading Porsche 911 is also ahead of last year’s trajectory, up 22.9 per cent, to 322 sales this year.

A 19.8 per cent gain in collective Ferrari sales, from 101 units to 121 this year, has also helped to steady the ship.

However, much of this has been offset by declines in sales of models such as the Mercedes S-Class coupe and convertible (-30.5%) and its Benz sibling, the Mercedes SL (-69.4%), as well as the BMW 6 Series (-40.3%). The decline of the latter is not surprising as the coupe variant has been discontinued and the convertible is on borrowed time.

Maserati and Lamborghini have both managed to remain ahead of last year’s sales rate, but Bentley’s sports variants have slumped by 75.5 per cent.

By Ron Hammerton

Read More: Related articles

Read More: Related articles