Jato Dynamics this week reported that it was the first time that Stellantis – formerly Fiat Chrysler Automobiles (FCA) – beat Volkswagen.

The strength of Stellantis comes as European new-car sales plunged 30 per cent in October to 790,652 units over the 26 markets.

Jato said Stellantis’ buoyancy is attributed to the repercussions of the shortages of semiconductor microchips which has curtained production and stymied the flow of vehicles to dealerships.

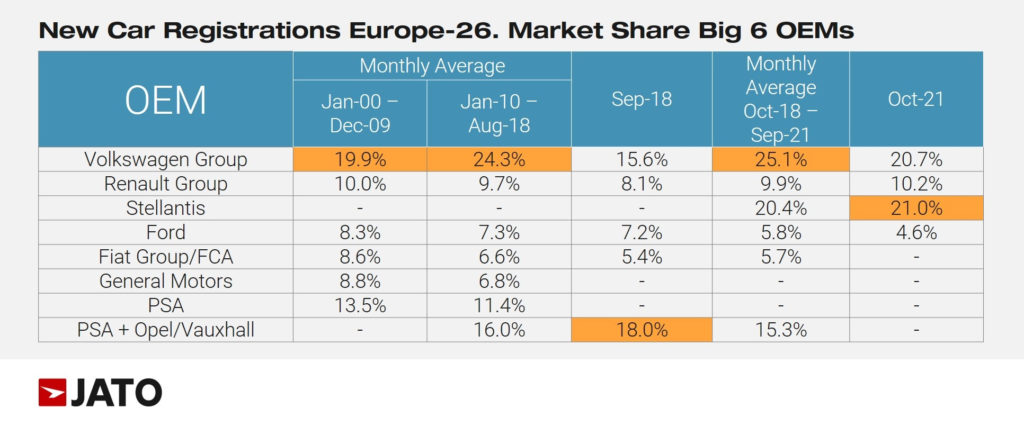

Jato statistics show Volkswagen Group had a 20.7 per cent share of the European market in October, just behind Stellantis at 21.0 per cent. Third place was Renault at 10.2 per cent ahead of Ford at 4.6 per cent.

By comparison, in September 2018, Volkswagen Group had a 15.6 per cent share of the market and Stellantis (then FCA) had 5.4 per cent.

On the effects of the semiconductor shortage, Jato said Volkswagen recorded a 42 per cent slump in volumes in October with double-digit drops in all countries except Ireland.

Most of the decline in Volkswagen sales was in its smaller models.

Jato’s global analyst, Felipe Munoz, said: “The shortage of semiconductors is proving to be as severe as the COVID lockdowns of last year.

“Carmakers are being forced to prioritise their best-selling segments, meaning that the few available semiconductors are being used solely to produce SUV and EVs.”

Smaller cars, Jato said, were being sacrificed as car-makers concentrated on the greater profits available on bigger, more highly-specified cars and SUVs.

Five of the 10 top-selling cars in Europe in October were from Stellantis, with the best seller being the Peugeot 2008 that despite an overall market sales plunge, recorded a nine per cent increase compared with October 2020.

Stellantis also had its Peugeot 208, Fiat-Abarth 500, Fiat Panda, and Citroen C3 in the Top 10.

Volkswagen only had its T-Roc SUV in the list. Renault had two – the Clio as the second-best seller and the Dacia Sandero SUV – while the biggest rise went to the new Hyundai Tucson that recorded a 59 per cent increase on its October 2020 result for its previous model.

Jato said that 181,300 units of electric vehicle (EV) and plug-in hybrid (PHEV) models were registered in October, accounting for a record 22.9 per cent market share.

It said diesel vehicles were struggling to gain traction in Europe, with market share dropping to just 19 per cent.

Mr Munoz said: “As we saw during the pandemic, the current crisis has proved to be more of an opportunity than a threat to the developing EV market.

“COP 26 marked a significant turning point for the industry as 24 countries and 11 OEMs committed to no longer producing ICE vehicles by 2040, and so the shift towards EVs will only accelerate further in the coming years.”

By Neil Dowling

Read More: Related articles

Read More: Related articles