But new research commissioned by leading Brisbane dealer Mark Woelders of the Motorama Group is suggesting that the young people of today are relying on dealers to buy their cars and that they place great value on the test drive as part of their buying process.

The Boyle Consulting New Vehicle Shopping Index, new research analysing the purchasing and buying habits of new-vehicle customers, has discovered your birthday significantly impacts your research preferences.

Boyle Consulting is a leading Australian-based consulting and training company.

The research is seen as a vital tool for dealers deciding on the generational structure of their sales teams and may give dealers pause before investing heavily on premises upgrades which rate poorly as a reason for visiting a dealership.

It showed that more than 90 per cent of all respondents placed visiting a dealership as the most helpful way to research a new car to buy, followed by taking a test drive.

But there were distinct preferences according to the age groups.

The research discovered the older you get the less you value the opinions of family and friends, with 76.5 per cent of 18-24-year-olds finding the technique useful compared to 54.8 per cent of people aged 55 years and older.

The youngest (18-24-year-olds) and the oldest (55+) age brackets found manufacturer websites the least helpful at 58.8 and 58.1 per cent respectively, while 25-34-year-olds (78.3 per cent) and 35-54- year-olds (75.7 per cent) found dealership websites the most helpful.

But the older the buyers, the lower they value the test drive. One hundred per cent of 18-24-year-old customers found dealership test drives helpful, compared to just 73.1 per cent of customers aged 55 years and above.

Boyle Consulting’s business development manager, Adrian Fox, said: “For the first time, we’ve been able to differentiate between the purchasing and buying behaviours of people of different ages searching for a new car.

“This level of intel will help dealership sales teams customise their approach, giving customers, irrespective of their gender, exactly what they want.

“At the same time, they’ll be able to modify their approach for older customers, eliminating information they don’t need when researching their next new-car purchase.”

The comprehensive 20-page research report was commissioned in partnership with Motorama dealer principal Mark Woelders who said the Index, which examined the research habits of customers prior to purchase, “has been insightful to finally get some Australian research that pinpoints the subtle differences between age”.

“We will be using these insights to further refine and tailor our customer approach to ensure every customer receives the most relevant and personalised buying experience we can provide,” he said.

Motorama represents Toyota, Holden, HSV, Ford, Mitsubishi, Nissan and Kia.

Boyle Consulting said the Index “answers a host of difficult to answer questions and unpacks the purchasing and buying habits of new-vehicle customers, including:

- What research methods do customers prefer and find most helpful?

- Are online research methods preferred to traditional methods?

- What reasons do buyers give for visiting a dealership?

- What reasons do buyers give for buying from a dealership?

- How many dealerships do customers visit when shopping for a new vehicle?

- How long is their shopping research phase?

- Does gender or age impact research and buying preferences?

When measuring the top reasons for visiting a dealership, the results came down heavily on what happens inside the dealership rather than what the dealership looks like.

By grouping the multiple-choice results, an instructive pattern emerges.

For example, in terms of drawing buyers to the business, ‘You stock the brands I want’ at 63 per cent was the strongest factor. ‘Immediate stock availability’ (29 per cent) and ‘Thought I would get a good price’ (20 per cent) were weaker factors.

‘Convenient location’ scored 47 per cent and ‘Reputation of dealership’ scored 31 per cent but ‘Dealership advertising’ (seven per cent), ‘Appearance of the dealership’ (six per cent) and ‘Online reviews of the dealership’ (three per cent) barely rated.

But what did rate was ‘The friendliness of the sales consultant’ at 52 per cent – the second most-important factor.

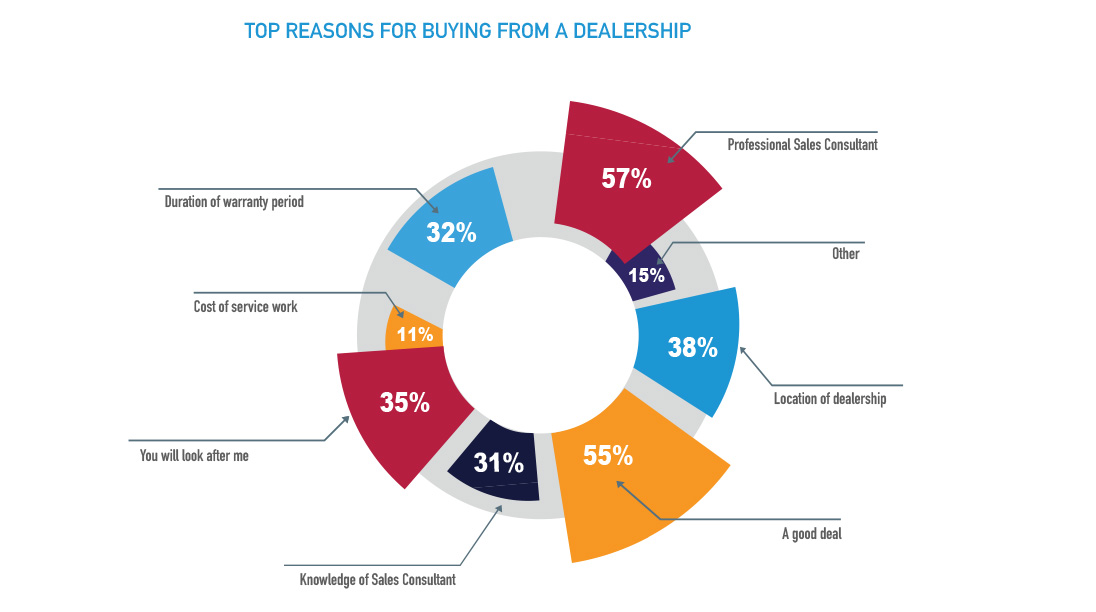

In terms of reasons for buying from the dealership, the clear leader was ‘The professionalism of the sales consultant’ (57 per cent) ahead of ‘A good deal’ at 55 per cent and ‘The knowledge of the sales consultant’ at 31 per cent.

This means that the professionalism of the sales consultants, their ability to get the buyer a good deal and their knowledge of what they are selling are key ingredients in a dealership’s success.

In terms of ongoing aftersales support, ‘Location of the dealership’ was a strong factor in buying from that business (38 per cent), ‘You will look after me’ was 35 per cent and ‘Duration of the warranty period’ came in at 32 per cent. Interestingly, the ‘Cost of service work’ only rated 11 per cent on buyers’ radars.

Delivery preferences were also illuminating. Only 45 per cent of buyers said they wanted an orientation drive and a full explanation of the features, whereas 24 per cent just wanted a short summary of the features and 22 per cent just wanted a short summary with more details when they come in for their first service. Nine per cent said, “Just give me the keys, I want to get going”.

By John Mellor

Read More: Related articles

Read More: Related articles