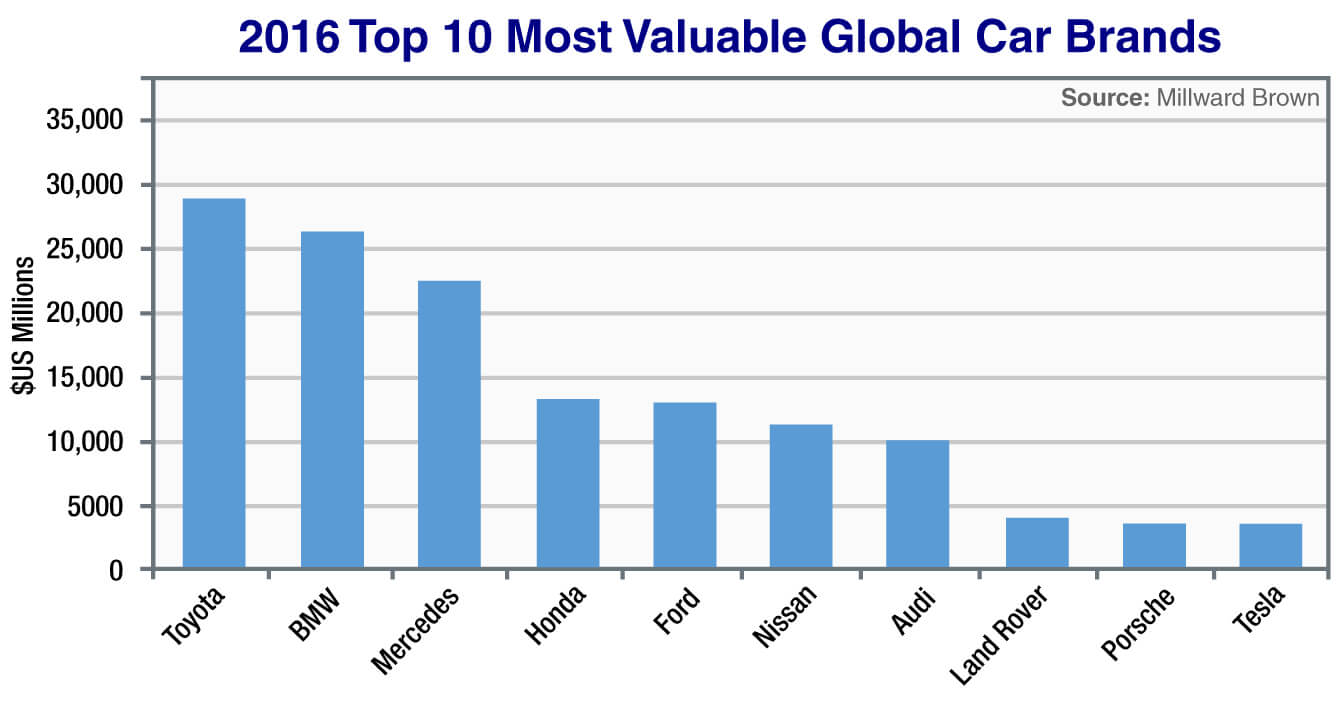

The annual Millward Brown BrandZ Top 100 Global Brands list, now in its 11th year, estimates Tesla’s brand value at $US4.43 billion ($A5.94b), which is sufficient to give it 10th spot on the automotive brands value list.

Tesla slotted in just behind another brand making a top-10 appearance for the first time, Porsche ($US4.44), with scandal-hit Volkswagen and Toyota’s luxury brand Lexus sliding out of the leader group.

Tesla made it into the top 10 in only its second year as a global player in an industry dominated by the usual cast of long-established characters from Japan, Europe and the United States.

Millward Brown global BrandZ director Peter Walshe said Tesla’s top-10 placing was a sign of the coming disruption in motor industry.

“The car business is facing perhaps the most challenging period since the arrival of the internal combustion engine, with the emissions crisis just one of many issues that it will have to navigate,” he said.

Electric brand: Tesla’s all-electric Model 3 is helping to generate global brand awareness for the American electric vehicle start-up.

“Those car groups with strong brands will be best placed to pivot both their business model and their engineering as the move to electric only and potentially driverless cars changes consumer perceptions of what it means to drive.

“The arrival of Tesla in the top 10 for the first time shows how much change is on the horizon. A strong brand will give established groups more time to make the fundamental changes they may need to make.”

The top seven rankings in the BrandZ list remained unchanged from last year, despite changes in value according to the Millward Brown formula.

Toyota’s brand value was estimated to be $US29.5 billion ($A39.5b), up 2.0 per cent on last year on the back of what BrandZ called hard work to combine technology leadership with a business strategy that appeals to its broad market.

It was the fourth consecutive year that the Japanese giant has earned the honour from BrandZ, created by London-based global research company Millward Brown from more than three million customer interviews and analysis of financial and business data.

Germany’s BMW ($US26.8b) and Mercedes-Benz (US26.8b) again took the other podium positions, ahead of Honda ($US13.1b), Ford ($US13b), Nissan ($US11.4b), Audi ($US9.4b) and Land Rover ($US4.7b).

Mercedes-Benz was the biggest improver, with an estimated 4.0 per cent increase in brand value, while rival Audi slipped 6.0 per cent.

Just the top six auto brands qualified for the overall global BrandZ top 100.

While Toyota topped the automotive brand values, it was ranked just 28th in the overall brands list which was headed by American tech giants Google ($US229b), Apple ($US228b), Microsoft ($US121b), AT&T ($US107b) and Facebook ($US102b).

BrandZ said Google’s brand value had grown 32 per cent in a year due to continual innovation, increased revenue from advertising and growth in its cloud business.

On the other hand, previous leader Apple had slipped to second place after its value dropped 8.0 per cent.

BrandZ said its research had shown that disruption had been a catalyst for brand value growth.

“The categories that increased in value were all either shaken up by challenger brands founded on a unique and meaningful proposition, such as Under Armour and Victoria’s Secret in the apparel category (+14 per cent), or innovated to a high degree in response to a new trend, such as the brands in the fast food category (+11 per cent) which successfully responded to global demand for healthier products,” it said.

In the automotive business, it singled out the rise of Uber and its Chinese rival Didikiaidi as one such change.

It said new finance deals that encourage consumers to assess their brand choice based on the monthly cost were repositioning the car business “from an ownership model to an ‘access to mobility’ equation”.

“Car manufacturers such as Ford and Audi also have new car-sharing models with more flexible access to models as consumers move through different life stages or transport needs,” it said.

By Ron Hammerton

Read More: Related articles

Read More: Related articles