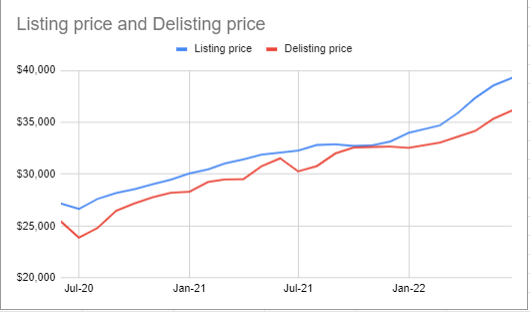

According to June data released by Cox Automotive Australia’s data solutions division, the average price at which cars are being listed from dealer websites has now risen to $39,279 compared with approximately $27,000 just two years ago.

The data also shows that the average price at which cars were being delisted, which is an indicator of the final used car translation price achieved by dealers, was also a record at $36,135.

This compares with an average price of $25,500 in June 2020.

Meanwhile the gap between what dealers are asking for their used cars on listing and what they are selling them for (delisted price) is relatively steady at $3144.

However this gap was as low as $153 last November and $148 last December indicating that dealers are now having more trouble coming close to achieving the prices they were hoping for, albeit, prices still running at all-time record levels.

This could be a further indicator that used car prices may have peaked and dealers and finance and leasing companies funding assets need to be increasingly alert to avoid being caught if used car prices of vehicles bought at these elevated price levels suddenly turn down.

On the auction side of the market, where price support is presumed to act like the canary in the coalmine for the used car industry, the June data from leading Australian auction house, Manheim, confirms the recent trend that indicates that while used-car prices at auction remain at record levels, the market is continuing to hesitate to push auction values for wholesale used cars even higher.

The Manheim Used Vehicle Value Index for June was 167 per cent of the index (which began in January 2006).

This was down slightly from May which was 171 per cent and compares with April number at 167 per cent and the all-time high in March of 178 per cent.

So far this year, the index has been averaging 169 per cent compared with the average for all of 2021, which came in at 153 per cent.

While that indicates an underlying strength remains in auction values, observers in the wholesale car industry are noting that the big increase experienced this year has levelled off and is actually declining slightly.

In terms of stock levels, the number of active vehicles (those listed for sales by dealers) in the Cox Automotive database has grown to more than 79,000 units, up from 72,650 in March. In May it was 77,300 units.

The number of delisted used vehicles (units sold) was 48,535, up from 45,780 in May and 41,500 in April.

By John Mellor

Read More: Related articles

Read More: Related articles