Cox Automotive Australia’s data solutions division has confirmed that the average price being achieved by dealers for used cars is now more than $33,000 – an all time record.

The number for February is $10,500 more than the average numbers dealers were getting for used cars at the start of the pandemic.

Data released by Cox’s used-car intelligence tool, AutoRadar, shows the number recorded for February is about $1000 more that dealers were achieving six months ago and $5000 more than they were achieving in January 2021.

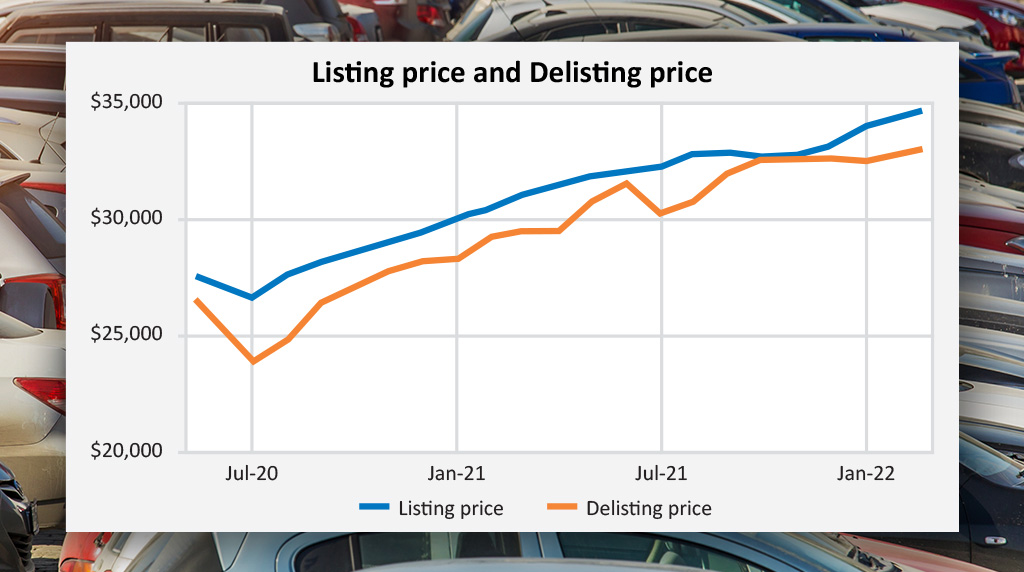

Source: AutoRadar

Both the average listing prices and the average delisting prices are at all-time highs. The gap shows the degree to which dealers reduced their listing prices to make their sales that month.

The data tracks the average price dealers were asking for their used cars at the time the cars were actually delisted (because they have been sold) which is an indicator of the final transaction price achieved for that vehicle.

The data also shows the price dealers are asking for their used cars at the time of listing which is a measure of their expectations of what the market will support for each car.

The average listing price in February reached approx. $34,700. In the lead-up to the pandemic dealers were asking only around an average of $25,000 at the time of listing their used cars.

Another market indicator revealed by the AutoRadar data is the success dealers are having in generating strong margins. This is a calculation of the difference between the average asking price when cars were listed and the average asking price when they were removed from sale. The number identifies the level of discounting dealers were having to apply to their cars in that month in order to close their used-vehicle sales.

The number identifies the level of discounting dealers were having to apply to their cars in that month in order to close their used-vehicle sales.

Throughout 2019 dealers were basically discounting by an average of around $2000. When COVID hit in 2020, and dealers set about trimming their used-car stock as they battened down the hatches, dealers were prepared to take less margin to make the sale.

The data shows that dealers tend to drop plus or minus $2000 on their initial asking price but from September 2020, as demand outstripped supply for used cars, dealers were dropping only plus or minus $1500.

However by September 2021 as stock became really short, the amount dealers were giving away to make a sale was reduced to $880 and it fell to $153 in October-November. In February the gap was out to $1600.

By John Mellor

Read More: Related articles

Read More: Related articles