The Transporter range is up 50.8 per cent to the end of November, with Multivan and Caravelle people-mover derivatives up 25.4 per cent and 84.6 per cent respectively, while the full-size Crafter is up 22.4 per cent.

Passenger-carrying versions of the Caddy are up 19.2 per cent, but the van variants are down 7.4 per cent. Amarok utes are treading water on 0.2 per cent growth for 4×4 variants, while the 4×2 is down 19.4 per cent.

Volkswagen Group Australia commercial vehicles director Carlos Santos revealed some of the strategies and successes that have helped deliver growth for his division.

“Our sales performance this year has come from the fleet side, and we are doing really well in that space to the point where we have now introduced a specialist dealer network,” he said.

“We have fleet business centres that must meet certain criteria, with dedicated fleet salesperson, service advisors.

“Five pilots launched this year and next year we will add another seven because we have had such a growth in direct fleet business.”

Crafty: Volkswagen turned a problem into an opportunity when the automatic Crafter large van was discontinued and created a simple, low-priced variant that could be sold by the passenger car salesforce in Australia.

Mr Santos provided the example of haulage giant Linfox, which is replacing its fleet of Toyota HiLux utilities with Amaroks, while Caddy and Transporter vans were replacing the Mercedes-Benz Vito and Toyota HiAce.

“Lots of big deals have been done in the past 12 months,” he said.

Unlike many overseas markets, the Amarok is sold through both passenger car and commercial vehicle showrooms in Australia.

Mr Santos said this country does not have the market density to justify the separation of Amarok to commercial dealerships, and that there were no plans to expand the overall number of dedicated commercial vehicle outlets due to the level of aftersales support provided by Volkswagen’s nationwide network of more than 100 passenger car dealerships.

“That’s the difference we have compared with other European commercial vehicle brands, we have the dealer footprint … If you buy (a VW) you know you can get it fixed and that positive quite far outweighs having a dedicated (commercial vehicle) network.”

Related to this was a successful strategy of creating a “simple, white, no-option van” that could be easily sold by the passenger car sales force.

The decision came out of the factory’s decision to cease production of automatic Crafter vans in the lead-up to an all-new version that will launch in Australia in the second half of next year.

“Since we are selling through passenger dealerships we adopted what we call a runner strategy, we introduced a base model at $39,990.” said Mr Santos.

“Just keep it simple, keep it good, but easy to understand. The easier you make it for the salesperson the better.”

He compared selling a passenger car such as the Golf to VW’s 300-page book of options available for the Crafter, including body styles such as long- and short-wheelbase, different roof heights, and refrigerated or motorhome conversions.

“Due to the Crafter success we did the same no-option simple white version of Caddy and T6 (Transporter),” said Mr Santos.

“Globally that T6 Transporter is car is sold out, its price is now within three per cent of our main competitors and people will pay three per cent extra for the T6.

“We haven’t even had a diesel Caddy this year because it’s been on stop-sale and that is usually 65 per cent of Caddy volume, but with only the petrol Caddy we’ve sold more than 1700 this year.”

Mr Santos said the Amarok, which straddles the passenger and commercial segments “has done a lot for the brand”.

“What the master (Volkswagen passenger vehicles) brand brings to Amarok is comfort. The Amarok segment is not traditionally about comfy seats, it’s about toughness and robustness, masculinity.”

Amarok sales are expected to pick up by the end of this year to register five per cent growth, with another five per cent expected in 2017 due to the new V6 turbo-diesel engine option.

Mr Santos said the Amarok only really competed in the 4×4 dual-cab segment and he saw opportunity to find more volume in other areas of the Australian ute market.

“There are lots of bits we don’t compete in, so I think we can do more,” he said.

However, he said competing with entry-level products such as Toyota’s HiLux WorkMate would be tough.

“If you can’t compete at the base 4×2 single-cab segment than you are better off making better value in the 4×4 pick-up segment, because it fits with the brand better.”

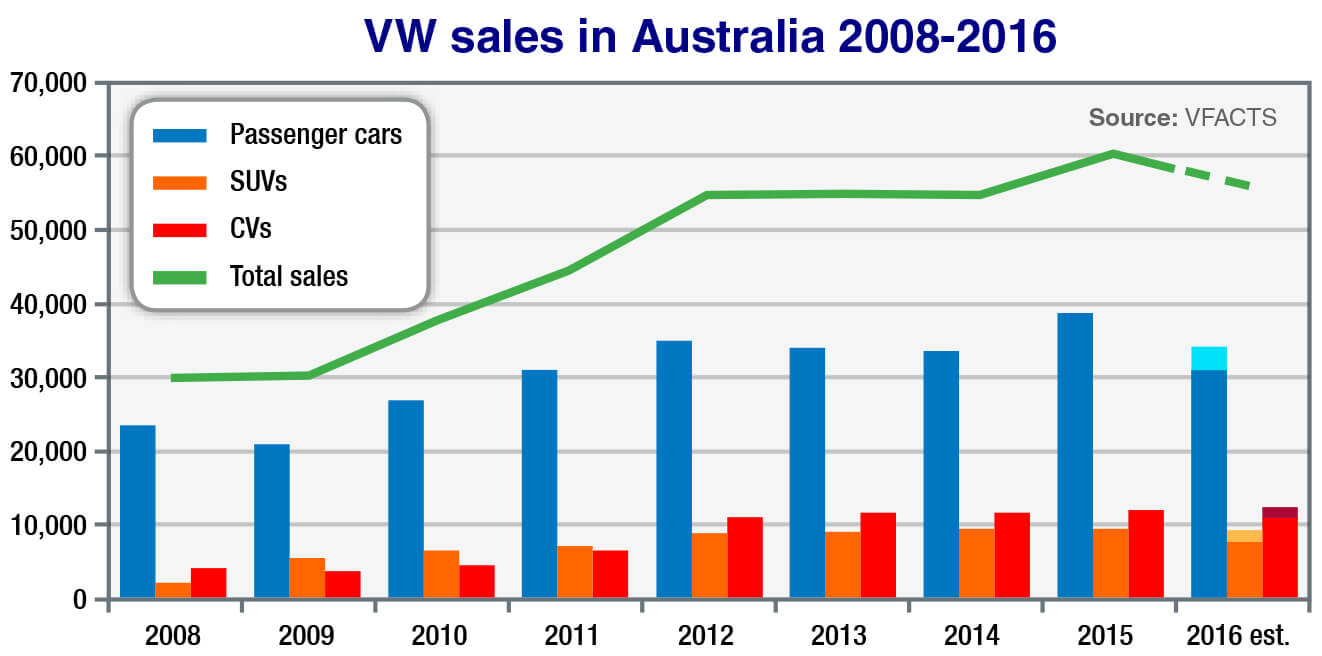

While VW commercial vehicles are roaring ahead, the brand’s only passenger car reporting a sales uptick year-to-date is the Passat mid-size sedan and wagon, up 41 per cent.

By Haitham Razagui

Read More: Related articles

Read More: Related articles