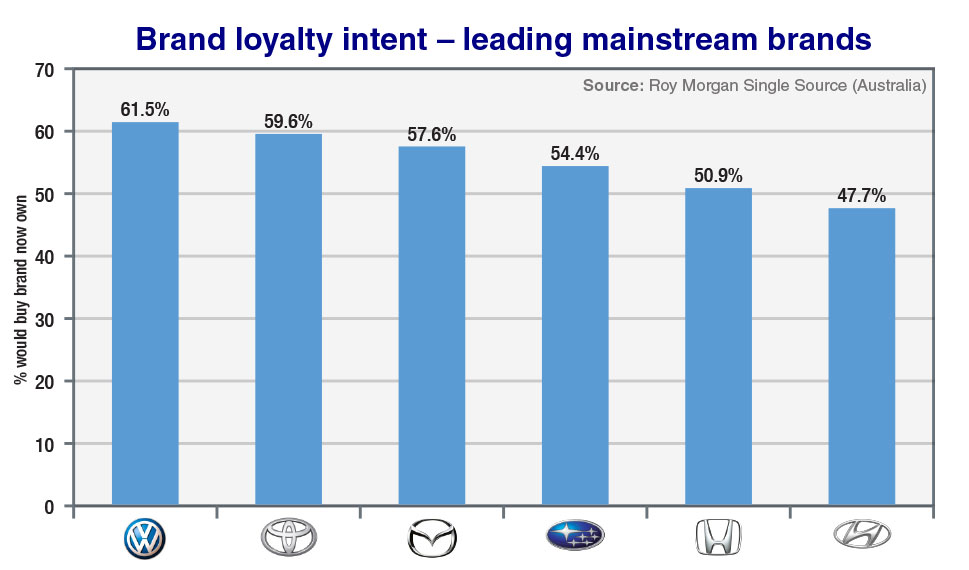

Based on the research firm’s ‘single source’ surveys, which are based on approximately 1000 interviews conducted each weekend, the latest data shows that of those respondents (in June) who identified as VW drivers and said they were planning to purchase a new vehicle in the next four years, 61.5 per cent indicated that they would look to buy from the same brand.

This placed Volkswagen at the top of the table, just ahead of Toyota on 59.6 per cent, followed by Mazda (57.6%), Subaru (54.4%), Honda (50.9%) and Hyundai (47.7%).

The German brand last led the field in September 2015 – the month when news broke of VW’s deliberate under-reporting of its cars’ diesel emissions – and at that point two-thirds of all Volkswagen drivers said they would remain loyal to the brand.

But within a few months, this had plunged to less than 50 per cent, placing the brand in unfamiliar territory and setting it on a lengthy road back to the top of the industry.

Analysing the figures over the past five years, Roy Morgan’s industry communications director Norman Morris told GoAuto that Volkswagen had gradually built itself up to a clear leadership position by September 2015, before the crisis hit.

At that time, 66.3 per cent of VW drivers professed loyalty to the brand, ahead of Subaru and Toyota tied for second on 58.1 per cent and Mazda next best on 54.4 per cent.

Hyundai and Honda were further afield on 45.9 and 44 per cent respectively.

According to Mr Morris, VW’s immediate and severe downturn to 49 per cent by early 2016 – where it remained for the next few months – could really only be explained by the diesel emissions crisis, with the brand then slowly winning back loyalty from its ownership base with incremental gains and a few dips over the next two years in what has generally been a consistent upward trend.

Return to form: Volkswagen has regained top position among mainstream car companies in terms of brand loyalty, three years after losing the mantle as a direct result of the global diesel emissions scandal.

He said VW had performed particularly well in the second quarter of this year, leading up to the June results, to the point where the emissions scandal and subsequent recall involving around 70,000 vehicles in Australia now appeared to be well behind it.

From here on, new-model launches, technology advancements and retail offers such as its temporary five-year warranty are likely to see VW maintain a strong position in terms of brand loyalty, although Mr Morris noted that there was very little separating the other top-performing brands, particularly Toyota, Mazda and Subaru.

These three Japanese brands have stood as industry benchmarks – among the mass-market players – for brand loyalty over a long period, with VW also in the mix before pushing up as a standout performer just prior to the 2015 crisis.

Back in 2010, for example, Subaru held sway with 63.1 per cent of drivers vowing to stick with the brand at their next purchase, ahead of Toyota (58.9%), Mazda (57.5%) and VW (56.5%).

By 2012, VW was at the top of the pack on 64 per cent, trumping Subaru (61%), Toyota (57%) and Mazda (52%), while the following year VW was back in fourth on 51.5 per cent with Mazda out in front (57.1%), holding off Toyota (56%) and Subaru (52.1%).

VW’s ability to build its brand loyalty to an impressive 66.3 per cent by 2015 came as it grew its customer base through strong new-vehicle sales over the same period, maintaining around 55,000 annual sales from 2012-14 – up from 38K in 2010 and 45K in 2011 – before breaking through the 60,000 barrier in 2015.

It finished 2016 with 56,571 new-vehicle registrations, down 6.1 per cent on the previous year, and managed 2.5 per cent growth last year to reach 58,000 units. To the end of September this year, VW’s sales are running lineball with the same period in 2017, up 0.5 per cent with 42,781 sales.

Roy Morgan’s independent Australian survey results reflect VW’s internal research, with the company’s global head of sales, marketing and aftersales Juergen Stackmann telling GoAuto at the Tokyo motor show in October last year that its brand image had improved across major markets after taking a hit with the emissions scandal.

“If you look at the image data of the Volkswagen brand, clearly we see a pretty progressive upswing now of the brand image basically through the world,” he said.

“People are still cognisant of the facts, but we really are starting to see that the brand is overcoming the issues now with new technology. We have a fresh mission in mind, and the changes we have done to the brand and our group, actually I think this is recognised by our consumers.

“Our consumers are very loyal to the brand. You see this now, our sales numbers over the last years, we are very happy to see basically a very strong restrengthening of the Volkswagen brand image around the world.”

Interbrand’s respected 2018 Best Global Brands report released last week also placed VW in a reasonably strong position, emerging as the eighth most valuable automotive brand – valued at $US12.2 billion ($A17.2b), up six per cent over last year.

This positioned it behind Toyota, in first, Mercedes-Benz, BMW, Honda, Ford, Hyundai and Nissan, but ahead of fellow VW Group brands Audi and Porsche, as well as Kia, Land Rover, Ferrari, Mini and Subaru.

Reflecting broader trends in the Australian auto industry, Roy Morgan’s latest survey results also show that 20.6 per cent of respondents who said they were planning to buy a new vehicle within 12 months were in the market for a ‘small vehicle’ – whether passenger car or SUV – compared to 7.7 per cent intending to purchase a medium-sized vehicle and 3.6 per cent a large model.

In other categories, mid-size SUVs were clearly the most appealing to would-be buyers, with 16.6 per cent of respondents planning to buy from this market segment, compared to 13.3 per cent for large SUVs (the biggest single percentage change, up from 11%), 7.1 per cent for small SUVs and 1.9 per cent for upper-large SUVs.

By Terry Martin

Read More: Related articles

Read More: Related articles