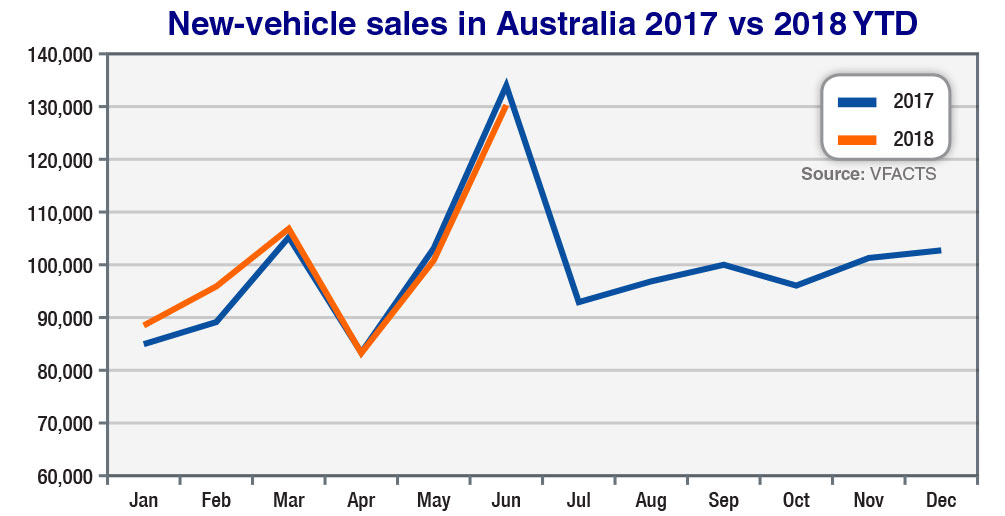

Vehicle sales bounced out of the blocks in January, up 4.3 per cent on the same month of 2017, and then accelerated further with a healthy 7.8 per cent jump in sales in February.

However, sales growth was trimmed to a mere 1.5 per cent in March, and since then, each month has been progressively softer, down 0.2 per cent in April, down 2.1 per cent in May and down 2.9 per cent in June, official VFACTS figures show.

Thanks to the bountiful first quarter, the year-to-date sales tally is still running ahead of last year, up 1.0 per cent, to 605,522 vehicles, at the halfway mark of 2018.

Lost passenger-car sales – down 25,917 units – have been mostly cancelled out by gains in SUV sales – up 25,010 vehicles – and light-commercial vehicles – up 3.3 per cent – as the seismic shift in buying habits continues apace.

But the industry must be wondering if the recent downward trend caused by the increasingly steep decline in traditional passenger-car sales will set the pattern for the rest of the year.

In June, the growth in SUV sales – up 4769 units for the month – could make up for only half the decline in passenger-car volume – down 9085 units – meaning a net slump of 2.9 per cent for the market for the month.

The large-car segment has again taken one of the biggest hits – down another 46.9 per cent – with year-to-date sales of Holden’s Commodore falling by half to a record low of 5384.

But this segment is not Robinson Crusoe, with the light, small, medium, upper large, people-mover and sportscar categories all contributing to the decline of passenger cars. Only the tiny micro segment lifted its game, up all of 388 units or 18.9 per cent.

Most of the SUV sales growth has been contributed by the most affordable classes – small and medium – with the former up 30.4 per cent and the latter rising 11.3 per cent so far in 2018.

Holding position: A strong performance by Toyota’s RAV4 has helped to lift the Japanese brand’s SUV share to 16.3 per cent.

The traditional large 4×4 segment has missed out on the SUV boom, down 5.4 per cent, despite the best efforts of market leader Toyota whose Prado and Kluger have both put on sales.

Kluger, in particular, hit its straps in June, notching a record 1757 June sales to lift its gain for the year to 26 per cent.

Along with strong sales of the mid-sized RAV4, small CH-R and large LandCruiser, the Kluger and Prado have helped Toyota to improve its SUV segment share this year to a healthy 16.3 per cent, up from 15.2 per cent last year.

That’s well above the next-best Mazda, with its 10.5 per cent SUV share, with much of that coming from its market-topping CX-5 medium SUV (13,847, +7.1 per cent).

In light-commercial vehicles, Toyota is also galloping ahead of its opposition on the back of strong sales of its HiLux which has gone from strength to strength this year.

HiLux capped its strong first-half performance with a record haul in June – 5787 units – to bring its six-month tally to 26,402, up more than 3000 units on last year.

This has helped to lift Toyota’s year-to-date light-commercial vehicle market share to a stunning 29.7 per cent, up from 27.3 per cent last year.

The next best is Ford with 18.7 per cent, mainly thanks to its locally developed Ranger that has settled into second place in the one-tonne ute market behind HiLux.

Healthy business sales have helped to bolster LCV sales this year, but that growth slowed in June when the 2.0 per cent gain fell short of the YTD rise of about 6.0 per cent.

Overall business vehicle sales are now only just in the black after June when corporate fleet and novated lease sales fell 1.5 per cent. Governments are also increasingly keeping their collective wallets in their pockets, with such sales falling 5.1 per cent in June.

A bright spot in the sales charts is the heavy-commercial vehicle tally that has grown 17.7 per cent for the year, albeit at a slower rate in June (+9.1 per cent).

Ron Hammerton

Read More: Related articles

Read More: Related articles