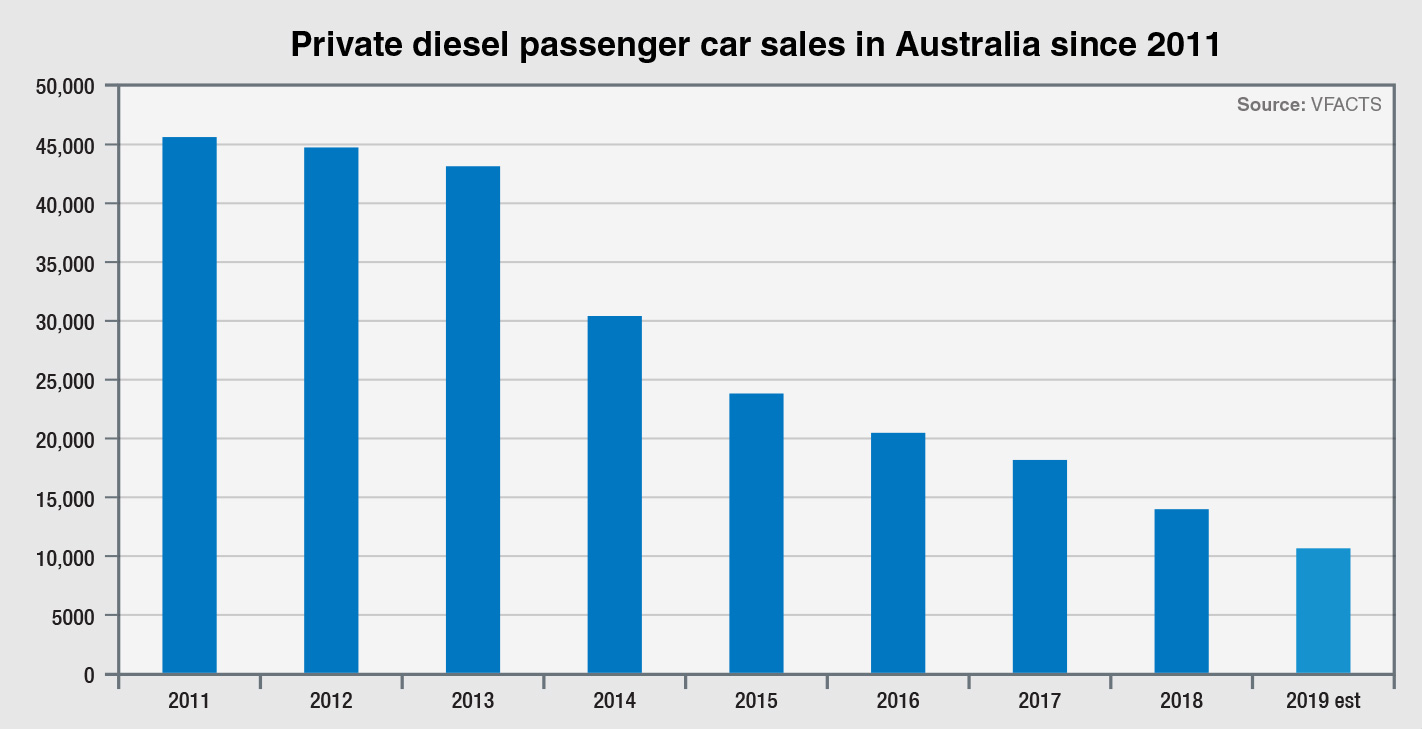

Diesel passenger car sales are down 45 per cent over the same period of 2018, outpacing the 17.8 per cent decline in overall passenger car sales.

Diesel SUV sales have dropped 14.5 per cent, compared with the overall SUV sales dip of 3.5 per cent in the year to date, according to official VFACTS sales data.

However, the rise to market favouritism of diesel pick-ups such as the Toyota HiLux, Ford Ranger and Mitsubishi Triton has helped offset diesel’s drop elsewhere.

Sales of electrified vehicles are still tiny compared to those with an internal combustion engine, racking up 5528 units in the first three months of this year. While that figure represents only 2.0 per cent of the overall market of 268,538 units, it is up from 1.17 per cent at the same time last year.

Of these electrified vehicles, the biggest chunk – 4809 units – comes from hybrids, where Toyota leads the charge. The Japanese giant has added hybrid variants to its new Corolla and RAV4 models, while at the same time dropping diesel from the latter.

Plug-in hybrids and pure EVs accounted for 719 sales in the first quarter of this year, but that is up from 529 vehicles in the January-March period of 2018 – a rise of 36 per cent. And that does not count sales of Tesla cars in Australia, as the company does not reveal its sales figures in the industry’s VFACTS sales data.

Petrol passenger cars still hold the lion’s share of sales, declining only slightly steeper (-19.8 per cent) than the overall passenger car slide that is being propelled by consumers rushing to SUVs and pick-ups and the collapse of the Australian car manufacturing industry.

Petrol SUV sales are in lock-step with overall SUV segment sales, partly because many manufacturers of smaller SUVs are beginning to dump diesel variants from their ranges.

From the bottom up: Toyota’s Corolla Hybrid is one of the variants taking electrified powertrains to the masses.

But among bigger SUVs such as the Toyota Prado, diesel remains king – at least for now.

Diesel remains the dominant force in light-commercial vehicles where the likes of the top-selling Toyota HiLux and Ford Ranger are universally diesel.

The rise to the top of the sales charts of these diesel utes has helped to counter the slide of diesel overall, with the new-vehicle market recording a drop of just 5.5 per cent in diesel sales.

Along with the heavy truck segment, these pick-ups are likely to be the last bastions of diesel as the rest of the market transitions to cleaner fuels.

Buses – particularly the urban variety – are already beginning the transition from diesel to electricity, with a number of trials around the nation.

In the mainstream car and SUV segments, motor companies are announcing new electrified models almost daily. In the past week, Ford Australia announced it would finally launch its first such model, a plug-in hybrid version of its next generation Escape, in 2020.

The biggest push is about to come from the European manufacturers that, in their home markets, have been put on notice that the end of diesel – indeed all fossil fuels – is nigh.

In Australia, the federal opposition is planning to go to the upcoming election with a policy mandating 50 per cent electrified vehicles by 2030, meaning car companies are on notice.

Chinese manufacturers, whose sales have risen 100 per cent in Australia this year, will not be far behind the Europeans, as they are backed by the world’s biggest EV industry, including some of the world’s biggest battery manufacturers.

Unsurprisingly, private buyers – early adopters – are buying most of the pure EVs in Australia, but business buyers prefer hybrids by a fair margin. This is most likely because the Toyota Camry Hybrid is a staple of the fleet business, especially taxis, and also because EV charging infrastructure is still scarce.

Hybrid passenger car sales to business buyers have risen 70 per cent this year, while EV and PHEV sales have gone backwards to the tune of 58.5 per cent in the same timeframe.

In SUVs, the reverse applies, as business buyers have bought about three times the number of EV/PHEVs as hybrids – 425 to 173.

By Ron Hammerton

Read More: Related articles

Read More: Related articles