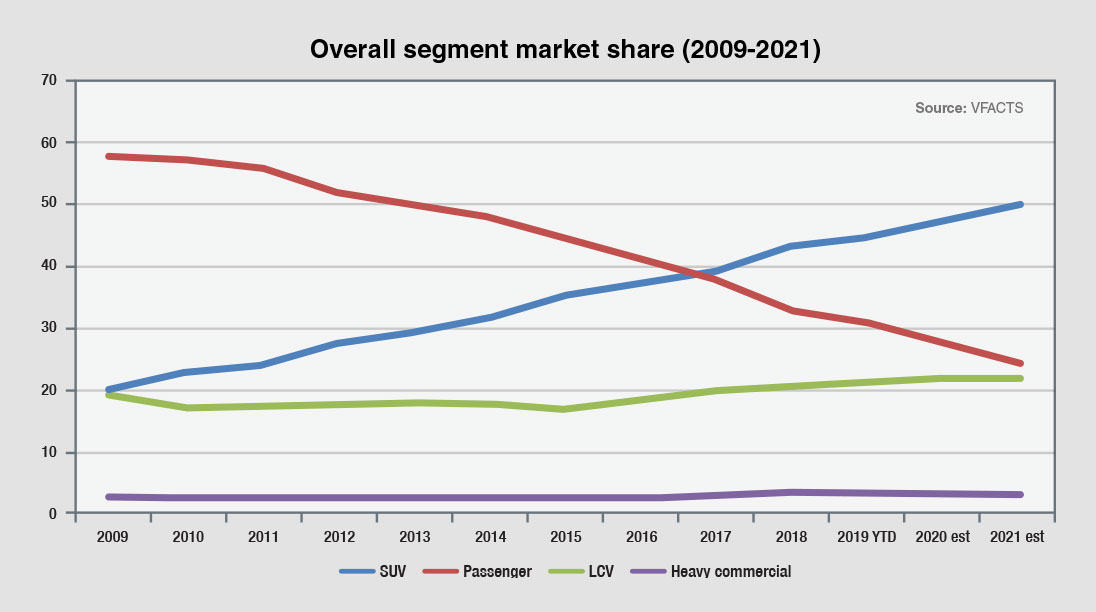

Currently accounting for 44.7 per cent of the Australian market, SUVs are taking market share from the once-dominant passenger car segment at the rate of two-to-three percentage points a year, meaning SUVs are likely to storm through the 50 per cent mark some time on the early 2020s, barring a sudden change in car-buying habits.

Just a decade ago, the situation was reversed, with traditional passenger cars – sedans, hatchbacks and station wagons – holding a dominant market share of about 60 per cent, compared with the SUV market slice of 20 per cent.

Passenger cars slipped below 50 per cent in 2013 as large and medium sedans fell out of favour, and then were overtaken by SUVs in 2017 as sales of small SUVs took off alongside the strong-selling medium and large SUVs.

For much of the past decade, overall vehicle sales in Australia have been growing on the back of soaring volumes of SUVs and to a lesser extent a boom in light-commercial vehicles, with the motor industry stringing together a series of million-vehicle-plus records.

The SUV cause was helped by the reinvention the category, with ever-softer vehicles appearing under the banner. Most of these are mechanically closely related to the passenger cars they appear to be replacing in the market, just jacked up a bit higher, with black plastic flares on the wheel-arches.

An increasing number of these “off-roaders” do not even have all-wheel drive, let alone low-ratio transfer cases and rugged chassis components for what traditionalists consider four-wheel driving.

The writing was on the wall in the 1990s with the advent of vehicles such as the Honda CR-V, Toyota RAV4 and Subaru Forester, all of which hit the spot with consumers.

Other manufacturers rushed to emulate these vehicles, first in the medium segment, then in the luxury market and finally in the small vehicle division where the likes of the Mitsubishi ASX are now outselling many bigger SUVs.

Last month, the list of SUVs in the top 10 selling vehicles in the country included the Toyota RAV4, Mazda CX-5, Nissan X-Trail and the ASX.

This year, SUV sales growth has stalled in the face of weaker economic conditions, with sales to the end of August down 3.8 per cent on the same period of last year.

The decline got even steeper in August, with SUV sales down 5.4 per cent for the month.

However, these falls are below that of the overall market’s 8.0 per cent and small compared with the slip in passenger car sales which have fallen 16 per cent this year – so far.

Consequently, SUVs are continuing to pick up market share in this vacuum.

Light commercial vehicles – utes and vans – are also picking up some of the passenger car outcasts, with well-equipped dual-cab pick-ups winning more buyers each year.

However, the market share of LCVs has been relatively steady over the decade. Back in 2009, in the midst of the global financial crisis, LCVs held 19.3 per cent of the market – almost as much as SUVs (20.1).

That share slipped away to about 17 per cent, before bouncing around the 18 per cent mark for several years. In 2017, LCVs pierced the 19 per cent barrier again before topping 20 per cent last year. The current share to the end of August 2019 is 21.1 per cent.

If the trend continues, we could see commercial vehicles with a quarter of the market, SUVs with half, and the remaining passenger cars scrapping over the final quarter.

By Neil Dowling

Read More: Related articles

Read More: Related articles