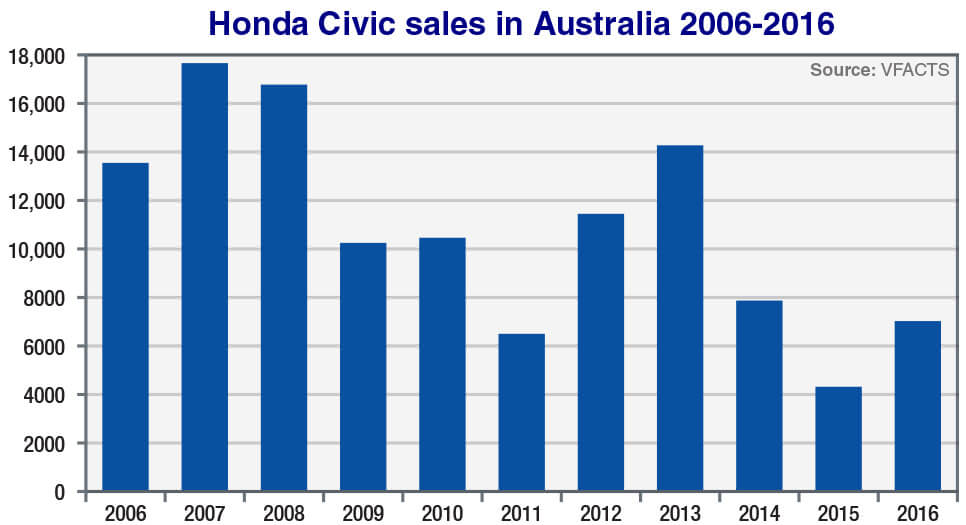

The company is determined to return to its glory days of a decade ago, when in 2007 Honda came close to its latest target with 17,643 sales in the first full year of trading for the eighth-generation Civic, which was a smash-hit for a few years despite the fact that, for the first time, no hatchback version was offered with the switch to UK manufacturing and the high cost of importing the model to Australia.

But Australia is a market that is hungry for small hatchbacks, and the absence of this body style in the mainstream Civic range took its toll as sales declined and took a huge triple hit with the combined effect of the global financial crisis, from which Honda was slow to recover, the devastating 2011 Japanese earthquake and tsunami, which restricted component supplies to Thailand where the Civic sedan was built, and the damaging Thai floods that turned up later that year – an event which crippled production and forced a switch to Japan, putting further pressure on the company with the higher costs this entailed.

Honda did manage to bring a Civic hatch to market during this period, but the costs involved in sourcing the model from Britain saw the single-spec Si emerge in 2009 for $38,990 – almost twice the price it needed to be for the brand to start clawing back sales and addressing its dwindling share of the segment.

Enter the ninth generation in early 2012, starting with the sedan – still sourced from Japan but switching to Thailand four months later, heralding a better-value ‘Series II’ – and the hatch in June, which had at last arrived from Ol’ Blighty with a decent sticker price (from $22,650) and a promise from management “to take up the fight in the small-hatch market”.

It did, too, in the first couple of years, with Civic resuming its spot as Honda’s best-selling model with 11,442 combined hatch/sedan sales in 2012 and 14,261 a year later, only for sales to plummet 45 per cent in 2014 (to 7878 units) and a further 45 per cent in 2015 to a low point of just 4326 units – a result it hadn’t seen for more than a decade.

The reasons for the downturn, as relayed from Honda’s Tullamarine head office near Melbourne airport, were familiar – problems with supply, exchange rates, tough competition, et al – coupled with deeper issues concerning the lack of desirable models across the Honda range and the damage this was inflicting on its once enviable brand image.

At last: With the arrival of the 10th-generation Civic hatch, Honda finally has its hands on an appealing model that sits neatly alongside the sedan – and comes from the same factory in Thailand.

Not quite in the blink of an eye, but certainly with some haste, Honda is working its way back on several fronts but in particular with the 10th-generation Civic, which marks the first time in generations that both sedan and hatch have emerged with a cohesive design and other attributes needed for success: strong aesthetic appeal, high perceived value, a modern powertrain, up-to-date technology, and so on.

Crucially, both variants are also now built in Thailand.

The image-leading Civic Type R is on its way and will certainly bring into showrooms buyers who had left the brand – or perhaps never imaged joining it – just as the sedan has already started the movement, taking Civic sales back past 7000 last year after launching in May.

Indeed, in its 10 months on sale from June 2016 to the end of April this year, the new and greatly improved Civic sedan has around 10,000 sales to its name.

With the hatch now here, Honda Australia has every reason to expect that Civic’s resurgence will continue apace – but to a record 18,000 units over the next 12 months for hatch and sedan combined?

This certainly looks feasible but there are limiting factors on several fronts.

To an unknown extent, the new Civic hatch will eat into Civic sedan sales; strong early demand for the new sedan has tapered off from around 930 a month last year to 870 this year; Hyundai has just placed an all-new, more upmarket i30 on the market; and buyers are being drawn to a variety of freshly minted ‘premium’ small cars other than Civic, such as Subaru’s Impreza and Holden’s Astra.

Small cars are now shopped against the new breed of small crossovers – both inside and out of any given showroom – and sales in the small-car segment are down 5.9 per cent this year, part of a downturn that has been in place since 2014.

Having left the lasting effects of the GFC and the Thai and Japanese natural disasters behind it, Honda Australia declared early in 2012 that its ninth-generation Civic marked a “line in the sand” for the company that would see it achieve 12,000 sales a year and help return the brand as a whole to 60,000 sales by 2015 – up from 30,107 in 2011.

As we have shown, Gen IX Civic hit that target only once (in 2013) before spiralling downwards, while Honda’s overall sales have waxed and waned, climbing only as high as 40,838 units last year.

HR-V and Gen X Civic sedan were the only positives to take out of last year’s result, but this year HR-V is in negative territory for the first time since it burst onto the scene early in 2015.

Not for the first time, everything bodes well for Civic. But history implores us not to be blindsided by a big launch of a crucial new model for a struggling brand.

By Terry Martin

Read More: Related articles

Read More: Related articles